From a selection of 144 Energy Country Profiles, KeyFacts Energy today feature Mexico in our series of 'at-a-glance' reports, with selected information taken from our 'Energy Country Review' database.

MEXICO

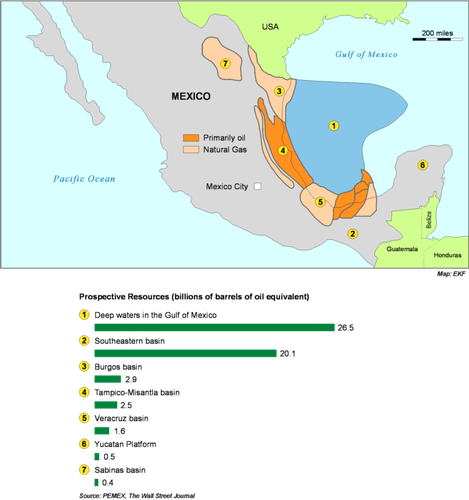

Oil production began in 1901 from the Northern Region and had commenced in many areas bordering the Gulf of Mexico by the 1960s. Onshore output has been in decline since 1979. Offshore the most productive area is shallow waters of Campeche Bay where the giant Cantarell complex began producing in 1979. Smaller fields on the west margin of the Gulf were developed after 1972. Cantarell is now declining but other field complexes, such as Ku-Zaap-Maloob, replaced some shortfall. Deep water exploration began in 2004. Gas comes from the onshore Burgos basin, the Golden Lane area west of the Gulf and Campeche Bay.

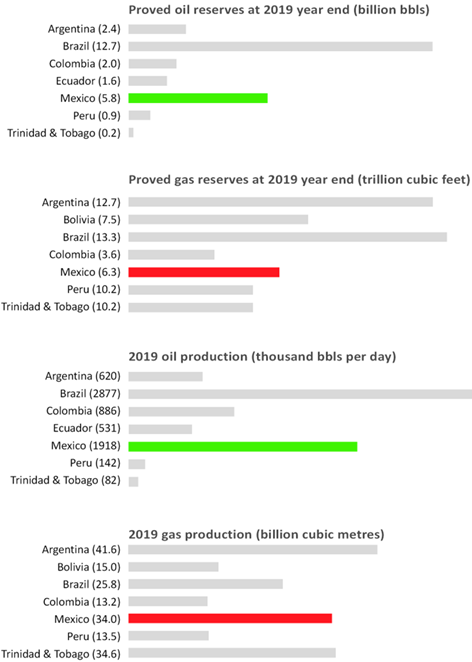

Reserves and production comparison data

Mexico is one of the world’s largest untapped resources of oil and gas. Recent significant discoveries in the Perdido and Sureste Basins are key indicators that the petroleum potential is definitive and with substantial rewards. In addition to its geological potential, recent changes to regulation and fiscal terms have been designed to bring international interest to Mexico. The result has seen a revitalization of the Energy industry which puts Mexico estimated ultimate recovery (EUR) potential in a similar category to such established provinces as Norway, UK and Brazil but with the promise of yet undiscovered potential with new investment.

Mexico is now one of the largest producers of petroleum and other liquids in the world, the fourth-largest producer in the Americas after the United States, Canada, and Brazil, and an important partner in U.S. energy trade.

Country Key Facts

| Official name: | Estados Unidos Mexicanos |

| Capital: | Mexico City |

| Population: | 128,773,952 (2020) |

| Area: | 1,964,375 square kilometers |

| Form of government: | Federal Republic |

| Language: | Spanish, various Mayan, Nahuatl |

| Religions: | Roman Catholic, Protestant |

| Currency: | Mexican Peso |

| Calling code: | +52 |

The institutions in charge of Mexico’s hydrocarbon industry

Ministry of Energy (SENER): develops Mexico’s upstream policy; determines areas to be made available and the schedule for public bidding; chooses which of the contract models to apply to which contract; and approves the non-fiscal terms of the contract.

Ministry of Finance (SHCP): determines the fiscal terms to apply to each contract and participates in audits.

National Hydrocarbons Commission (CNH): interfaces with Pemex and private companies, conducts and manages contracts, and oversees the industry.

Energy Regulatory Commission (CRE): grant permits for transportation, storage, distribution, compression, liquefaction, decompression, regasification, marketing, and sale of crude oil, oil products, and natural gas.

National Agency for Industrial Safety and Environmental Protection (new): regulates environmental and safety concerns.

Key oil and gas players in Mexico

BHP

In December 2016, BHP Billiton submitted the winning bid to acquire a 60 per cent participating interest in and operatorship of blocks AE-0092 and AE-0093 containing the Trion discovery located in the deep-water Gulf of Mexico offshore Mexico. PEMEX Exploration & Production Mexico (Pemex) retained a 40 per cent interest in the blocks. Pemex estimates the gross recoverable resource to be 485 MMboe.

BHP Billiton’s bid for Trion included an upfront cash payment of US$62.4 million and a commitment to a Minimum Work Program (estimated to be up to a maximum of US$320 million).

In March 2017, BHP Billiton executed a contract with PEMEX to complete work on the significant Trion discovery.

Cairn

Cairn has interests in four blocks in the Gulf of Mexico, two as operator (Blocks 9 and 15) and two as non-operator (Blocks 7 and 10). Mexico provides an exciting opportunity to discover commercial quantities of hydrocarbons in a highly prolific, yet underexplored region.

In Q1 2020, an oil discovery was confirmed on the non-operated Saasken-1 exploration well (15% WI)* in Block 10 in the Sureste Basin. Preliminary estimates by the Operator, Eni, indicate the discovery may contain 200 to 300 million barrels of oil in place.

Cheiron

On 4 October 2017, Cheiron was awarded a 50% share and the operatorship in a production sharing agreement covering the Cardenas Mora fields, with PEMEX holding the remaining interest. The Concession is valid until 2042 with the option of two extension periods of five years each.

The Altamira field is a heavy oil, mature and shallow onshore reservoir in the contractual area of the same name in Northern Mexico. The service contract for the exploration, development and production of hydrocarbons at Altamira was awarded to Cheiron’s Mexican subsidiary in 2012.

Chevron

In December 2016, an international consortium operated by Chevron Corporation’s subsidiary, Chevron Energía de Mexico, S de R.L. de C.V., was awarded an exploration contract for Block 3 in the deepwater Gulf of Mexico, one of the most significant opportunities in Mexico’s 1.4 bid round. Other partners in the bidding consortium are Pemex Exploration and Production and INPEX Corporation.

In October 2019, Reuters reported that Chevron has signed an agreement with a unit of Royal Dutch Shell to acquire a 40% stake in three deepwater blocks in the Mexican Gulf that the Anglo-Dutch firm won in auctions under the nation’s energy reform.

Citla

In September 2017, Citla Energy signed three hydrocarbon exploration and production contracts as part of Mexican Round 2.1. The blocks were awarded under production sharing contracts with a duration of up to 40 years (30 years plus two 5 year extensions) and are located in the south east of the Gulf of Mexico, one of the most prolific and under explored shallow water basins in the world.

In April 2018, Citla won its fourth production-sharing contract as part of Round 3.1 of the Mexican Energy Reform. The newly won contract is associated with "Block 15," a geographic area located in the Tampico Misantla basin of the Gulf of Mexico, covering about 962 km².

CNOOC

In December 2016, Mexico awarded China Offshore Oil Corporation (CNOOC) the first block tendered from the Gulf of Mexico's Perdido Fold Belt off the U.S.-Mexico maritime border, in a historic deep water oil and gas auction.

CNOOC International now has 100% working interest in two deepwater exploration blocks – Block 1 and Block 4 – in the Gulf of Mexico’s Cinurón Plegado Perdido, located in the offshore segment of the Burgos geological province, containing mostly oil.

Eni

Eni is producing approximately 15,000 barrels of oil equivalent per day (boed) from Area 1 and expects to reach a plateau of 100,000 boed in the first half of 2021. Eni is also planning an important exploration campaign in the other licenses held in Mexico.

In February 2020, the company announced a new oil discovery on the Saasken Exploration Prospect in Block 10. According to preliminary estimates, the new discovery may contain between 200 and 300 million barrels of oil in place. The discovery is opening a potential commercial outcome of Block 10 since several other prospects located nearby may be clustered in a synergic development.

Equinor

In December 2016, Statoil (now Equinor) was awarded blocks 1 and 3 in the Saline Basin in the Deepwater exploration tender in the Mexican Round 1.

The blocks cover an area of about 5,650 km² in the largely unexplored deepwater areas of the Saline Basin. Statoil will be the operator of blocks 1 and 3, at 33.4% equity, with partners BP and Total participating equally with the remaining equity.

ExxonMobil

In December 2016, Mexico awarded a consortium comprising ExxonMobil and Total the second block tendered from the Gulf of Mexico's Perdido Fold Belt off the U.S.-Mexico maritime border in a historic deep water oil and gas auction.

Block 2 is a 1,149 square mile (2,976.6 square km) block which is thought to contain some 1.440 billion barrels of oil equivalent (boe) in light and extra light crude as well as natural gas.

Fieldwood

In September 2015, Fieldwood and its partner were the high bidder on Area 4. Area 4 is comprised of two fields, Ichalkil and Pokoch, in the Bay of Campeche about 60 miles from the Mexican coastline in 100-150 feet of water. Both of these fields have been tested by successful exploration wells, but there is no current production within Area 4.

Harbour Energy

Harbour Energy has an interest in the giant Zama field in Mexico’s Sureste basin and exposure to material exploration upside through our other offshore licences.

The company has a 25 percent interest in Block 7, in the shallow water Sureste Basin. Block 7 contains the giant Zama field which extends into the neighbouring block which is 100 percent owned by Pemex. The Block 7 partners and Pemex continue to progress Zama towards a targeted late 2021 final investment decision (FID).

Harbour have a 30 percent non-operated interest in Block 30, which is located directly to the south of the Zama field in the Sureste Basin.

The company additionally has a 100 percent interest in Block 11 and Block 13 in the highly prospective Burgos basin inboard of the prolific deep water Peridido fold belt.

INPEX

In December 2016, INPEX announced a successful joint bid in Mexico's first deepwater lease auction to explore Block 3 located in the Perdido Fold Belt in the Mexican sector of the northern Gulf of Mexico.

The Block is located offshore in the Mexican sector of the northern Gulf of Mexico and covers an area of 1,687km² where the water depth ranges between approximately 500m to 1,700m. INPEX and PEMEX each hold a 33.3333% participating interest in the Block while Chevron, the operator, holds a 33.3334% participating interest.

International Frontier Resources

IFR was early to identify the oil and gas opportunities offered by Mexico's historic energy reform. IFR, through its joint venture (JV) Tonalli Energia, has now achieved its initial goals, in partnership with Mexican petrochemical leader Grupo IDESA S.A. de CV.

Through its JV with Grupo IDESA, IFR became one of the first foreign companies to participate in Mexico's energy reform in the first bid round of the onshore blocks ("Round 1.3"). Moreover, it was one of the first foreign companies to be awarded an onshore oil and gas development block through a license contract.

Jaguar E&P

In March 2021, Jaguar E&P reported important discoveries of natural gas in the Burgos Basin, in the Dieciocho de Marzo field, and natural gas with light oil in the Spinini prospect, in the Tampico - Misantla Basin.

The blocks containing these fields were awarded to Jaguar in Round 2.2 and 2.3. To date, Jaguar has engaged in exploration activities, including drilling wells at a total cost of over $100 million dollars. Jaguar discovered reserves estimated by management to be between 30 and 50 billion cubic feet (BCF) of natural gas in 18 de Marzo and 160 BCF of gas and between 20 and 30 million barrels of light crude in Spinini (both wells are management estimates of recoverable hydrocarbons on a PMean estimate).

Lewis Energy

In March 2018, PEMEX and Lewis Energy México signed the first Integrated Exploration and Extraction Contract for the Olmos field, which is located in the state of Coahuila. The purpose is to assess and develop the Eagle Ford field in Mexico.

By formalizing this contract, an investment of 617 million dollars is expected, and the companies aim to reach a daily production of 117 million cubic feet of natural gas by 2021.

Lukoil

In January 2017, Lukoil selected Canada-based Renaissance Oil Corp as its partner for operations in the Amatitlán block, located near Poza Rica in Veracruz.

In March 2018, Eni and its partner Lukoil were awarded rights to Block 28, located in the medium-deep waters of the Cuenca Salina basin, offshore Mexico. This allows Eni to build up and consolidate a new core area with significant operational synergies in the Country.

In February 2020, Eni announced a new oil discovery on the Saasken Exploration Prospect in Block 10, located in the mid-deep water of the Cuenca Salina in the Sureste Basin, Offshore Mexico. According to preliminary estimates, the new discovery may contain between 200 and 300 million barrels of oil in place.

PT Medco

Following their acquisition of Ophir Energy in May 2019, Medco inherited exploration acreage in Mexico.

In February 2018, Ophir Energy, together with its joint venture partners, were awarded Block 10 and Block 12 as part of the Mexico offshore bid round 2.4. Both of these licences are located in the Ridges basin, which features a proven hydrocarbon system and material prospectivity.

The Block 10 partnership is comprised of Repsol (operator), Petronas and Ophir (20% interest). The block covers an area of 2,000 km² in water depths between 500m and 2,000m.

Murphy

In December 2016, Murphy and joint venture partners were the high bidder on Block 5, which was offered as part of Mexico’s fourth phase, Round one deepwater auction. Murphy was formally awarded the block in March 2017. Murphy is the operator of the Block with a 30% working interest. Block 5 is located in the deepwater Salinas basin covering approximately 640,000 gross acres (2,600 square kilometers) and water depths in this block range from 2,300 to 3,500 feet (700 to 1,100 meters).

Pan American Energy

PAE participate in the development of areas located in the shallow waters of the Gulf of Mexico.

The company operate the Hokchi area and blocks 31 and 2 and were part of the winning consortium for Block 34, in association with Total E&P México and BP Exploration México.

PAE are the first private company to drill in shallow water and to generate income for the Mexican State through a shared production contract. PAE were also the first private operator whose Development Plan was approved by the National Hydrocarbons Commission after the country's Energy Reform.

PEMEX

Mexico nationalized its oil sector in 1938, and Petróleos Mexicanos was created as the sole oil operator in the country. PEMEX is the largest company in Mexico and one of the largest oil companies in the world. The energy sector is regulated by the Secretaría de Energía (SENER), while the Comisión Nacional de Hidrocarburos (CNH) provides additional oversight of PEMEX and its oil and gas activities.

Perenco

In 2018 Perenco acquired 49% of Petrofac Netherlands Holding, which holds Petrofac contracts in Mexico and operates alongside Pemex, the State Company. This partnership has allowed Perenco to invest in the development of the Santuario, Magallanes and Arenque fields.

In November 2020, Petrofac completed the sale of its remaining 51% interest in its upstream IES operations in Mexico, including Santuario, Magallanes and Arenque, to Perenco. Following the sale, Perenco now owns 100% of the operations in Mexico.

Perseus

In December 2015, Perseus was awarded Tajon A and B fields in Macuspana Muspac formation and Fortuna Nacional Field in Bellota Jujo formation both in Tabasco México.

Petrobras

Petrobras began their activities in Mexico in 2003 as operators in natural gas exploration and production service contracts in the Cuervito and Fronterizo blocks (onshore), located in the Burgos Basin, north of Mexico.

The two integral service-rendering agreements include exploration and production activities, as well projects involved in infrastructure construction and maintenance.

Additionally, Petrobras had a scientific and technological collaboration agreement in effect with Pemex through 2014; negitiations are currently underway for its renewal.

PETRONAS

In December 2016, PETRONAS confirmed the award of deep water Block 4 and Block 5 in the Gulf of Mexico’s Salina Basin, following Mexico’s first ever auction of its deep water exploration areas.

In August 2018, PETRONAS was awarded shallow water Block 6 in the Gulf of Mexico’s Salina Basin. The block covers an area of about 559 square kilometres in water depths of between 30 and 80 metres and is operated by PC Carigali Mexico in a 50:50 partnership with Ecopetrol.

In May 2020, PETRONAS, together with its partners announced successful discoveries with two exploration wells in Block 29 located in the Salina Basin, offshore Mexico. The first exploration well, 'Polok-1', was drilled to a depth of 2,620 meters and encountered approximately 200 meters of net oil pay, followed by the second exploration well, 'Chinwol-1', which was drilled to a depth of 1,850 meters and encountered net oil pay approximately 150 meters.

PTTEP

PTTEP holds two exploration blocks in Offshore Mexico; Block 29 and Block 12.

In May 2020, PTTEP and its joint venture partners made two successful deep-water oil discoveries in Block 29, offshore Mexico, with good quality reservoirs. Commercial potential of the new discovery will be assessed in the next phase.

Qatar Petroleum

In February 2018, Qatar Petroleum won the exploration rights for blocks 3, 4, 6, and 7 in the Perdido basin as part of a consortium comprising Shell (operator with a 60% interest) and Qatar Petroleum (with a 40% interest).

Qatar Petroleum also won the exploration rights for block 24 in the Campeche basin as part of a consortium comprising Eni (operator with a 65% interest) and Qatar Petroleum (with a 35% interest).

In December 2018, Eni and Qatar Petroleum signed a sale and purchase agreement to enable Qatar Petroleum to acquire a 35% participating interest in Area 1, offshore Mexico, from Eni. Eni will continue to be the Operator.

Renaissance Oil

Renaissance Oil is a Mexico-focused oil and gas company that is developing a prolific block in the Tampico-Misantla onshore basin. The Upper Jurassic shale formations in the Tampico-Misantla basin are the major source rocks for the world’s largest producing offshore oil field (Cantarell, with peak production of 2.1 million barrels a day), and the world’s most prolific oil well ever found (Cerro Azul-4; produced at a peak of 260,000 barrels a day). Renaissance Oil is using the latest technology to prove up and develop the Upper Jurassic shales in the company’s 60,000 acre Amatitlan block in the heart of Tampico-Misanlta basin.

Repsol

Repsol operates a total of six blocks offshore Mexico, three in deep water and three in shallow water areas. The company continues to evaluate all seismic and available data from the rest of the blocks in order to fulfill its work programs approved by CNH.

In May 2020, Repsol, together with its partners announced successful discoveries with two exploration wells in Block 29 located in the Salina Basin, offshore Mexico.

Shell

Shell has been in Mexico since 1954 and has a large portfolio of businesses that includes retail, trading, petrochemicals, lubricants, import and sales of LNG.

In 2018, Shell won nine deep-water exploration blocks; four blocks on their own (Shell interest 100%), four with their partner Qatar Petroleum International Limited (Shell interest 60%), and one with their partner Pemex Exploración y Producción (Shell interest 50%). The total area of these nine blocks is 18,996 square kilometres. Shell is the operator of all nine blocks.

Talos Energy

Talos Energy (operator), together with its joint venture partners Harbour Energy and Sierra Oil & Gas, were awarded Blocks 2 and 7 in Mexico’s Round 1. The Blocks contain numerous leads in established and emerging plays, located in the shallow water Sureste Basin, a proven and prolific hydrocarbon province in the Gulf of Mexico.

Blocks 2 and 7 contain Tertiary clastic plays, typical of the Salinas sub-basin. The forward plan is to acquire, evaluate and reprocess 3D seismic data with a view to firming up drilling locations towards the end of 2016.

The JV comprises Talos Energy (operator, 35 per cent), Wintershall Dea (40 per cent) and Harbour Energy (25 per cent).

TotalEnergies

TotalEnergies operate Block 2 (50%), located in the Perdido Basin in water depths of 2,300 to 3,600 meters and covering a surface area of 2,977 square kilometers and Block 15 (60%), located in shallow water off the coast of the State of Campeche in the country’s southeast.

The company also have interests in Blocks 1 and 3 (33.3%), in the Salina Basin, Blocks 32 and 33 (50%), in shallow water and Block 34 (42.5%), in shallow water.

Wintershall Dea

After entering the national oil and gas market in 2017, Wintershall Dea established a major position in Mexico. This includes being operator of the producing Ogarrio oil field. The company also holds shares in promising exploration licences. The takeover of Sierra Oil & Gas secured Wintershall Dea a considerable share of Zama, one of the world’s largest shallow-water discoveries.

In May 2020, Wintershall Dea, together with its partners announced successful discoveries with two exploration wells in Block 29 located in the Salina Basin, offshore Mexico. The first exploration well, 'Polok-1', was drilled to a depth of 2,620 meters and encountered approximately 200 meters of net oil pay, followed by the second exploration well, 'Chinwol-1', which was drilled to a depth of 1,850 meters and encountered net oil pay approximately 150 meters.

KeyFacts Energy provide bespoke reports covering selected country and energy company 'at-a-glance' reviews, allowing users to access valuable 'first-pass' information ahead of more detailed analysis. Contact us for further information.

KeyFacts Energy: Country Profile

KEYFACT Energy

KEYFACT Energy