KeyFacts Energy: BW Energy Gabon country profile

- EBITDA of USD 46.9 million for the second quarter and USD 80.2 million for the first-half 2021

- Strong balance sheet with cash position of USD 216.5 million and no debt

- Drilled and completed DTM-7H on time and below budget, with first oil expected from DTM-6H and DTM-7H in Q4 2021

- Drilling operations on Hibiscus North exploration well ongoing

- On track for the Hibiscus-Ruche development including the jack-up rig re-purposing

- Q2 2021 gross production of 0.95 million barrels, or equal to ~10,500 bbls/day

EBITDA for the second quarter of 2021 was USD 46.9 million, up from USD 33.2 million in the first quarter of 2021 due to increased oil sales and realised oil price.

“We are pleased with our performance and result in the quarter. The next milestones for BW Energy are the tie-in of two production wells at the Tortue field in the fourth quarter, as well as the result of the Hibiscus North exploration well”, commented CEO Carl K. Arnet.

Gross production from the Tortue field averaged approximately 10,500 barrels of oil per day in the second quarter of 2021, amounting to a total gross production of 0.95 million barrels of oil for the period. The decrease in production compared to the first quarter of 2021 was mainly due to a planned maintenance shutdown.

BW Energy completed two liftings in the quarter and realised an average price of USD 69.8 per barrel. Production cost (excluding royalties) was approximately USD 31 per barrel. The increase in production cost per barrel has mainly been impacted by the lower quarterly production.

The Hibiscus North exploration well (DHBNM-1) was spudded late July and drilling operations are currently ongoing. The well has a geological analogue to the Ruche Field, where the Gamba structure is the primary target.

Total Dussafu production for 2020 is projected to be ~12,800 barrels per day (gross), compared to 14,100 barrels per day on average in 2020. OPEX per barrel is expected to be approximately USD 26 per barrel, compared to USD 20 per barrel on average for 2020. Tie-in of the two wells (DTM-6H and 7H) to BW Adolo in Q4 2021 will give a significant reduction in the OPEX per barrel.

BW Energy had a cash balance of USD 216 million at 30 June 2021, compared to USD 185 million at 31 March 2021. The increase is mainly due to a strong operating cash flow reflecting a higher realised oil price. The company is well capitalised for the upcoming investment activities with a robust balance sheet and no external debt.

Dussafu

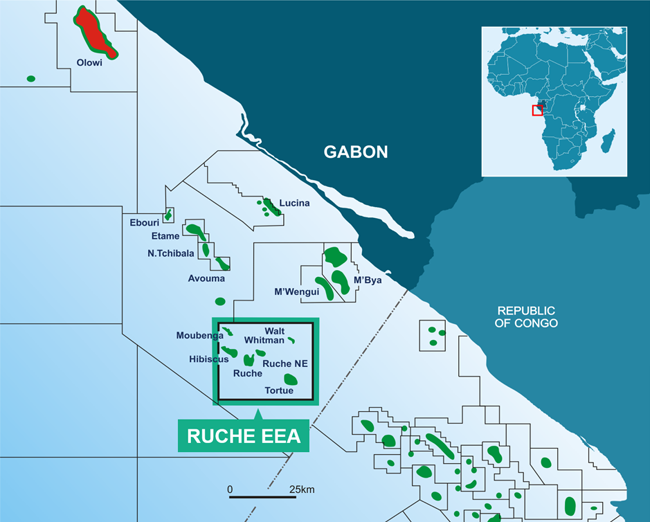

The Dussafu Marin Permit and the associated Ruche Exclusive Exploitation Area (EEA) production license are located approximately 50 kilometers off the coast of Gabon.

The Ruche EEA covers an area of approximately 850 square kilometers. The water depth within the Ruche EEA ranges from 70 meters in the northeast corner to 650 meters in the southwest corner. Six oil discoveries have been made on the license to date: Tortue, Hibiscus, Ruche, Ruche North East, Moubenga and Walt Whitman.

The area comprising the Tortue, Hibiscus, Ruche and Ruche NE fields is centrally located within the Ruche EEA, with a water depth of approximately 116 meters.

Oil from Dussafu is a good quality crude that generally trades on an equivalent basis to Brent. The crude is typical of the region and is sweet with an API gravity of 28 to 30 degrees API.

KEYFACT Energy

KEYFACT Energy