Afentra's strategy is to build an oil and gas business of scale through the acquisition of both operated and non-operated production assets and discovered resources in Africa, where its management team have extensive operational experience. Afentra is well positioned to take advantage of the energy transition and associated market dynamics which is creating opportunities for experienced operators with a strong track record to acquire quality producing assets.

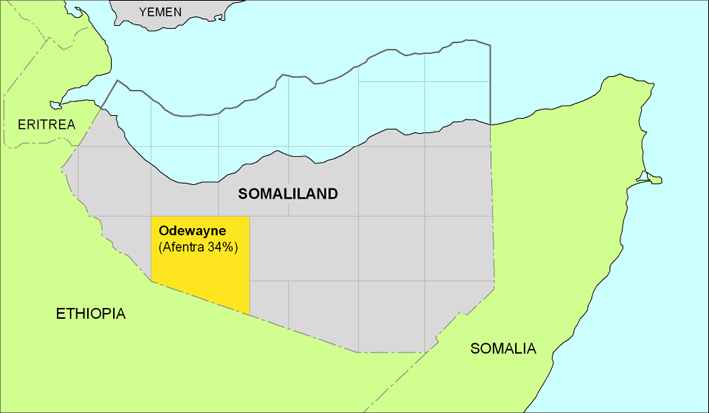

The Company currently has a position in the onshore Odewayne exploration block in Somaliland that is operated by Genel Energy, where its 34% interest is fully carried.

Operations summary

Odewayne Licence - new Afentra team continue its technical assessment and outlook on block prospectivity in discussion with the operator

Business Development - experienced team now in place and actively pursuing potential deals in Africa, primarily focused on operated and non-operated production assets

Corporate summary

- 18 February 2021: Several institutional and high net worth investors purchased shares sold by existing shareholders including Waterford Finance and Investment Limited (equating to its entire 29.23% shareholding in the Company) and Mistyvale Limited (equating to its entire 15.66% shareholding in the Company)

- 16 March 2021: Paul McDade and Ian Cloke join the Board of Directors as CEO and COO respectively

- 30 March 2021: Jeffrey MacDonald and Gavin Wilson join the Board of Directors as Independent non-executive Chairman and Independent non-executive Director respectively

- 13 April 2021: The Company announced its intention to change its name from Sterling Energy plc to Afentra plc and adopt new articles of association. The proposed changes were approved at the General Meeting held on 30 April 2021

- 5 May 2021: Afentra plc launched and Anastasia Deulina is appointed as Chief Financial Officer

Financial summary

- Cash resources as at 30 June 2021 of $40.8 million (30 June 2020 of $43.8 million).

- Adjusted EBITDAX loss of $1.5 million (1H 2020: loss $289k).

- Loss after tax of $2.4 million (1H 2020: loss $866k).

- The Group remains debt free and fully carried for Odewayne operations (Third and the Fourth Period).

Paul McDade, Chief Executive Officer, Afentra plc commented:

"2021 has been an eventful period during which we have established Afentra plc and set the company on an exciting strategic path. The market drivers for the energy transition across Africa are presenting a wide range of compelling opportunities and we believe that our proven operating track record, focused ESG agenda, strong balance sheet and supportive shareholder base put us in a unique position to capitalise on these opportunities."

Map source: KeyFacts Energy

Operations Review

Somaliland

Somaliland offers one of the last great opportunities to target an undrilled onshore rift basin in Africa. The Odewayne block, with access to Berbera deepwater port less than a 100km to the north, is ideally located to commercialise any discovered hydrocarbons. The company has continued to work the reprocessed 2D seismic survey along with field data and legacy geological field studies to determine if a Mesozoic age sedimentary basin is present in the block and its prospectivity.

Odewayne (W.I. 34%) Exploration block

Overview

This large, unexplored, frontier acreage position covers 22,840km2, the equivalent of c. 100 UK North Sea blocks. Exploration activity prior to the 2017 regional 2D seismic acquisition program has been limited to the acquisition of airborne gravity and magnetic data and surface fieldwork studies, with no wells drilled on block.

The Company's wholly owned subsidiary, Afentra (East Africa) Limited ('A(EA)L'), holds a 34% working interest in the PSA (fully carried by Genel Energy Somaliland Limited for its share of the costs of all exploration activities during the Third and Fourth Periods of the PSA). The Odewayne production sharing agreement is in the Third Period, with a 1,000km, 10km by 10km 2D seismic grid acquired in 2017 by BGP. The Third Period has been further extended, through the 8th deed of amendment. This data was reprocessed in 2019 and is currently being reviewed after the disruption caused by Covid in 2020-21.

In 2H 2021 the Company will review the reprocessed 2D seismic data set and will update its technical assessment and outlook on block prospectivity accordingly. Alongside the seismic reprocessing review, the Operator is undertaking a number of work streams and it is anticipated that these will aid the JV partnership in developing an appropriate forward work program to further evaluate the prospectivity of the licence.

Outlook on buy and build strategy

In March 2021 the Company shifted focus to support a responsible energy transition in Africa by establishing itself as a credible partner for divesting IOCs and Host Governments. The Company is specifically targeting producing assets and discovered resources in Africa. The focus will be on operated positions but will also consider non-operated positions alongside credible operators with shared standards and within a joint venture where we can leverage the company's operating experience to influence outcomes and add value to operator plans. The Company has developed a rigorous ESG agenda which is being utilised in the screening process to ensure any acquisition opportunities meet their risk criteria and provide scope to reduce emissions through focused operational excellence.

An experienced technical and commercial team, of staff and consultants, with deep knowledge of the West African region has been assembled and is screening a number of opportunities.

KeyFacts Energy: Afentra Somaliland country profile

KEYFACT Energy

KEYFACT Energy