As part of our 'at-a-glance' guide to company global operational activity, today we feature Challenger Energy.

From small private operators through to multi-national companies, KeyFacts Energy's database includes over 600 ‘first pass’ preliminary review profiles.

Challenger Energy is a Caribbean and Atlantic margin focused oil and gas company, with a range of exploration, appraisal, development and production assets and licences, located onshore in Trinidad and Tobago, and Suriname, and offshore in the waters of The Bahamas and Uruguay, and onshore in Trinidad and Tobago, and Suriname.

Challenger Energy’s portfolio of opportunities represents a mix of valuable production assets in Trinidad and Tobago, near-term appraisal and development projects in Trinidad and Tobago and Suriname, and high impact exploration assets located in The Bahamas, Uruguay and Trinidad and Tobago.

Challenger Energy Board, management team and staff base have a broad range of skills as well as deep technical and industry experience.

Global operations

The Bahamas

- 5 licences (100%) plus 3 licence applications (100%), all offshore

- The recently drilled Perseverance #1 well evaluated the potential Albian and Aptian reservoirs of the B North segment of the enormous B structure

- Licences to be renewed end June 2021 (with 50% relinquishment). Renewed farmout process commenced. ‘Drill or Drop’ by early 2023

Trinidad and Tobago

- 6 licences (100%), 1 licence (83.8%) -all onshore, close to sales infrastructure

- c. 400 -450 bopd production base from multiple fields and considerable well stock

- Production enhancement opportunities from workovers, reactivations & new pumps accessing shallow reservoirs

- Enhanced sweep efficiency and increased recovery factor via EOR techniques and in-fill wells

- Discovery at Saffron – Saffron-2 appraisal well and early-stage development

- Low-cost development options across portfolio

- Targeting up to 9 Saffron lookalikes form the target of onshore exploration activities following reprocessing of existing. 3D seismic coverage

Suriname

- 1 onshore licence -Weg Naar Zee PSC (100%)

- Planning for Extended Well Test (EWT) with realised production able to be sold-success leads to early, low-cost development and reserves adds (24 mmbbl STOIIP)

Uruguay

- 1 offshore licence OFF-1 (100%); ~15,000 km²

- Challenger Energy Estimated Resource: >1 billion barrels. ANCAP (State-owned company) independently identified Lenteja Prospect 1.4 billion barrels recoverable

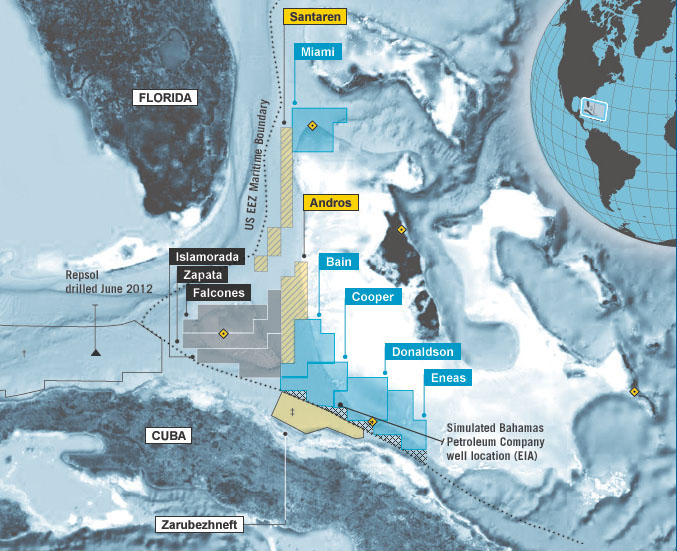

BAHAMAS

Summary Information

- Asset: Southern Licences (Bain, Cooper, Eneas, Donald)*

- Location: Offshore, Southern Territorial Waters, The Bahamas

- Ownership: 100%

- Operator: Challenger Energy

- Stage: Exploration drilling

- Asset Type: License

- Resource Estimate: Perseverance #1 drilled in February 2021 drilled the ‘B’ structure (75 kms by 5-10 kms, 423 km² total closure) targeting stacked carbonate reservoirs throughout the Aptian sections. The well encountered hydrocarbons, but not in commercial quantities; but technically validated trap, seal & reservoir models at both the play and prospect scales

- Fiscal Regime: Royalty; no corporate tax or CGT. 30 year production right

* In addition, Challenger Energy holds 100% of the Miami license, in the northern waters of The Bahamas, pending relinquishment or a renewal agreement with the government.

In The Bahamas, Challenger Energy holds 100% of five exploration licences covering approximately 16,000km² (4 million acres). Four of the licences are located in the southern territorial waters of The Bahamas, together referred to as the “Southern Licences” (Bain, Cooper, Donaldson, Eneas), and a fifth, the Miami licence, in the northern territorial waters of The Bahamas. The main licences of interest and focus for Challenger Energy are the Southern Licences. All licences were awarded for an initial exploration period of three years, with up to three further exploration periods possible. The Southern Licences are commercially co-joined, meaning that the fulfilment of work obligations on any one of the Southern Licences will satisfy the work obligation in respect of all the Southern Licences.

The Southern Licences are currently in their second exploration term (expiring end June 2021), during which Challenger Energy was obliged to drill an initial exploration well, Perseverance #1, which was completed in early 2021.

The well, Perseverance #1, was drilled notwithstanding considerable challenges – including a year’s delay and significant disruption caused by the Covid-19 pandemic, a collapse in oil prices, and a last-minute legal action by environmental activists seeking to halt drilling which was successfully defended by the Company. The well was drilled safely and without an environmental or safety incident, and whilst the well-encountered oil, indicated from LWD (Logging While Drilling) tools, and corroborated by gas chromatography and mud logs, it did not result in a commercial discovery.

The Company is, however, encouraged that the data from the Perseverance #1 well successfully validated the structural model, a competent seal, good reservoir quality, charge, and established a working petroleum system which collectively supports the view that other closures, structures and both shallower stratigraphic and deeper structural plays in the Company’s Bahamian licence areas continue to provide significant commercial prospectivity, and with multiple viable drillable prospects of scale which merit additional study and exploration activity.

Given these technical results, since announcing the results of the well the Company has had a number of discussions with industry counterparties in relation to a potential farm-out of the licences, and the Company has formally launched an entirely new farm-out process via Gneiss Energy. The farm-out is seeking to introduce funding and operating partner for the next stage of exploration activity in The Bahamas.

Concurrent with the farm-out process, the Company will seek to retain its 100% interest in the Southern Licences by extending the licences in to the third exploration period whilst formalising the relinquishment of the Miami licence. The third exploration period for the Southern Licences will last for three years and will require further exploration wells to be drilled before the period expires, failing which the licences would be forfeited (i.e., “drill or drop”). An extension of the licences will attract an annual licence fee and requires a relinquishment of 50% of the licence area. Notification of renewal of the licences has been submitted to the appropriate Ministry, and the area to be relinquished has been identified as being the area equivalent to that over the shallower water depths covered by the Southern Licences (less than circa 200 feet).

Established Petroleum System, Adjacent Producing Analogues

- Four commercially co-joined offshore licenses covering 12,600 km² adjacent to the Cuban border with a further 9,400 km² under application that would secure the on-trend prospective acreage.

- The licences have a 12-year exploration period (4×3 years) with the option for a 30-year production lease on discovery.

- The region is significantly underexplored with only 5 historic wells over an area of 124,000 km². All five wells encountered oil shows.

- A large data base of geological information has been acquired and studied to define the prospectivity of the region. This includes 8,000 km of regional 2D, 1,100 km local 2D and 3,000 km². BroadSeis 3D seismic acquired in 2011.

- The extensive dataset and G&G analysis establishes presence of petroleum systems bracketing key source, maturity, migration pathway, reservoir and seal parameters.

TRINIDAD & TOBAGO

Challenger Energy has five (5) producing fields in Trinidad (Goudron, Inniss-Trinity, South Erin, Bonasse, and Icacos), an appraisal/development project (Saffron) and an exploration portfolio in the South West Peninsula (SWP).

In January 2020, drilling and testing of the Saffron well in the SWP was completed. Oil was discovered in the Lower and Middle Cruse portions with 2,363 ft of gross sands with six reservoir intervals of interest with a 47% net/gross ratio.

In addition, the Company has a number of drill-ready prospects in SWP and targets to carry out exploration drilling on the initial shortlisted prospects following the reinterpretation of 3D seismic reprocessing.

In Trinidad and Tobago, Challenger Energy has a portfolio of assets across the life cycle of the E&P, focussed on the following value-driven activities:

Production and Production Enhancement Projects

- In 2020 Challenger Energy set and achieved its target production of 500 bopd. Production remains stable and the Company is working on a prioritised list of activities, including increasing workover frequency and proactive interventions, reducing well downtime and continuing to drive production to above this baseline.

- In addition, the Company is undertaking a series of projects that improve overall oil recovery. These projects help to improve either the reservoir pressure (such as CO2 and water injection) to allow for higher sustained production rates or reservoir access (via new wells, recompletions and incremental perforations). By increasing the production from existing fields we maximise the use of infrastructure and resources helping to drive down operating costs and improve profitability.

Accelerated Appraisal and Early Stage Development

- In early 2020 Saffron #1 successfully discovered producible oil at both the Middle and Lower Cruse reservoir levels. Prior to drilling, the estimated recoverable volumes from this new accumulation was up to 11 MMbbl, representing a material upside for appraisal and development.

- The drilling of Saffron #2 will focus on the Lower Cruse sands and will lead directly to production and sales upon completion.

- The successful appraisal and future development of the Saffron prospect is estimated to have the potential to produce up to 4,000 bopd.

High Impact Exploration

- Challenger Energy holds a significant and dominant acreage position in the South West Peninsula (SWP) of Trinidad.

- The recent discovery at Saffron has further de-risked the potential of the area which is estimated to have in excess of 230 MMbbl of unrisked prospective resources.

- With 3D seismic available across the area of focus, Challenger Energy is using its international geological and geophysical experience to reprocess the seismic database and mature numerous prospects in the inventory to drill-ready status. Further exploration success in the SWP will provide additional and replicable development options to grow the company’s overall production potential.

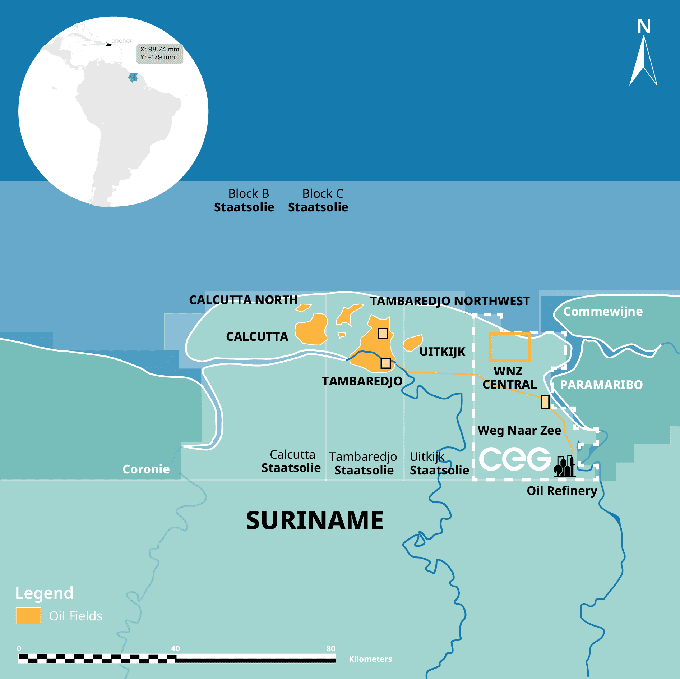

SURINAME

Summary Information

- Asset: Weg Naar Zee (WNZ)

- Location: Onshore, Suriname

- Ownership: 100%

- Operator: Challenger Energy

- Stage: Appraisal / Extended Well Test

- Asset Type: Production Sharing Contract

- STOIIP: 24.1mmbbl (over 8 pools)

- Fiscal Regime: Cost recovery and R-Factor based production sharing

- Tenur: 3-year exploration period to October 2022 / 30-year PSC term to October 2039 or 25-years from approval of first development plan, whichever is later

Map source: Challenger Energy

Production Potential

- WNZ is an onshore block -approximately 900 km² which is located close to both Paramaribo (Suriname capital) and the existing oil sales infrastructure of the main onshore Tambaredjo production field and local refinery

- Extensive 2D seismic data and previous well information (including well test data) is available to assist in future development of hydrocarbons from WNZ

- Discovered oil in mapped discrete sand bodies

- Suitable for application of Enhanced Oil Recovery techniques used in Trinidad

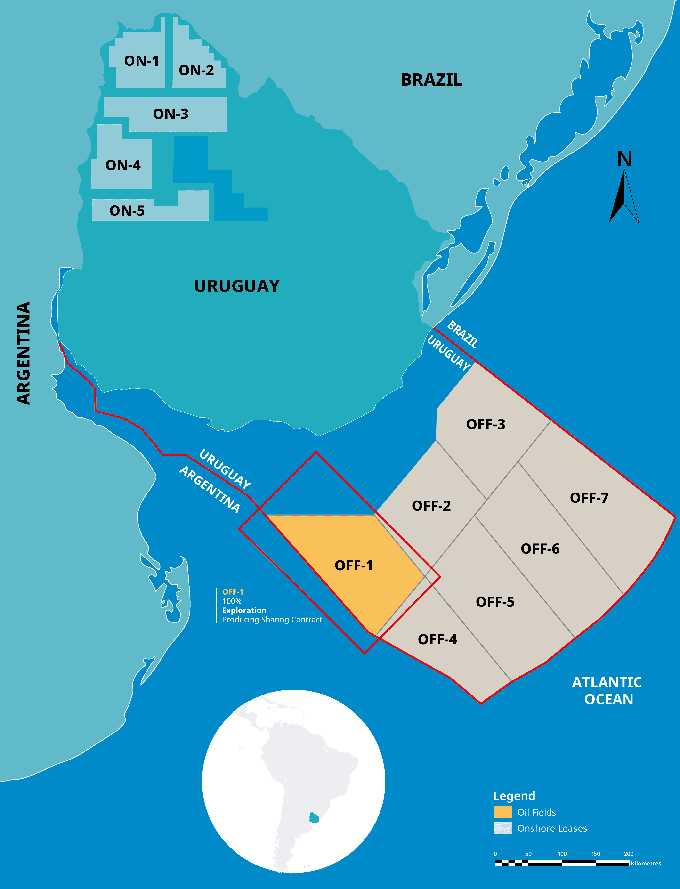

URUGUAY

OFF-1

- Location: Offshore, Uruguay

- Ownership: 100%

- Operator: BPC

- Stage: Exploration

- Licence size: 15,000km²

- Asset Type: Production Sharing Contract

- Anticipated Resource: 1 billion bbl (estimate)

- Fiscal Regime: Cost recovery and R-factor based production sharing

- Tenure: Pending formal signing

New Exploration Province

- Schedule: Initial 4-year exploration term

- Estimated Resource: >1 billion barrels

- Commitments: Purchase, reprocessing and reinterpretation of existing 2D seismic data –no drilling required in initial exploration term

Exploration Potential

Multiple exploration plays and leads in modest water depths with significant running room

- Licence play systems analogous to prolific Cretaceous discoveries currently being evaluated/developed offshore Guyana and Suriname

- Adjacent licence activity in Uruguay and Argentina

- Comparable to the “low cost option” represented by BPC’s licences in the Bahamas when first awarded

- Modest work commitment that secures a sizable, technically high quality, frontier play

- Historic well data and regional seismic available

Map source: Challenger Energy

In June 2020, Bahamas Petroleum was chosen as the successful applicant for the award of an exploration licence offshore Uruguay by the Uruguayan national regulatory agency, ANCAP. This follows a period in which BPC's technical and operational credentials were first evaluated by ANCAP and BPC was approved as a qualified offshore operator, and thereafter BPC submitted an application for the AREA OFF-1 block.

The OFF-1 licence provides for an initial four-year exploration period, during which time BPC will reprocess approximately 2,000 kilometres of legacy 2D seismic and undertake a number of new geotechnical studies. The Company expects that the cost of the work program in the initial period will consist of approx. US$200,000 per annum in historic seismic data acquisition and reprocessing, G&G studies and other technical work to be largely supported by the Company's existing technical staff base currently supporting operations in The Bahamas. Apart from the costs of completion of the minimum work program there are no annual licence fee payments, and no drilling is required in the initial four-year period, with extension into a second exploration period entirely at BPC's election.

OFF-1 has many operational and subsurface similarities to BPC's licences in The Bahamas - the Uruguay and Bahamas acreage is in similar water depths, both contain multiple, lower exploration risk structural plays in addition to the high impact fans, and both have material volume scope and extensive running room.

About AREA OFF-1

The AREA OFF-1 licence has a total area of approximately 15,000 km² (comparable to BPC's four southern licences in The Bahamas which comprise an aggregate area of 12,500 km²) and is situated in water depths from 20 to 1000 meters, approximately 100 kms off the Uruguayan coast.

There has been considerable prior legacy activity on and adjacent to the OFF-1 block, comprising some historical 2D seismic (approximately 12,000 line-kilometres acquired from the early 1970s to 2015). However only two historic wells have been drilled to-date in the area (in 1976 by Chevron), with no 3D coverage. Current mapping reveals a diversity of exploration plays and leads in relatively shallow water and indicates an estimated resource potential of up to 1 billion barrels of oil equivalent (BBOE). Given the successfully bid fiscal regime, BPC's preliminary analysis suggests that any of the individually mapped current prospects is likely to be economic, even at currently historically low oil prices.

Technically, the OFF-1 exploration play is similar in nature to the prolific Guyana - Suriname basin currently being successfully explored by multiple oil companies, as well as the Cretaceous turbidite plays that have been successfully explored offshore north-eastern South America.

There has been considerable licencing activity proximate to OFF-1 in recent years. During 2019, oil majors Shell, BP, Total and Equinor bid for and were awarded various licences offshore Argentina, adjacent to ours which is proximate to the Argentina-Uruguay maritime border, and where the primary targets in those licences are likely to be the same Cretaceous plays potentially present in OFF-1. More recently, In December 2019, Kosmos Energy bid for and was awarded the two adjacent Uruguayan offshore blocks to OFF-1.

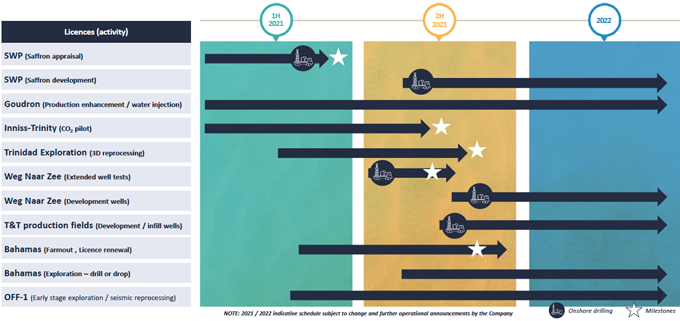

Challenger Energy’s Activity Timeline

LEADERSHIP

Bill Schrader

Non-Executive Chairman

James Smith

Non-Executive Deputy Chairman

Eytan Uliel

Chief Executive Officer

Nathan Rayner

Operations Director

Dr. Parbodh Gogna

Hse&S And Government Relations Director

Randolph Hiscock

New Business Director

Geoffrey Leid

Trinidad & Tobago Country Head And Gm

Gagan Khurana

Commercial Manager

Benjamin Proffitt

Finance Director And Company Secretary

Senator Hon. Jobeth Coleby-davis

Legal Counsel

CONTACT

Head Office

IOMA House, Hope Street, Douglas, Isle of Man, IM1 1AP

Tel: +44 (0) 1624 647883

Email: info@cegplc.com

The Bahamas

Building 5 Caves Village, West Bay Street, P.O. Box SP-64135, Nassau, NP, The Bahamas

Tel: +1 (242) 362 5120

Trinidad & Tobago - San Fernando office

Unit 1, Bldg. 1,61-67 Cipero Road, Retrench, San Fernando, Trinidad and Tobago, W.I.

Tel: +868 285 9065

Email: info.trinidad@cegplc.com

London

Suite 114, 90 Long Acre, London, WC2E 9RA, UK

Tel: +44(0)7 747 845 987

KeyFacts Energy: Challenger Energy Bahamas country profile

* KeyFacts Energy hold a database of over 600 oil and gas company profiles, allowing users to instantly access operational activity, geographic locations and key personnel in our succinct reviews. For more information about this bespoke low-cost service, contact us.

KEYFACT Energy

KEYFACT Energy