Sound Energy has entered into a sale and purchase agreement with Schlumberger Holdings II to acquire the entire issued share capital of Schlumberger Silk Route Services Limited.

Acquisition Highlights:

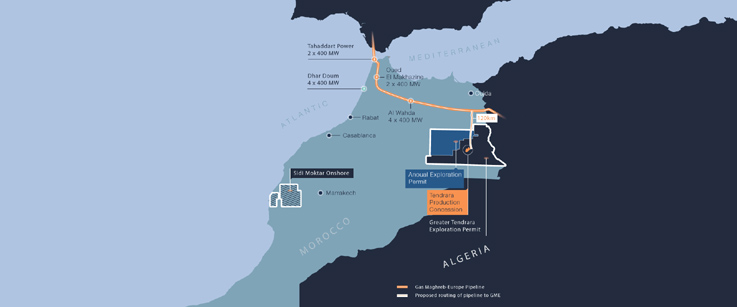

- The Group will have increased participating interests in in the Anoual and Greater Tendrara exploration permits in Eastern Morocco by 27.5% to 75%, together with full control over its 75% participating interest in the Tendrara Concession

- Accretive acquisition on highly attractive terms

- Positions Sound Energy to generate enhanced returns, cashflow and value as it moves forward the phased development of the TE-5 Horst

- Significantly enhances discovered and undiscovered resource position

- Increased participating interest to 75% will not impact the planned phased development strategy in East Morocco and underlines Sound Energy's position as a leading gas developer in country

- Sound Energy will remain fully funded for its increased 75% working interest of planned phase 1 Tendrara Concession capital investments required until first gas, subject to finalising funding arrangements previously announced with Afriquia Gaz, our strategic partner and a major participant in the Moroccan gas industry

SSRS holds a 27.5% participating interest in the Anoual and Greater Tendrara exploration permits in Eastern Morocco together with a 27.5% indirect interest in the Tendrara Concession through its contractual relationship with the Group. Following completion of the Acquisition, Sound Energy will control operated working interests of 75% in the Exploration Permits and in the Concession.

In consideration for the Acquisition, the Group shall make an initial payment of US$1 (one US dollar) to the Seller in cash on completion and may make future payments to the Seller pursuant to a Profit Sharing Deed ("PSD").

Under the principal terms of the PSD, the Group will pay to the Seller an amount equivalent to between 8% and 11% of total net profits (after costs, taxes and other applicable deductions) arising from the Concession over a period of 12 years from first commercial production from the Concession. In the event of a cash disposal by the Company of part or the whole of the SSRS's interest in the Exploration Permits on or before 28 February 2023, the Seller would be entitled to receive from Sound Energy 27.5% of the net cash proceeds related to the disposal of the SSRS Permit Interest, rising to 55% of proceeds related to the SSRS Permit Interest in the event of such a disposal occurring prior to 31 December 2021.

The Acquisition is conditional upon the Seller taking the necessary steps on or before 5 September 2021 to sell the entire issued share capital of SSRS to Sound Energy on a cash-free, debt-free basis at completion. Upon completion of the Acquisition, Sound Energy will grant to the Seller a share charge over 100% of the share capital of Sound Energy Morocco East Limited, the Company's wholly owned subsidiary, in connection with the PSD and the Exploration Permit Disposal Right. Under the terms of the PSD, there is a mechanism for reducing this share charge upon certain milestones having been met and also for replacing the share charge with an alternative security mechanism following the first payment arising from the PSD.

As at 31 December 2020, SSRS had unaudited net assets of US$ 87.1 million and recorded a loss for the year before tax of US$ 0.2 million.

Commenting, Graham Lyon, Executive Chairman, said:

"We are delighted to have increased our working interest in our principal assets in Eastern Morocco on highly attractive terms. This accretive transaction will, when completed, underline Sound Energy's position as the leading gas developer in Morocco and position us to generate enhanced returns, cashflow and value as we move forward the phased development of the TE-5 Horst. The increased position on the licences significantly enhances our discovered and undiscovered resource position in Eastern Morocco as we continue to deliver on our phased development strategy. Importantly, upon securing the funding envisaged under the Heads of Terms previously entered into with Afriquia Gaz, the Company will remain fully funded for its increased 75% working interest of planned phase 1 Tendrara Concession capital investments required until planned first gas.

KeyFacts Energy: Sound Energy Morocco country profile

KEYFACT Energy

KEYFACT Energy