Deltic Energy Plc, the AIM-quoted natural resources investing company with a high impact exploration and appraisal portfolio focused on the Southern and Central North Sea, today announced its interim results for the six months ended 30 June 2021.

Highlights

- Confirmation of first well to be drilled by Deltic on the Pensacola Prospect (Licence P2252)

- Deltic-Shell JV scheduled to drill Pensacola well in Q2 2022

- Well planning rapidly progressing with site survey commenced

- Transformational farm-out deal with Cairn Energy PLC ("Cairn") over five Deltic licences

- Introduction of Cairn further enhances Deltic's strong partner base

- Endorsement of the quality of Deltic's assets, technical team and strategy to identify opportunities and attract partners

- Will accelerate development of Deltic's core Southern North Sea (SNS) licences and see significant investment through to a drilling decision.

- 3D seismic survey over P2428, the Cupertino Area, has commenced

- The Company has retained a strong balance sheet with cash of £11.1m as at 30 June 2021 (30 June 2020: £12.8m)

- Loss for the period of £691,754 (six months to 30 June 2020: £869,505)

- Cash out flow for the period of £873,064 (six months to 30 June 2020: £1,030,654)

Graham Swindells, CEO, commented:

"I am extremely pleased with my team's achievements in 2021 so far, with great progress across the portfolio. The decision to drill Pensacola and transformational deal with Cairn have been particular highlights. Both demonstrate our strategy to build a diverse portfolio of opportunities and attract high quality partners. We are looking forward to commencing our partnership with Cairn, as well as continuing our work with Shell as we progress towards drilling our high impact SNS gas prospects. The next twelve months are set to be an exciting time for our company."

Cairn Energy Farm-in to Licences P2560, 2561, 2562, 2567 and 2428

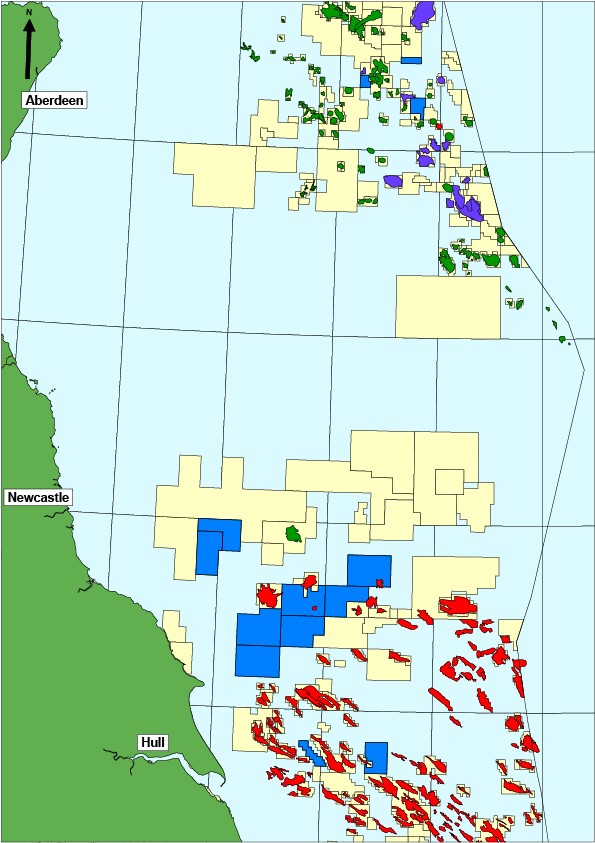

Deltic started the year having recently been awarded six additional North Sea licences. This success allowed the Company to create an extremely strong strategic position of contiguous gas licences in the Southern North Sea, built up through the previous two licensing rounds. This provides the Company with a valuable core of licences and significant running room to facilitate an entire basin entry, as opposed to being confined to a single licence farm-out.

The groundwork for this transaction was laid during 2020 with the identification of additional prospectivity on P2428 (Cupertino Area), following the delivery of reprocessed seismic data. Three distinct prospects were delineated in the Zechstein, Leman Sandstone and the Carboniferous. A farm out process commenced shortly before the start of the year, which attracted a significant level of interest in this licence with the Plymouth Zechstein Reef prospect emerging as the primary target. It quickly became apparent that interest extended beyond that of P2428 to include a number of the additional SNS licences awarded to Deltic in the 32nd Licensing Round, including Licence P2567 which contains the Cadence Prospect.

On 12 August 2021, the Company entered into a binding, conditional farm-out agreement in relation to five of its gas licences in the Southern North Sea with Cairn. Under the terms of the farm-out, Cairn will acquire a 70% working interest in licences P2560, P2561 and P2562 (which are located between the Breagh and Tolmount Gas Fields) and a 60% interest in licences P2567 (Cadence) and P2428 (Cupertino Area). In return, Cairn will pay an initial consideration of USD$1m on completion and will fully carry Deltic through 100% of an agreed work programme for each of the five licences, up to the point of making a drill or drop decision on each licence. This includes the shooting of new seismic data over Licence P2428. At the point of a drilling decision on either of P2428 and P2567 (the two licences with the most advanced prospects), Cairn will fund 70% of the costs of whichever well is drilled first, subject to a gross well cost cap of USD$25 million.

This agreement represents the commencement of a wide-ranging partnership with Cairn, whose successful history of opening up new basins is very much aligned with our exploration-focused strategy. The partnership will result in a significant investment across multiple licences within Deltic's Southern North Sea gas exploration portfolio, as we jointly progress the next high impact drilling targets. It also provides further endorsement of the quality of the portfolio that our team has developed and our gas focussed exploration strategy, as we continue to develop our portfolio of opportunities and attract the highest quality partners.

The partnership is committed to immediate activity and this is highlighted by the fact that the shooting of the new 3D seismic survey over P2428 has already commenced.

Pensacola & Selene

Deltic have continued to work closely throughout the year with Shell, and confirmed a positive well investment decision on the Pensacola Prospect at the end of March. Well planning is now progressing rapidly as the Company start to count down to the drilling of the Company's first well in Q2 next year, while also continuing to work towards reaching a positive well investment decision on the Selene Prospect.

The decision to drill the Pensacola gas prospect followed an extensive evaluation of the new 3D data acquired. This work led to a significant de-risking of the prospect, resulting in the geological chance of success (GCoS) increasing from 20% to 55%. Well planning has been underway for some time with the site survey, a key part of well planning, currently taking place following the appointment of Fugro to carry out this work. Pensacola will be the first well which Deltic drills and, if successful, will be transformational and have a far reaching positive impact on the business. The Zechstein reef play is an exciting emerging play - the large Plymouth Reef prospect on licence P2428 is analogous to Pensacola and is a key focus for the Deltic-Cairn JV.

As confirmed at the time, the Deltic-Shell JV expect the Pensacola well to be drilled in Q2 2022. Well costs are being refined, however Deltic remains fully funded for its 30% share of well costs.

On the Selene Prospect on Licence P2437, the Company's other JV with Shell, the partnership has continued to progress the technical and commercial workflows required to support a well investment decision. Deltic considers Selene to represent the largest undrilled structure of its kind in this part of the SNS, and the Company remains committed to progressing this prospect to drilling.

Central North Sea

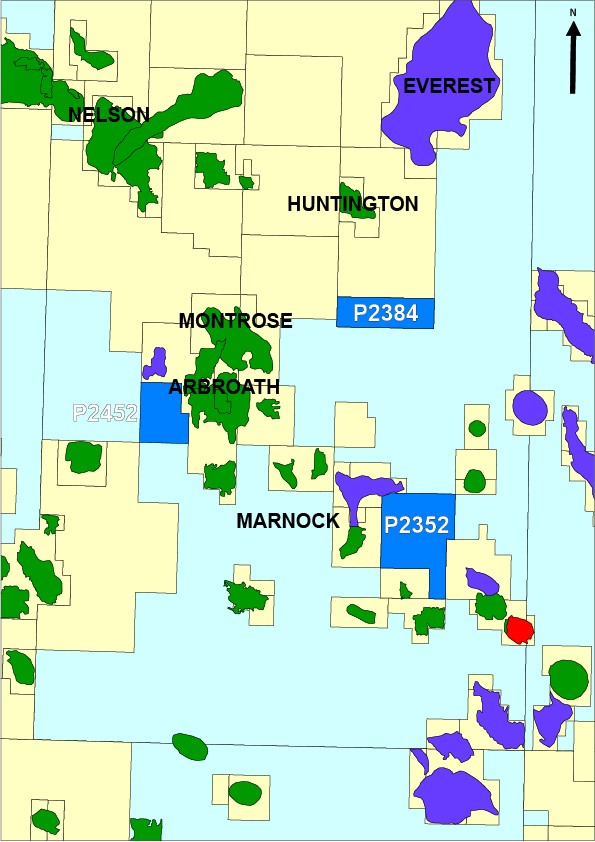

The Company continues to work on its key licences in the Central North Sea, being P2352 (Dewar) and P2542 (Syros).

The Dewar Prospect remains an attractive, highly prospective opportunity located close to existing infrastructure and one which could be developed quickly. Appetite for oil prospects such as Dewar was badly affected by the pandemic, however the Company continues to believe this to be an attractive drill-ready prospect with strong economics and therefore remains committed to seeking a partner which will lead to the Dewar Prospect being drilled.

P2542 which contains the Syros Prospect, was awarded formally in December 2020. Technical work has commenced and will continue into next year with a view to commencing a farm out process in due course.

Operating Review

Despite what remains a challenging operating environment for oil and gas companies, Deltic has continued to make impressive progress in delivering a conveyor belt of drilling opportunities across its portfolio of UKCS exploration assets. During the reporting period the Company was focussed on technical engagement with other operators, in particular Cairn Energy, across the SNS portfolio, resulting in a successful farm-out as communicated post reporting period in August. In parallel, the Deltic technical team has been engaged with Shell in relation to the Pensacola site survey planning and well design work to support next year's drilling activity. Engagement with Shell on the Selene well investment decision continues and we remain confident that a positive well investment decision can be made before the end of 2021.

Over the coming months we look forward to progressing our work with Cairn, accelerating the technical workflows required to support drilling decisions across the five farm-in licences, and in the acquisition of new seismic data.

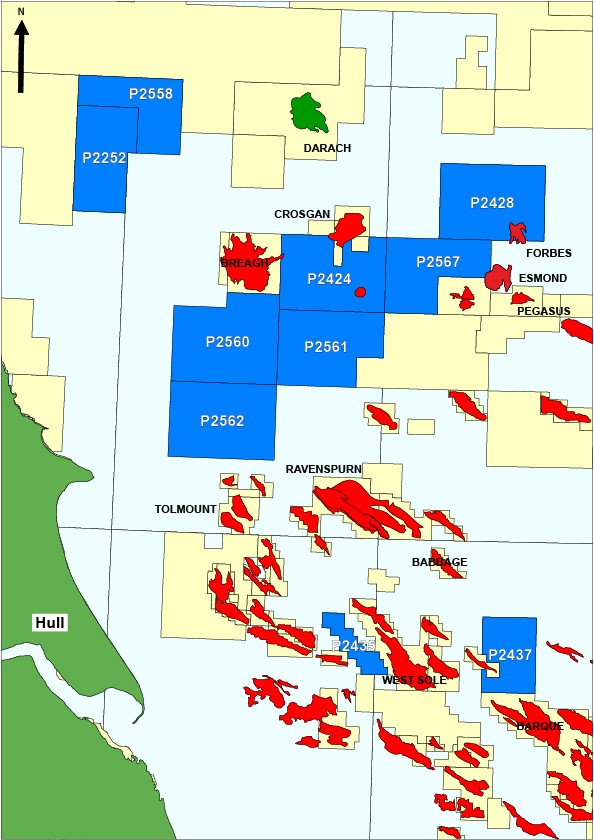

P2252 - Pensacola (30% Deltic)

On 29 March 2021 the Shell-Deltic JV confirmed its intention to drill the Pensacola exploration well. The JV remains on schedule to commence drilling activities in Q2 2022. Preparatory works to support drilling activities are well advanced with the recent commencement of site survey work.

Licence P2252, located in the Southern North Sea Gas Basin, contains the Pensacola prospect. Pensacola is estimated to contain gross P50 Prospective Resources of 309 BCF in a Zechstein carbonate build-up. The licence was farmed out to Shell U.K. Ltd in February 2019, which resulted in the Company being fully carried through the 3D seismic acquisition and processing-based work programme through to well investment decision. Following the well investment decision on 29 March 2021, Deltic is now paying its 30% share of costs associated with this well and remains fully funded to do so.

P2437 - Selene (50% Deltic)

The Shell-Deltic JV continues to progress the Selene prospect in anticipation of a well investment decision and Deltic remains confident that a positive well decision can be made during 2021. Given the delay in coming to a final well investment decision, it is now anticipated that the earliest the Selene exploration well could be drilled is the end of 2022.

Licence P2437 is located in the Leman Sandstone fairway of the Southern North Sea Gas Basin and contains the Selene prospect which we believe is the largest undrilled prospect in this mature play. Deltic estimates that the Selene prospect contains gross P50 Prospective Resources of 271 BCF with a GCoS of 70%. The P2437 licence was farmed out to Shell U.K. Ltd in April 2019, with Deltic retaining a 50% interest and operatorship until a final well investment decision is made. Once the well investment decision is taken, Shell will assume operatorship and will pay for 75% of the costs of the initial exploration well, up to a gross well cost of USD$25M.

P2428 - Cupertino Area (100% Deltic)

During the period, the focus of work on Licence P2428 was securing a successful outcome to the farm-out process that commenced in December 2020. This was achieved with the binding, conditional farm-out to Cairn Energy PLC, announced on 12 August 2021. Work continues to discharge standard conditions related to regulatory approvals required before the transaction becomes unconditional and completes. Following completion, a 60% working interest and licence operatorship will be transferred to Cairn.

The primary target in the P2428 licence area is the Plymouth Zechstein reef prospect. New 3D seismic data will be acquired over the Plymouth prospect throughout September and October, with final data expected to be delivered mid-2022. A drilling decision will be made once this new data has been fully evaluated by the Cairn-Deltic JV.

The Plymouth prospect is a build-up of the Z2 Zechstein carbonate, which is analogous to the Crosgan discovery and the Pensacola prospect which the Company is due to drill with Shell in 2022. Deltic estimates that Plymouth contains gross P50 Prospective Resources of 282 BCF with a GCoS of 19%, which we anticipate will be significantly improved following acquisition of 3D seismic over this area.

Significant additional upside exists across the licence area in the Richmond prospect in the Leman Sandstone and in the deeper Cupertino prospect in the Carboniferous. Both prospects will be further evaluated following the acquisition of the new 3D seismic data.

P2567 - Cadence (100% Deltic)

Licence P2567 contains prospects in both the Carboniferous and Triassic Bunter Sandstone and was included in the farm-out to Cairn Energy announced on 12 August. Work continues to discharge standard conditions related to regulatory approvals required before the transaction completes and becomes unconditional. Following completion, a 60% working interest and licence operatorship will be transferred to Cairn Energy.

It is anticipated that technical work over the coming months will focus on the reprocessing of the legacy 3D seismic survey that covers 100% of the licence area, which will in turn be followed by detailed technical evaluation of the previously identified prospectivity. In line with the licence conditions, the latest the OGA can be informed of the JV's intentions in relation to future drilling activity on the licence is early September 2023. Deltic are fully carried by Cairn for the pre-well investment technical work programme through to a drill or drop decision.

P2560, P2561 & P2562 - South Breagh Area (100% Deltic)

Licences P2560, P2561 and P2562 were also awarded in the most recent 32nd Licensing Round. The licences contain early stage exploration opportunities located between the Breagh and Tolmount gas fields and have significant potential in the Carboniferous sandstones, Permian Leman Sandstones and the Zechstein carbonates. The area is covered by a mixture of legacy 2D and older 3D seismic data which requires modern reprocessing, which will be the key focus over the coming year.

All three licences were included in the farm-out to Cairn Energy announced on 12 August. Work continues to discharge standard conditions related to regulatory approvals required before the transaction becomes unconditional and completes. Following completion, a 70% working interest in each of the three licences, along with licence operatorship, will be transferred to Cairn Energy.

P2352 - Dewar (100% Deltic)

Licence P2352, located in the Central North Sea, was awarded to the Company in the 30th UK Offshore Licensing Round with an effective date of 1 October 2018. The primary prospect on Licence P2352 is the Dewar prospect, which is estimated to contain gross P50 Prospective Resources of 39.5 MMBO in a Forties Sandstone channel. The Dewar Prospect is supported by a clear amplitude versus offset (AVO) anomaly and has a GCoS of 41%.

In the event of exploration success, the Dewar Prospect is a highly attractive commercial proposition as it is located approximately 5km east of BP's Eastern Trough Area Project (ETAP) Central Processing Facility. A commercial feasibility study commissioned by the Company in 2019 demonstrated that the project would be highly economic.

With the recent recovery in oil prices, there appears to be a renewed interest in the Central North Sea, demonstrated by a modest increase in M&A activity. Over the coming months we will continue to pursue farm-out discussions with several companies, building on the positive dialogues established prior to the COVID enforced lockdowns.

Other Licences

Licence P2435, which is operated by The Parkmead Group, and contains the Blackadder prospect, has effectively been on a 'care and maintenance' footing over the last 18 months due to the COVID pandemic. However, with restrictions lifting and an improved gas price environment we will continue work with Parkmead to establish the technical and commercial way forward for this licence. The Phase A period of this Licence runs until 30 September 2022.

Licence P2542 was awarded to Deltic in the most recent 32nd Licensing Round. Technical work on this licence, which is located in the Central North Sea and contains the Syros prospect, has commenced. Work over the next 12 months will focus on maturing that prospect, such that farm-out marketing can be commenced in mid-2022.

DELTIC ENERGY COMPANY PROFILE

Deltic Energy Plc is a London based oil and gas exploration business investing in the UK’s proven hydrocarbon provinces where it currently holds significant equity positions in a number of highly prospective licences in the Southern and Central North Sea.

The company have amassed a portfolio of low risk, high impact exploration assets with net P50 prospective resources of more than 360 mmboe in the infrastructure rich, well established basins of the UKCS. The portfolio is primarily focused on future gas production given the increasing importance of natural gas in the transition to a low carbon future.

Deltic are fully funded for their medium term exploration activities including participation in two low risk, high impact wells with Shell that are expected to be drilled in 2021 and 2022.

SOUTHERN NORTH SEA OPERATIONS

P2252 – Pensacola

P2252 is a 28th Round licence located to the north west of the Breagh gas field and contains the Pensacola prospect. Deltic have identified a number of high quality exploration and appraisal targets within Zechstein carbonates including the Pensacola Reef Prospect which has gross P50 recoverable resources of 309 BCF. The licence was the subject of a farm-in by Shell in 2019 and the partnership acquired new 3D seismic across the Pensacola area in August 2019.

In November 2020, operator Shell reiterated to Deltic and the UK Oil and Gas Authority, its plan to drill the high impact, play opening Pensacola Prospect on Licence P2252 and that it remains scheduled to be drilled in Q4 2021.

This progress has allowed well planning on Pensacola to commence. Well design work is underway and competitive scoping of the exploration well is in the process of being completed.

The additional processing being carried out by Shell will further de-risk the Pensacola prospect, help refine the range of volumes and exact well location and is a key enabler of Shell's internal approval processes. Other workflows including refinement of recoverable gas resources, analogue studies, detailed well engineering and development options are continuing in parallel with this additional seismic processing work, which will support the ongoing well planning process. Shell will continue to carry 100% of Deltic's costs until the well investment decision is made.

P2437 – Selene

P2437 is a 30th Round licence situated in the Permian aged Lower Leman Sandstone play fairway, on the eastern edge of the Sole Pit Inversion and contains the Selene Prospect. Selene is one of the largest undrilled Permian structures in the SNS with gross P50 prospective resources of 291 BCF.

Shell U.K. Ltd Farm-in to P2437: On 30th April 2019 the Company announced that Shell U.K. Ltd exercised their option on Licence P2437 and specifically the Selene prospect. Following completion of the transaction in August 2019, Deltic have transferred a 50% working interest in Licence P2437 to Shell in return for a cash sum of USD$600,000 and Shell funding 75% of the costs the first exploration to be drilled on the licence up to a gross well cost of USD$25M.

P2428 – Cupertino

P2428 is a 30th Round licence located to the north-east of the Crosgan discovery and the to the west of the Cygnus gas field. Deltic reprocessed legacy 2D seismic across the area to pre-SDM in the 2nd half of 2019 which has significantly improved image quality over previous iterations. Interpretation work is now complete and the the Company believes that Licence P2428 represents a significant prize in the underexplored northern part of the Southern North Sea with several new fields potentially located in an area of limited seismic data and very few well penetrations. The Company will be initiating a farm out process from December 2020.

Cupertino Prospect: Cupertino is a large Carboniferous inversion structure at the NW end of the Southern North Sea. The target reservoir is the Scremerston Formation and although there are no well penetrations on the licence the sandstones of the Scremerston are proven producers at the Breagh Field and the nearby Crosgan discovery.

The prospect is a 3-way dip and fault sealed structure with the large North Dogger Fault providing side seal along the Northern edge of the prospect. The fault seal provides the potential for the greatest upside volumes associated with the prospect and is also a key risk.

Cupertino has estimated P50 Prospective Resources of 370 BCF with a GCoS of 26% which is expected to improve if 3D seismic is shot across the acreage.

P2424 – Cortez

P2424 is a 30th Round licence comprising of blocks 42/14 and 42/15 located in the Lower Carboniferous play fairway immediately to the east of the producing Breagh gas field and to the south of the Crosgan discovery. The block also contains potential within the Bunter Sandstone and the small Furasta discovery is located centrally on block 42/15b.

Burbank Prospect:The Burbank Prospect is mapped as a 3-way dip and fault controlled trap in the Bunter Sandstone on the NW end of a 6.5km wide and 25km long NW-SE anticline created by post-depositional salt pillow style halokenesis in the underlying Zechstein salt.

The Prospect is partially imaged on 2D and 3D seismic and covers an area of approximately 29km².

P2435 – Blackadder

P2435 is a 30th Round licence located on the western limit of the Sole Pit Basin of the Southern North Sea, approximately 65km south east of Flamborough Head. The primary play in over the licence is the Permian Rotliegendes which provides the reservoir in all adjacent fields and discoveries.

P2567 – Cadence

P2567 is a 32nd Round licence located to the north west of the Pegasus and Andromeda complex. The 43/11 block was previously held by Deltic as P2248 and contains the Cadence, Bassett and Bathurst prospects, whilst the newly awarded 43/12b contains the Cordova prospect.

The Company has worked extensively on the seismic data and other datasets to enhance its understanding of this area which has resulted in a more robust interpretation over the intra-Carboniferous Cadence prospect and the identification of additional prospectivity beneath the Base Permian Unconformity ("BPU"). The Board considers this BPU prospect, the Cordova prospect, to be highly analogous to the recent Andromeda North discovery which was drilled by Spirit Energy in 2019 on the block immediately to the south of 43/12b.

P2560/P2561/P2562 – Breagh South Area

Licences P2560, P2561 and P2562 were awarded to Deltic in the 32nd Licence Round and are located to the South and southeast of the Breagh field in the Southern North Sea. This is a proven gas bearing area with a limited number of well penetrations and a mixture of 2D and 3D seismic data of varying vintage and quality which will respond well to modern reprocessing. The Company considers this area to have significant potential, with multiple leads mapped in the Carboniferous with additional upside in the Zechstein and the Leman Sandstone in the southern-most blocks.

P2558 – Pensacola North

P2558 is a 32nd Round licence located in the Southern North Sea, to the East of the Pensacola Zechstein Reef prospect. Deltic applied for the acreage on behalf of the P2252 Pensacola partnership and is Operator. Extensions to the Zechstein reefs are mapped across the licence as leads on the new Bluewater 3D survey shot by the JV in 2019. The Company has a 30% working interest in the licence and will fulfil the role of operator as the technical work begins.

CENTRAL NORTH SEA OPERATIONS

P2384 – Manhattan

P2384 a 30th Round licence situated in the East Central Graben of the Central North Sea, NE of the Montrose/Arbroath High and South of the Huntington Field.

P2542 – Syros

P2542 is a 32nd Round licence situated on the western flank of the Montrose/Arbroath High. The key prospectivity is found in the Jurassic aged Fulmar Sandstone, which is proven by the Cayley Field to the North of the licence. Syros is the main prospect on P2542 and is mapped on 3D seismic data as a pinch out of the Fulmar Fm against the high.

P2352 – Dewar

P2352 is a 30th Round licence situated in the East Central Graben of the Central North Sea, SE of the Marnock field, and contains the Dewar prospect in the Forties Sandstone. P50 Prospective Resources are estimated at 39.5mmboe which is considered to be highly attractive given is location close to the existing production infrastructure of ETAP (the BP operated Eastern Trough Area Project) which has recently been the subject of a significant life extension project.

The surrounding area has seen significant activity recently with first oil at the Culzean field in 2019 and new developments proposed on the Seagull discovery and the Skua field.

Given the Company's 100% equity position in this licence, Deltic is actively looking to attract funding and/or an operating partner to support the maturation of this asset towards drilling activity.

32nd Offshore Licensing Round

In September 2020, Deltic Energy announced the provisional award of six licences covering twelve full and part blocks covering approximately 2,155.5 km², by the UK Oil and Gas Authority in the UK’s 32nd Offshore Licensing Round.

With the exception of blocks 41/05b and 42/01b, all blocks are being awarded to the Company on a 100% equity position. Blocks 41/05b and 42/01b have been jointly awarded with Shell holding a 70% working interest.

In December 2020, these six new licences comprising twelve blocks were formally awarded to Deltic.

LEADERSHIP

Mark Lappin Chairman

Graham Swindells Chief Executive Officer

Andrew Nunn Chief Operating Officer

Peter Cowley Non-Executive Director

Sarah McLeod Chief Financial Officer

CONTACT

Deltic Energy Plc

1st Floor, 150 Waterloo Road

London, SE1 8SB, United Kingdom

Telephone: +44 (0)20 7887 2630

Email: ir@delticenergy.com

KeyFacts Energy: Deltic Energy UK country profile

* KeyFacts Energy hold a database of over 500 oil and gas company profiles, allowing users to instantly access operational activity, geographic locations and key personnel in our succinct 2-page reviews. For more information about this bespoke low-cost service, contact us.

KEYFACT Energy

KEYFACT Energy