- Completion of Senegal RSSD sale to Woodside and sale proceeds of US$126 million

- Appointment of new Chairman and non-executive director

- Mobilisation of drill ship for Bambo-1 well, offshore The Gambia, scheduled for mid-October

- Planned capital return to shareholders of A$0.80 per share

Offshore Senegal Rufisque, Sangomar and Sandomar Deep (FAR13.7% Working Interest (WI))

On 19 January 2021 the FAR group executed a Sale and Purchase Agreement with Woodside in relation to FAR’s Senegal RSSD asset. Shareholders approved the sale of FAR's interest in the RSSD project to Woodside at a General Meeting held on 28 April. In the intervening period, FAR and Woodside worked cooperatively to satisfy the conditions precedent for the sale and close out remaining tasks.

In events post the end of the quarter, formal completion of the sale took place on 6 July in Senegal and monies received by FAR in Australia on 7 July. As consideration for the sale Woodside has paid FAR US$45 million and reimbursed FAR’s share of working capital for the RSSD Project from 1 January 2020 of approximately US$82 million, totalling US$126 million (including deductions for interest charged on outstanding cash calls).

Additional payments to FAR, up to US$55 million, are contingent on future oil price and timing of first oil. First oil is targeted for 2023.

Following the completion of the sale to Woodside, FAR has no remaining interest in Offshore Senegal.

The Gambia

Blocks A2/A5 (FAR 50% WI and Operator)

FAR continued operational preparations for drilling the Bambo-1 well in Q4 of 2021.

FAR has contracted Exceed’s wells management team in Aberdeen to assist with the planning and execution of the well.

The contract for the drillship was executed during the quarter and rig owner and operator, Stena, has advised the window for mobilisation of the Stena IceMax drillship to Gambia to be in the second half of October.

In early July, the bundled services contract with Schlumberger was executed for delivery of the drilling fluids and cement for drilling operations and rental of the wireline services and logging equipment for the well. This equipment is all scheduled to be delivered to the drill ship or FAR’s base of operations at the Port of Dakar prior to spud in late October/early November. The exact date of spud will be dependent on mobilisation of the drill ship. Other contracts for key services are in place, and long-lead materials and equipment have been ordered and drill pipe for the operation has been delivered to the Dakar shore base. In the forthcoming quarter, FAR expects to award contracts for helicopter services and marine support vessels that will transport crew and equipment to the drill ship.

The Environment and Social Impact Assessment (ESIA) has been approved and a range of secondary level permits are in progress with the regulatory authorities of The Gambia.

The well is designed to drill into a series of vertically stacked targets with a combined estimated recoverable, prospective resource of 1,118 mmbbls (arithmetic sum of the Best Estimates, unrisked, 559 mmbbls net to FAR) and the chance of geological success for the various horizons ranges from 7% to 37%.

The targets are:

- Bambo - A shallower reservoir not intersected during the Senegal campaign.

- Soloo - The extension of the hydrocarbon-bearing reservoirs in the adjacent Sangomar Oil Field, Senegal.

- Soloo Deep (S552 & S562) – two additional horizons, also not penetrated during the Senegal drilling campaigns. Soloo Deep has a lower chance of success but higher potential volumes.

The approved budget for the Bambo-1 well is US$51M with US$6.5M expended to date. At 50% working interest, FAR’s share of the budgted well cost is US$25.5M with US$22.25M yet to be spent. FAR’s share of the well cost will be funded from cash at hand.

Outside well preparations for the drilling of the Bambo-1 well, FAR is undertaking success case planning in the event of a discovery and continuing evaluation of the additional prospects in A2 and A5 (Jobo, Jatto and Marlo) as well as reviewing opportunities for addiitional acreage in a success case. Success in the Bambo-1 well will high grade these other prospects for drilling in the future.

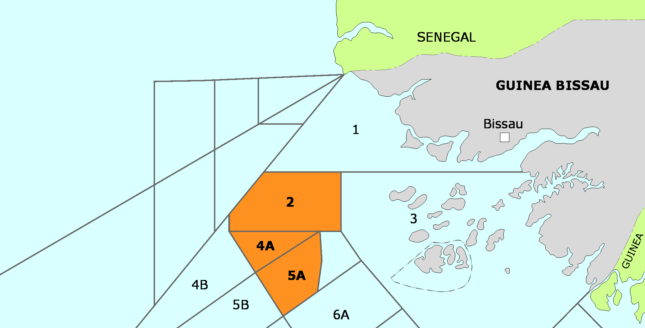

Guinea-Bissau (FAR 21.43% WI)

The Sinapa (Block 2) and Esperança (Blocks 4A and 5A) licences in Guinea-Bissau have been extended for 3 years and are valid until 2 October 2023 during which time there is an obligation on the Joint Venture to drill a exploration well. FAR is working with new operator, PetroNor, to finalise the 2022 work program and budget for approval and finalisation by the end of October. FAR has commenced a farm down of it’s interest prior to drilling a well before October 2023.

PetroNor and FAR are undertaking a full review of a potential well location for the 2023 program with the Atum Propsect the key drill target (mapped to contain Best Estimate Prospective Resource of 471 mmbbls, gross, unrisked, 235 mmbbls net to FAR).

The Operator is also undertaking a review of the commerciality of the Sinapa discovery in the offshore shallow water. Sinapa contains 13.4 mmbbls of oil with 2.9 mmbbls net to FAR in 2C contingent resources (Best Estimate). In addition, there is an estimated 72 mmbbls of propective resource in the West and East Sinapa Prospects that are able to be tied into a potential development at Sinapa (Best Estimate, unrisked, 15.4 mmbbls net to FAR).

NW Shelf (Australia 100% WI and Operator)

Through its wholly owned subsidiary, Lightmark Enterprises Pty Ltd, FAR has a 100% interest in Petroleum Exploration Permit WA-458-P, which is in the prolific oil-producing Dampier Sub-basin along Australia’s North West Shelf.

Divestment activities for some or all of FAR’s interest in WA-458-P is ongoing. FAR has a “drill or drop” obligation on the licence in early 2022.

Corporate

On Monday 21 June, FAR announced the resignation of non-executive director, Timothy Woodall, and as a result, the resolution to re-elect Mr Woodall to the FAR board was withdrawn at the AGM.

FAR held its Annual General Meeting of Shareholders in Melbourne and online on Tuesday 22 June. At the meeting shareholders voted for a 1:100 share consolidation which was completed in early July. At the meeting, FAR recorded a ‘first strike’ vote against the remuneration report.

Following the end of the quarter, on 1 July FAR announced the resignation of non-executive chairman, Nicholas Limb, and non-executive director, Reginald Nelson coincident with the appintment of Patrick O’Connor (non-executive chairman) and Robert Kaye SC (non-executive director) to the FAR board.

The new independent non-executive directors Patrick O’Connor (Chairman) and Robert Kaye SC, together with managing director Cath Norman have undertaken a review of the capital management of the Senegal sale proceeds taking into account committed exploration costs and working capital requirements with the surplus, being approximately A$80M (at the rate of $A0.80 per share), to be returned to shareholders by way of capital return.

The Company contemplates making an application to the Australian Tax Office for a class ruling seeking advice to the effect that the capital return is not assessable to Australian resident shareholders holding their shares on capital account. It is proposed to put the capital return to shareholders for their approval at a general meeting of shareholders, as is mandated by legislative requirements. This will contain precise timing and other details.

FAR’s share of the forthcoming Bambo-1 well, offshore The Gambia, contingency, success case options as well as expenditure on other assets and general administration costs will be funded from cash at hand following the capital return.

ASX suspended FAR's shares from trading in September 2020 and following the sale of the Senegal project, the ASX has advised that it will reinstate trading of FAR’s securities on Friday, 23 June 2021.

KeyFacts Energy: FAR Australia country profile

KEYFACT Energy

KEYFACT Energy