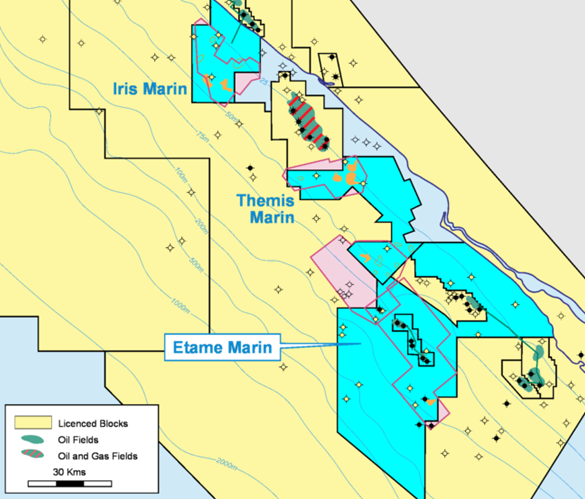

VAALCO Energy today announced that its affiliate VAALCO Gabon, SA has signed a binding letter of intent (“LOI”) with World Carrier Offshore Services to provide and operate a Floating Storage and Offloading (“FSO”) unit at VAALCO’s Etame Marin field offshore Gabon for up to eight years with additional option periods available upon the expiration of the current Floating Production, Storage and Offloading (“FPSO”) contract in September 2022. The non-binding LOI with Omni Offshore Terminals Pte Ltd, which VAALCO announced in April of this year, expired without any mutually agreeable contract being reached.

Key Highlights

- Signed a binding LOI with World Carrier to enter into a Bareboat Contract and Operating Agreement to provide and operate the Cap Diamant, a double-hull crude tanker built in 2001, as an FSO;

- The Bareboat Contract and Operating Agreement will become effective upon approval from the Etame joint owners which is expected by early September 2021;

- Compared to the current FPSO solution:

- Reduces storage and offloading costs almost 50%;

- Lowers total operating costs at Etame by approximately 17% to 20% through 2030;

- Increases effective capacity for storage by over 50%, allowing for greater operational and lifting flexibility and a material reduction in per barrel lifting costs;

- Expected to lead to an extension of the economic field life, resulting in a corresponding increase in recovery and reserves at Etame;

- Requires a prepayment of $2 million gross ($1.3 million net) in 2021 and $5 million gross ($3.2 million net) in 2022 of which $6 million will be recovered against future rentals; and

- Forecasting capital costs including field reconfiguration and the 2021/2022 drilling program to be funded with cash from operations and cash on hand.

George Maxwell, VAALCO’s Chief Executive Officer, commented,

“We are very pleased to finalize an agreement with World Carrier that will allow us to sustain our operational excellence and robust financial performance at Etame through 2030. Additionally, this new solution costs almost 50% less than the current FPSO solution and will reduce our overall costs by approximately 17% to 20%. Current total field level capital conversion estimates are $40 to $50 million gross ($26 to $32 million net to VAALCO) spread across 2021 and 2022. This capital investment is projected to save approximately $20 to $25 million gross per year ($13 to $16 million net to VAALCO) in operational costs through 2030, giving the project a very attractive payback period of only two to two and a half years.

It is clear this is a very economical solution for VAALCO and should help us to enhance the profitability of our flagship asset at Etame and materially increase stakeholder returns. We expect to have the FSO in place and operating in September 2022 prior to when our current FPSO contract expires. We will continue to maximize the value opportunities for our shareholders and look forward to beginning our next drilling campaign at Etame later this year.”

VAALCO has studied several alternatives regarding the expiration of the contract on its current FPSO in September 2022. The proposed development approach utilizing an FSO with all processing on existing platforms aligns with VAALCO’s ongoing strategy to reduce operating costs and extend field life. This is particularly attractive due to the potential for meaningful ongoing operating cost reductions over its term compared with the current FPSO arrangement and other options analyzed, as well as removing both the risk of life extension costs on the existing vessel.

Once the field is reconfigured, the agreement with World Carrier to convert and operate the Cap Diamant is expected to lead to annual operating expense savings of around $20 to $25 million gross ($13 to $16 million net to VAALCO) over the life of the new agreement, resulting in a fast payback of its invested capital and enhanced margins going forward. These savings are achieved due to a more simplified processing system that avoids duplication of processing on the platforms and again on the FSO. This change is expected to reduce or eliminate the need for ongoing life extension costs, in addition to a significant reduction in planned/unplanned downtime. Additionally, VAALCO continues to believe that the capital costs for the field reconfiguration and the upcoming planned 2021/2022 drilling campaign can be funded with cash from operations and cash on hand.

KEYFACT Energy

KEYFACT Energy