Kistos, the low carbon intensity gas producer pursuing a strategy to acquire assets with a role in energy transition, today provides a trading and operational update.

2021 first half highlights

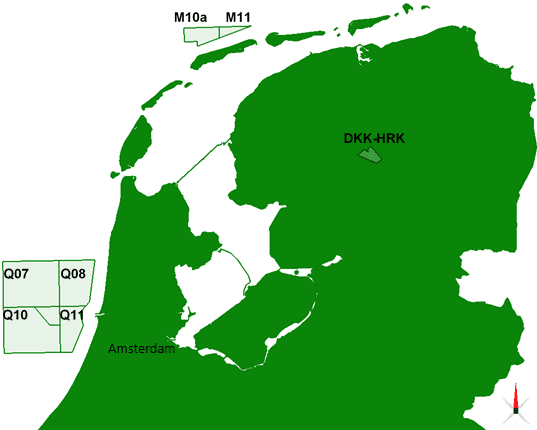

- On 20th May 2021, Kistos completed the acquisition of Tulip Oil Netherlands B.V. for €223MM (including the assumption of €87MM of debt). This deal included a 60% interest in and operatorship of the producing Q10-A gas field with 2P reserves of 32.9 MMboe.

- In the first half of 2021, gross production from Q10-A averaged 1.35 MM Nm3/d. This is equivalent to 48 MMcf/d or 8.6 kboe/d.

- After raising €150MM in the Nordic Bond market and approximately £100MM from equity investors since it was incorporated in October 2020, the Company remains well-funded. Cash balances at 30th June 2021 were €59.1MM.

2021 drilling campaign

Borr Drilling's Prospector-1 jack-up drilling is expected to arrive on location before the end of July and to remain on contract with Kistos for approximately four months. During that time, it will conduct a drilling campaign that is part of the process of converting approximately 100 MMboe (gross) of 2C resources into 2P reserves. Planned activities include:

- Appraisal of the Q11-B gas discovery, which is estimated to contain 2C resources of over 170 Bcf or 30.8 MMboe (gross). If this well meets expectations, it is anticipated to lead to Q11-B coming onstream before the end of 2023.

- Conduct a flow test of the Vlieland light oil discovery, which is located in a naturally fractured reservoir overlying the producing Q10-A field and is estimated to contain gross 2C resources of more than 70 MMbbl.

- Sidetrack the Q10-A-04 well, which is not currently onstream, to a new location in the Slochteren formation, which is the field's primary producing reservoir.

- Re-perforate the Q10-A-06 well to increase output.

Management appointments

- The Company is pleased to announce the recent appointments of Peter Mann as Managing Director and Richard Slape as Chief Financial Officer.

- It is anticipated that Interim CEO Andrew Austin will revert to his previous role of Executive Chairman before the end of 2021.

Outlook

- Kistos expects the Q10-A gas field to exit 2021 with gross production of more than 2.0 MM Nm3/d (71 MMcf/d or 12,700 boe/d).

- Success with the forthcoming Vlieland oil test and / or the Q11-B appraisal well could result in a further significant uplift in production by the mid-2020s.

- The Company continues to mature further opportunities within its existing portfolio, which is expected to lead to further drilling in the medium term

- Kistos is continuing to evaluate a number of business development opportunities in the energy transition space, in line with its strategy.

Commenting, Andrew Austin, Kistos' Interim CEO, said:

"Kistos is well placed to generate substantial value for shareholders. We have a busy schedule in the second half of 2021, which we hope and expect will result in strong organic growth in our production from 2023 onwards. In the meantime, we will seek to deploy our balance sheet strength to make further acquisitions that meet our criteria. We look forward to reporting on further progress as the year unfolds".

KeyFacts Energy: Kistos UK country profile

KEYFACT Energy

KEYFACT Energy