Equinor is an international energy company present in more than 30 countries worldwide, including several of the world’s most important oil and gas provinces. Founded in 1972 under the name Den Norske Stats Oljeselskap AS - Statoil (the Norwegian State Oil company), The name changed to Equinor in May 2018.

Equinor is engaged in exploration, development and production of oil and gas in addition to renewables. They are the leading operator on the Norwegian continental shelf and have substantial international activities. Equinor sell crude oil and is a major supplier of natural gas. Processing, refining, offshore wind and carbon capture and storage is also part of their operations.

Shareholders

The Norwegian State holds 67% of the company's shares through the Ministry of Petroleum and Energy, while US investors hold 11%, private Norwegian owners hold 8%, other European investors 8%, UK investors hold 3%, and others 2%.

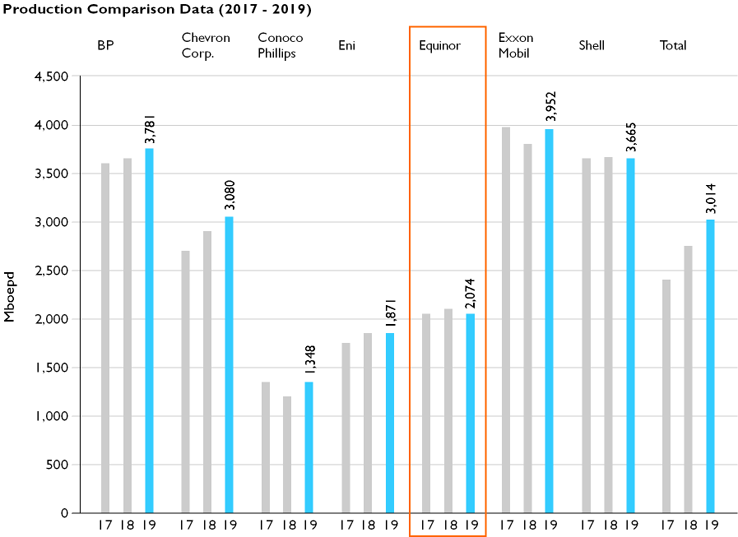

Production and reserves

Equinor delivered total equity production of 2,043 mboe per day in the fourth quarter of 2020, down from 2,198 mboe per day in the same period in 2019, with a minor increase in gas share due to high flexible production in gas fields. Adjusting for portfolio transactions the production growth for 2020 was 2.4%.

The proved reserves replacement ratio (RRR) was negative 5% in 2020, following capital discipline and the prioritisation of financial flexibility during market uncertainty, with a three-year average of 95%. With 5.26 billion barrels in proved reserves, Equinor’s reserves to production ratio (R/P) was 7.4 years.

History

Equinor has grown up along with the emergence of the Norwegian oil and gas industry, dating back to the late 1960s. Today, the company is one of the world's largest suppliers of oil and gas.

In 1972, the Norwegian State Oil Company, Statoil, was formed, and two years later the Statfjord field was discovered in the North Sea. In 1979, the Statfjord field commenced production, and in 1981 Statoil was the first Norwegian company to be given operator responsibility for a field, at Gullfaks in the North Sea.

Statoil merged with Norsk Hydro’s oil and gas division on 1 October 2007. The new company was given the temporary name of StatoilHydro, and the company reached a size and strength for considerable international expansion. The company changed its name back to Statoil on 1 November 2009.

Norsk Hydro’s oil history stretches back to the late 1960’s, when the company was a license holder in the giant Ekofisk discovery in the North Sea in 1969.

In May 2018, the company name changed to Equinor, supporting the company’s strategy and development as a broad energy company.

Equinor has been one of the most important players in the Norwegian oil industry, and has contributed strongly to make Norway into a modern industrial nation. Today, Norway is one of the world's most productive petroleum provinces and a test lab for technology development.

Renewable projects

Equinor has a sizeable renewables portfolio with an offshore wind portfolio with the capacity of providing over 1 million homes with renewable energy. The company operates the Sheringham Shoal wind farm in the UK, which has been in production since 2012. The Dudgeon offshore wind farm in the UK, also operated by Equinor – and the world’s first floating offshore wind farm, Hywind Scotland – started producing in 2017. In 2016 Equinor also acquired 50% of the Arkona offshore wind farm in Germany, which will deliver power in 2019.

Global operations

ALGERIA

Together with BP and the Algerian national oil company Sonatrach Equinor is involved in the development and production of two of the largest gas fields in the country, In Salah and In Amenas.

Equinor, then Statoil, entered Algeria in 2003 following the purchase of 50% of BP shares in the gas-condensate field In Amenas and 49% of BP shares in the dry gas field In Salah. These two deals were ratified by Algerian authorities in 2004 and Equinor established their office in Algiers the same year. In 2014, Equinor were awarded the Timissit Permit Licence in the Illizi-Ghadames Basin in partnership with Shell. The Timissit licence represents an opportunity to build on Equinor’s position in Algeria with material exploration potential. Sonatrach is the operator with 70% equity while Equinor holds a 30% share. The licence located in southeast Algeria covers an area of 2,730 square kilometres.

Equinor ALGERIA AS SUCCURSALE

1 chemin Doudou Mokhtar Ben, Aknoun, Algeria

Tel: +213 770 24 06 45

ANGOLA

The Angolan continental shelf is one the largest contributors to our oil production outside Norway.

Equinor is a partner in eight Angolan offshore producing fields in the Congo basin on the Angolan continental shelf totaling an equity production of around 150,000 barrels of oil equivalent per day (2019).

Block 17, Total operated

One of the first deep-offshore blocks to be licensed in Angola. Production from four FPSOs. Equinor equity production approximately 100 kbbl/day.

Block 15, Exxon operated

Production from four FPSOs. Equinor equity production approximately 30 kbbl/day.

Block 31, BP operated

Production from one FPSO. Equinor equity production approximately 10 kbbl/day.

Block 1/14

The exploration block 1/14 was accessed in 2020 through a Risk Service Contract. ENI (35%) is the operator with partners Equinor (30%), Sonangol P&P (25%) and local company ACREP (10%). The block is located In the Lower Congo basin - east of the prolific block 15. Several prospects and leads have been identified. The first exploration period has a duration of 4 years and the initial work program consists of seismic and 2 wells.

Angola office

Belas business park, Edifício Luanda 3º andar - Talatona, Luanda

Tel: +244 222 640 939

ARGENTINA

Argentina’s unconventional oil and gas resources are among the world’s largest. The Vaca Muerta is a geological formation in the Neuquén basin covering 30,000 km² mainly in the province of Neuquén at the northern end of Patagonia, containing oil and gas found at a depth of more than 2,500 meters. Argentina’s Neuquén province is the country’s most prolific hydrocarbon basin.

Bajo del Toro

In August 2017 Equinor, and YPF entered into an agreement to jointly explore hydrocarbons in the Bajo del Toro block. Equinor are in the process of converting the block into a 35 years exploitation concession.

Bajo del Toro Este

In November 2017 Equinor was awarded the Bajo del Toro Este exploration licence as part of the Argentina’s Gas y Petróleo del Neuquén’s (GyP) 5th bidding round.

Equinor operate the licence with a 90% working interest, with Gas y Petróleo del Neuquén retaining a 10% interest. The Bajo del Toro Este licence borders the Bajo del Toro licence to the east. The Bajo del Toro Este exploration licence permit covers an area of 133 km².

Equinor has committed to one exploration well before 2022.

Aguila Mora Noreste

Equinor was awarded the Aguila Mora Noreste exploration licence in December 2019, as part of Gas y Petróleo del Neuquén’s bidding round. Equinor is the operator with a 90% working interest, with Gas y Petróleo del Neuquén holding the remaining 10%.

Equinor has committed to one exploration well before 2023.

Bandurria Sur

In January 2020, Equinor and their partner Shell completed a joint acquisition of the 49% interest held by Schlumberger in the Bandurria Sur onshore block in Argentina’s Neuquén province. Later the same year Equinor and Shell acquired additional 11% interest from the operator, YPF. Equinor and Shell now each own a 30% non-operated interest, with YPF owning a 40% interest continuing as operator.

The block is in the early development phase with a current production of around 8,000 barrels of oil equivalent per day. It covers around 56,000 gross acres in the central area of the prolific Vaca Muerta play.

Offshore

In 2019 Equinor added eight offshore exploration blocks in Argentina to its portfolio.

Equinor were granted permits for five blocks as operator and participated in winning bids for one block to be operated by YPF and one block to be operated by Total, in the 1st Offshore Licensing Round in April 2019. In August the same year Equinor farmed into the CAN_100 block with YPF in the North and took over operatorship.

Argentina office

Regus Laminar Plaza, Ingeniero Enrique Butty 240, Floor: 5º, B1101AFB, Buenos Aires

Tel: +54 (11) 4590 2200

AUSTRALIA

The North West Shelf

In September 2019, Equinor was offered exploration permit WA-542-P for an initial period of six years. Equinor accepted the permit in October 2019. The permit covers approximately 4,800 square kilometres.

The Great Australian Bight

Equinor became operator and 100% owner of exploration permits EPP39 and EPP40 in June 2017. The permits cover approximately 12,000 square kilometres.

Although their Environment Plan for the Bight was accepted by NOPSEMA, Equinor discontinued plans to drill in Licence EPP39 as the opportunity was not commercially competitive.

AZERBAIJAN

Equinor have been operating in Azerbaijan since 1992 and are one of the largest foreign investors.

Equinor has an interest in the Azeri-Chirag-Gunashli (ACG) oil field, as well as the Baku-Tbilisi-Ceyhan (BTC) pipeline—which runs from the Azerbaijan capital of Baku to the south Turkish port of Ceyhan on the Mediterranean. Equinor has a 7.27% interest in the extended ACG PSA. BP is the operator of ACG. BP currently estimates total recoverable reserves in ACG over the period of extended PSA (2018-2049) at ca 3 billion barrels of oil.

Baku-Tbilisi-Ceyhan (BTC) oil export pipeline is the main export rout for the ACG oil. Equinor has an 8,71% interest in BTC project. BTC pipeline passes Azerbaijan, Georgia and Turkey, connecting the Caspian with the Mediterranean Sea.

On 30 May 2018 Equinor and SOCAR signed a Risk Service Agreement related to the appraisal and development of the Karabagh oilfield and a Production Sharing Agreement for the Ashrafi-Dan-Ulduzu-Aypara (ADUA) area in the Caspian Sea. Equinor and SOCAR hold equal shares in both projects.

The Karabagh oilfield is located 120 kilometres east of Baku, close to the SOCAR operated Shallow Water Gunashli (SWG) field and the BP operated Azeri-Chirag-Gunashli (ACG) field. In December 2019, Equinor started drilling the KPS-4 appraisal in water depth of approximately 180 meters. In March 2020, Equinor and SOCAR confirmed oil discovery in the Karabagh field. To operate the licence, Equinor and SOCAR established a 50-50 joint operating company.

The ADUA exploration area is located around 100-110 kilometres north-east of Baku.

Baku office

Marine Plaza Business Center, 62 Uzeyir Hajibeyli Street, 16th floor, 1095 Baku, Azerbaijan

Tel: +99412 4977340

BRAZIL

Equinor has been present in Brazil for nearly two decades, and see the country as a core area for long-term growth.

The company have a diversified oil and gas portfolio in the country, with licenses at different stages - exploration, development and production - in the Campos, Santos and Espírito Santo Basins. Equinor are the largest international company in terms of production volume, with an average of approximately 100 thousand barrels of oil per day.

Outlook

By the end of 2022, five high-impact prospects in the pre-salt will be drilled.

Renewable

The Apodi complex, opened in November 2018, is the first initiative by Equinor in solar energy, and is in Quixeré, Ceará. A gigantic complex with 500,000 solar panels, occupying an area equivalent to 300 football fields and an installed capacity of 162MW.

Apodi is operated by the company's Norwegian partner Scatec, and has Brazilian partners from the ApodiPar consortium. Equinor also closed an exclusive cooperation agreement with Scatec to continue developing other solar projects in Brazil in the coming years.

Rio de Janeiro office

Rua do Russel 804, Glória, Rio de Janeiro, RJ, Postal code: 22.210-010, Brazil

Telephone: +55 (21) 3479-9800

CANADA

The company have been present offshore Newfoundland and Labrador since 1996, when Norsk Hydro first acquired assets. Through their operating and partner fields, Equinor are making significant investments in Canada’s offshore industry.

Equinor have strengthened their long-term position in the Canadian offshore by acquiring exploration licenses in the Flemish Pass Basin in 2015 and the Jeanne d’Arc Basin in 2018, where they will apply the exploration knowledge and experience gained globally and in the North Atlantic specifically.

Equinor is operator of seven discoveries offshore Newfoundland in the Flemish pass basin:

- Mizzen - The company's first discovery made in 2009 in the Basin

- Harpoon - A light hydrocarbon discovery in 2013

- Bay du Nord - A 2013 discovery estimated to hold ~300 million barrels of light high-quality oil

- Bay de Verde - A light high-quality oil discovery in 2016 located adjacent to the Bay du Nord discovery

- Baccalieu - A light high-quality oil discovery in 2016 approximately 15 km from the Bay du Nord discovery

- Cappahayden and Cambriol - Two discoveries made in 2020, approximately 500 kms east of St. John’s, NL

Equinor also holds working interests in four projects offshore Newfoundland:

- Suncor-operated Terra Nova (15%) producing asset

- ExxonMobil-operated Hebron (9%) producing asset

- ExxonMobil-operated Hibernia (5%) producing asset/Hibernia Southern Extension (9%)

The Hibernia oil field has proven and probable field reserves totaling about 1.6 billion barrels of recoverable crude oil, making it the province's largest producing field to date.

The Terra Nova oil field has proven reserves of approximately 506 million barrels of recoverable crude.

St John's office

Steers Cove, NL A1C 6J5, St. John’s, Canada

Tel: +1 709-726-9091

CHINA

Equinor’s history in China goes back to the early 1980s, when they set up their first international office in Beijing. Their partnership with the China National Offshore Oil Corporation (CNOOC) led to the company's first operatorship, the Lufeng oil field in the South China Sea, which was in production from 1997 to 2009, five years longer than originally planned.

In 2007, Equinor entered into a strategic cooperation agreement with CNPC, covering domestic and international exploration and production, research and development, gas value chains, new energy and downstream. In 2010 the company agreed with Sinopec to conduct a joint study on their QiongDongNan deepwater block in the South China Sea.

In 2014 Equinor delivered their first liquefied natural gas (LNG) cargo to China.

GERMANY

Arkona Offshore wind

The Arkona offshore wind farm officially opened in spring 2019 with a ceremony in the port of Mukran. Arkona is the largest wind farm in the Baltic Sea and is located 35 kilometers northeast of the island of Rügen.

The wind farm is operated by E.ON and was built in cooperation with Equinor. Arkona started feeding electricity into the German grid in September 2018. The total of 60 turbines in the six-megawatt class achieved their peak performance at the beginning of 2019. The wind farm has a total capacity of 385 megawatts. Arkona can save up to 1.2 million tons of CO2 annually compared to conventionally generated electricity. The park is also a symbol of the close energy partnership between Norway and Germany.

IRELAND

Equinor is a partner in the Corrib field, providing natural gas to Ireland, and the company are looking into several potential offshore wind projects with their Irish partner ESB.

The Corrib field development, operated by Vermilion, started production on 30 December 2015. The gas field is located 83 kilometres off Ireland’s northwest coast in water depths of almost 350 metres.

The field reached peak production of 350 MM scf/d of gas, which is 60,000 barrels of oil equivalent per day (boe/d) in 2016.

Offshore wind

The coast of Ireland has strong wind conditions making it an interesting market for offshore wind. Together with our Irish partner, ESB, we are considering the feasibility of the following potential offshore wind projects:

- Sea Stacks Offshore Wind

- Helvick Offshore Wind

- LochGarman Offshore Wind

- Moneypoint Offshore Wind

- Celtic Offshore Wind

Contact

Equinor House, Prime Four Crescent, Kingswells, Aberdeen AB15 8QG United Kingdom

Tel: +44 (0) 1224 540 540

LIBYA

Equinor has been present in Libya for 25 years with onshore exploration and oil production activities. The company now participate in licenses on the Mabruk field and in the Murzuq basin.

NC-186 (MURZUQ)

Operated by Akakus Oil Operations, this license is governed by an Exploration and Production Sharing Agreement (EPSA) between the Libyan National Oil Corporation (NOC) and a second party consortium comprising Repsol (32%), Total (24%), OMV (24%) and Equinor (20%). Production resumed in early 2017 after an interruption of more than two years. The total field capacity is around 120 kbbl/d.

NC-17 (MABRUK)

Operated by Mabruk Oil Operations, the field is governed by an EPSA between NOC and Total (75%) and Equinor (25%) as second party. The field was damaged by a terrorist attack in 2015 and has been abandoned since. Re-development will only be possible when the security situation allows.

MEXICO

In December 2016, blocks 1 and 3 in the Saline Basin were awarded to a consortium consisting of then Statoil, (now Equinor), (33.4%), BP (33.3%) and Total (33.3%). Equinor is the operator of Block 3, while BP is the operator of Block 1. The blocks cover an area of about 5,650 km² in a largely unexplored deepwater area. The partnership is currently working on maturing the assets.

Mexico city office

Torre del Bosque, Blvd. Manuel Avila Camacho No. 24, P18, Col. Lomad de Chapultepec 11000, Mexico, D.F.

Tel: +52 55 5540 6237

NICARAGUA

In May 2015, Equinor was awarded four licences offshore the Nicaraguan Pacific, together with partner Petronic.

In October 2018, Cairn Energy entered as a partner with 35.1% equity in the licences. After the transaction, Equinor is the operator with 49.9% equity. Empresa Nicaraguense del Petroleo (Petronic) participates with the remaining 15% equity.

The licences cover an area of about 16,000 square kilometres in the Sandino Basin.

The partnership has a step-wise exploration programme for the area. The initial work commitments during the first exploration phase of 3.5 years include acquisition of new seismic 2D data, re-processing of old 2D seismic data and geological and geophysical studies. During Q3 2018, a total of 3,187 square kilometres of 3D seismic data and 1.759 kilometres of new 2D seismic data were acquired. Based on encouraging results it has been decided to start preparations for drilling the Mango-1 well.

NIGERIA

Equinor have been in Nigeria since 1992 and have played a significant role in developing the country’s biggest deepwater field Agbami, utilising one of the world’s largest floating production, storage and offloading vessels. It is located 110 kilometres off the Nigerian coast in water depths of 1,500 metres. The FPSO can store up to 2.2 million barrels of oil and will be on location for more than 20 years. Equinor has a 20.21% stake in Agbami, while Chevron is the operator with 67.30% interest and Petrobras holds the remaining 12.49%.

Equinor also operates two exploration licences—OMLs 128 and 129—with a 53.85% share in both. Six wells have been drilled in both, with two discoveries made. While the Nnwa discovery is predominantly comprised of gas as well as some oil, Bilah is a gas and condensate discovery. Both discoveries remain undeveloped today.

Lagos office

13th Floor, Heritage Place, 21 Lugard Avenue, Ikoyi, Lagos, Nigeria

Tel: +234 1 2713532

NORWAY

Equinor operate 42 fields on the Norwegian continental shelf and produce around 2.5 million barrels a day, including the volumes from their partners.

Equinor operated fields

Equinor are responsible for 70% of oil and gas production in Norway and are on track to maintain profitable production from the Norwegian continental shelf at current level towards 2030.

- The Alve gas and condensate field is developed as a subsea satellite field tied back to the Norne field's production vessel.

- The Fram oil finds in the North Sea comprise the Fram Vest and Fram Øst fields.

- Gina Krog is located about 30 kilometres northwest of Sleipner, and came on stream in June 2017.

- The Grane oil field Grane in the North Sea was discovered by Hydro in 1991, and came on stream on 23 September 2003.

- The Gudrun field, located in the North Sea in licence area PL025, holds about 184 million barrels of oil equivalent.

- The main Gullfaks field lies in block 34/10 in the northern part of the Norwegian North Sea. The Gullfaks A platform began production on 22 December 1986, with Gullfaks B following on 29 February 1988 and the C platform on 4 November 1989.

- Heidrun was discovered in 1985 by Conoco and has been producing oil and gas since October 1995.

- Heimdal is a gas field west of Sveio in Hordaland county, in the northern part of the North Sea, north of Johan Sverdrup and south of Oseberg, near the border with the UK shelf.

- Huldra was developed with a wellhead platform which ranked as the first Equinor offshore installation designed for normally unstaffed operation. Equinor proved the field in 1982, and development work began in the spring of 1999.

- The development concept for the small oil field Hyme includes a subsea installation tied back to the Njord A platform.

- Equinor's Johan Sverdrup field came on stream in October 2019, and is expected to increase daily production to 535,000 barrels of oil by mid-2021.

- The Kristin gas and condensate field came on stream on 3 November 2005. Daily production capacity from the field is 125,000 barrels of condensate and just over 18 million cubic metres of rich gas.

- The Kvitebjørn gas and condensate field lies in block 34/11, east of Gullfaks in the Norwegian North Sea. Production from the field began on 26 September 2004.

- Mikkel has been producing gas and condensate (light oil) since 1 August 2003.

- Equinor commenced production of oil from the Morvin subsea field towards the Åsgard field in the Norwegian Sea 1 August 2010.

- The Njord field was in production from 1997 to 2016. The platform and the storage vessel is now undergoing an extensive upgrade. The work will take place from 2016 to 2021, and it will make the field ready to produce until 2040.

- Norne lies in a licence which was awarded in 1986, and embraces blocks 6608/10 and 6608/11, located 85 kilometres from Heidrun.

- The Sigyn gas and condensate (light oil) field lies in block 16/7 in the Sleipner area, roughly 12 kilometres south-east of Sleipner Øst.

- Skuld is an oil and gas field located on Haltenbanken in the Norwegian sea and the largest of the development fields in Equinor’s fast-track portfolio.

- The Sleipner area embraces the gas and condensate fields Sleipner Øst, Gungne and Sleipner Vest. The Sleipner installations are also processing hydrocarbons from the tie-in fields Sigyn, Volve, Gudrun and from 2017 also rich gas from Gina Krog.

- Spanning blocks 34/4 and 34/7 in the Tampen area of the Norwegian North Sea, the Snorre field has been producing oil and gas since August 1992. The field consists of the platforms Snorre A and Snorre B, and extensive underwater production systems.

- Snøhvit is the first offshore development in the southern Barents Sea and is the first major development on the Norwegian continental shelf with no surface installations.

- The Oseberg Field Centre includes three platforms, Oseberg A, B and D, connected to one another with bridges, in the southern part of the Oseberg field, and the Oseberg C platform, which lies 14 kilometres north of the field centre.

- Discovered by Mobil in 1974, Statfjord is one of the oldest producing fields on the Norwegian continental shelf, and the largest oil discovery in the North Sea.

- The Tordis oil field lies in block 34/7 in the Tampen area of the Norwegian North Sea, and came on stream in 1994.

- The Troll field comprises the main Troll Øst and Troll Vest structures in blocks 31/2, 31/3, 31/5 and 31/6. Containing about 40 per cent of total gas reserves on the Norwegian continental shelf (NCS), it represents the very cornerstone of Norway’s offshore gas production.

- Located 10 kilometres southwest of the Oseberg Field Center, the Tune field was discovered with an exploration well in 1995 and confirmed with an appraisal well in 1996.

- Tyrihans is a complete subsea solution tied back to existing installations and infrastructure on the Kristin and Åsgard fields in the Halten Bank area of the Norwegian Sea.

- The Urd field in the Norwegian Sea began production on 8 November 2005.

- Vale is a gas and condensate field developed as a satellite installation with a sea-floor template tied into the Heimdal Gas Center platform by a 16.5 kilometer long pipeline.

- The Valemon field is one of Equinor’s stand-alone development projects on the Norwegian continental shelf. Containing about 192 million barrels of oil equivalent the field will be producing through a separate platform.

- Veslefrikk lies in Norwegian North Sea block 30/3. The field came on stream in 1989 as the first development off Norway to use a floating production unit.

- Vigdis lies in block 34/7 in the Tampen area of the Norwegian North Sea and came on stream in 1997. In addition to the main structure, this field comprises the Borg Nordvest and Vigdis Øst structures.

- Visund is an oil and gas field in blocks 34/8 and 34/7, 22 kilometres north-east of the Gullfaks field in the Tampen area of the Norwegian North Sea.

- The Volve oil field, located 200 kilometres west of Stavanger at the southern end of the Norwegian sector, was decommissioned in September 2016 after 8.5 years in operation, more than twice as long as originally planned.

- Åsgard is located in Haltenbanken in the Norwegian Sea, around 200 kilometres off mid-Norway and 50 kilometres south of the Heidrun field.

- The Aasta Hansteen field is located in 1 300 metres of water in the Vøring area in the Norwegian Sea, 300 kilometres west of Sandnessjøen. Its floating platform is higher than the Eiffel tower.

Oslo office

Martin Linges vei 33, 1364 Fornebu

Postal address: Equinor ASA, PO Box 3, 1330 Fornebu

Tel: +47 51990000

Stavanger headquarters

Forusbeen 50, Forus East

Postal address: Equinor ASA, 4035 Stavanger

Tel: +47 51990000

Bergen

Equinor ASA, Sandsliveien 90, 5254 Sandsli

Postal address: Equinor ASA, PO Box: 7200, 5020 Bergen

Tel: +47 51 99 00 00

POLAND

Renewable

In the period 2018—2019, Equinor signed agreements with Polenergia to acquire a 50% interest in the early-phase offshore wind development projects MFW Baltyk I, MFW Baltyk II and MFW Baltyk III.

Equinor has interest in all three Baltyk offshore wind development projects (MFW Baltyk III, MFW Baltyk II and MFW Baltyk I). This gives the company an opportunity to build scale and value in what they see as an important energy region.

The wind farm area is in the Baltic Sea approximately 80 kilometers from the port of Leba, with water depths of 25-35 meters.

Baltyk III and Baltyk II are two early-phase offshore wind development projects where Equinor has a 50% interest and Polenergia has a 50% interest. The two projects have a planned capacity of 1440 MW with the potential to power more than 2 million Polish households.

In 2019 Equinor completed the acquisition of a 50% interest in the offshore wind development project Baltyk I from Polenergia. The license allows for a development of a wind farm with a capacity up to 1,560 MW.

Equinor will be the manager for the construction preparation and the potential construction and operational phases of the projects. Equinor and Polenergia have a 50/50 joint venture and are working together to mature the Baltyk projects towards construction.

Warszawa office

Ludwika Warynskiego 3a, 00-645 Warszawa, Poland

RUSSIA

Equinor has been present in Russia for 28 years and have developed close relationships with Russian energy companies and communities.

Key projects

In 2012 Equinor entered into a strategic cooperation with Rosneft. This cooperation covers several joint projects,including the North Komsomolskoye pilot project for viscous oil development in West Siberia, pilot project for development of Domanik limestone formation in the Samara region and offshore exploration.

North-Komsomolsk field

In January 2019, Equinor acquired 33.3% of Sevkomneftegaz (Rosneft subsidiary), which will develop the North-Komsomolsk field in the Yamalo-Nenets Autonomous District. In December 2019, Rosneft took an investment decision on the first stage of the North Komsomolskoye full field development. Total recoverable volumes for stage one are estimated at 250 million barrels of oil and 23 bcm of gas.

Kharyaga field

Equinor holds a 30% interest in the Kharyaga field, part of Timan-Pechora basin located in the Nenets Autonomous District 60 kilometres north of the Arctic Circle. The Kharyaga PSA licence provides Equinor an equity production of approximately 10,000 barrels per day. Equinor owns 30%, Zarubezhneft 40% (operator), Total 20%, and Nenets Oil Company (NOC) 10%.

Sea of Okhotsk licences

In the Sea of Okhotsk Equinor holds three licences - Magadan-1, Lisyansky and Kashevarovsky - covering 79,000 square kilometres in the northern part of the Sea of Okhotsk, north-east of Sakhalin Island. Rosneft and Equinor have established joint ventures to explore these licences with Equinor holding 33.33%.

West Siberia

In September 2017, Equinor and Rosneft signed the shareholders and operating agreement and agreed to set up a JV (Equinor 33.33%) for the North-Komsomolskoye onshore project, a significant non-producing viscous oil field onshore West Siberia.

Eastern Siberia

In December 2020, Equinor completed an agreement with Rosneft that increases its onshore presence in Russia.

Through this agreement Equinor acquired a 49% interest in the limited liability company LLC KrasGeoNaC (KGN) which holds twelve conventional onshore exploration and production licenses in Eastern Siberia. One of these twelve licenses, the North Danilovsky development, started production in July 2020. Production is expected to reach 40,000 barrels of oil per day by 2024, with subsequent plans to increase this to 70,000 barrels of oil per day.

Russia representative office

Paveletskaya square 2, bl.2, floor 14, Moscow, 115054 Russia l Tel: +7 495 967 38 18

SOUTH AFRICA

Equinor entered into South Africa in 2015 and today has four exploration licences in the country.

In 2015 the company acquired a 35 percent interest in the Exploration Right 12/3/154 Tugela South. The remaining interests are held by the operator ExxonMobil (40%) and co-venturer Impact Africa (25%). The licence covers an area of approximately 9,000 square kilometres.

In 2017 Equinor, then Statoil, acquired a 35 percent interest in the Exploration Right Transkei-Algoa. Operator ExxonMobil holds 40 percent and partner Impact Africa 35 percent. The licence covers an area of approximately 45,000 square kilometres.

In 2017 Equinor also acquired a 90 percent interest and operatorship for the Exploration Right East Algoa. The remaining 10 percent is held by partner OK Energy. The licence covers an area of approximately 9,300 square kilometres.

In 2018 Equinor finalized a farm-in for 50% equity share in the Deepwater Durban exploration license. ExxonMobil is the operator and holds the remaining 50% equity share. The licence covers an area of more than 50,000 square kilometres.

All licences are located in deep waters with depths up to 3,000 metres.

SURINAME

Equinor has interest in three blocks offshore Suriname.

The company signed production sharing contracts (PSCs) for block 54 in 2014 and blocks 59 and 60 in 2017.

- Block 54: Tullow 30% (operator), Equinor 50%, Noble 20%. Water depths approx. 200 to 1,300 metres.

- Block 59: ExxonMobil 33,34% (operator), Equinor 33,33%, Hess 33,33%. Water depths approx. 2,900 to 3,500 metres.

- Block 60: Equinor 100% (operator). Water depths approx. 700 to 1,300 metres.

TANZANIA

Equinor has been in Tanzania since 2007 when the company signed a Production Sharing Agreement (PSA) for Block 2 with Tanzania Petroleum Development Corporation (TPDC). Equinor Tanzania is the Operator with 65% participating interest while ExxonMobil is partner with a 35% working interest. TPDC has the right to participate with a 10% interest.

Major gas discoveries have been made offshore Tanzania and the country is emerging as a potential large gas producer in East Africa. Equinor started exploration drilling activities in Block 2 Offshore Tanzania in 2011. A total of 15 exploration wells have been drilled, resulting in nine discoveries with estimated volumes of more than 20 Tcf of gas in place.

Dar es Salaam office

429 Mahando Street, Block A, Msasani Peninsula, Dar Es Salaam, United Republic of Tanzania

Tel: +255 684 226203

UNITED KINGDOM

On the UK Continental Shelf Equinor operate the Mariner, Bressay and Utgard Fields, as well as being partners in the Jupiter and Alba fields.

Equinor also holds interests in more than 20 exploration licenses, most of them as operator. The Company are increasing their investment on the UK continental shelf through the development of the Mariner field, an ambitious 30-year project which represents one of the largest capital expenditure commitments on the UK continental shelf for over a decade - a gross investment of more than GBP 4.5 billion.

UK operations at a glance

- Equinor is the largest supplier of crude oil to the UK and the largest supplier of natural gas. Equinor’s gas supplies meet more than 25% of UK demand, enough to heat or power 8 million British homes and businesses every year.

- Equinor’s operated offshore wind farms (Sheringham Shoal, Dudgeon and Hywind Scotland) together supply electricity to 650,000 UK homes. Hywind Scotland is the first floating offshore wind park in the world and is partnered with Batwind, the world’s first battery for offshore wind.

- Equinor is currently developing Mariner, one of the largest upstream investments in the UK in the last 10 years – a gross investment of more than GBP 4.5 billion.

- In May 2018, Equinor was awarded nine new licences in the 30th Offshore Licensing round, eight as operator.

- Equinor, with its partner SSE, is developing the Dogger Bank offshore wind project which has the potential to provide around 10% of the UK’s total electricity needs. Once fully developed it will be one of the largest offshore wind farms in the world.

- In January 2019, Equinor completed the acquisition of Chevron’s 40% operated interest in the Rosebank project in the West of Shetland region of the UK Continental Shelf

Renewable

Dogger Bank

In September 2019, Equinor and its partner SSE were awarded contracts to develop three large scale offshore wind projects in the Dogger Bank region of the North Sea. This will be the world’s biggest offshore wind farm development with a total installed capacity of 3.6 GW. The projects are expected to produce enough energy to power the equivalent of 4.5 million UK homes.

Northern Endurance Partnership (NEP)

In October 2020, bp, Eni, Equinor, National Grid, Shell and Total formed ?a new partnership, the Northern Endurance Partnership (NEP), to develop offshore carbon dioxide ??(CO2) transport and storage infrastructure in the UK North Sea, with bp as operator. This ?infrastructure will serve the proposed Net Zero Teesside (NZT) and Zero Carbon Humber (ZCH) ?projects that aim to establish decarbonized industrial clusters in Teesside and Humberside.?

Equinor (U.K.) Limited

9th Floor, 1 Kingdom Street, London W2 6BD, United Kingdom

Tel: +44 (020) 3204 3200

UNITED STATES

Equinor are the 5th largest producer of oil & gas in the US Gulf of Mexico and their US onshore operations are Equinor’s largest international production outside Norway.

Gulf of Mexico

Equinor is one of the most active exploration companies in the Gulf of Mexico, with more than 100 exploration leases in its portfolio containing multiple prospects and leads. The company are constantly adding new opportunities to the portfolio through lease sales and market transactions, and expect to continue to drill exploration wells in the US Gulf of Mexico every year.

Onshore

Equinor has been active in the development and production of onshore oil and gas in the US since 2009. Their onshore portfolio is focused on the Bakken play in North Dakota and the Marcellus/Utica formations in the Appalachian Basins. From these assets the company were producing over 321,000 boepd in 2019.

RENEWABLE

In September 2020, Equinor entered into an agreement with bp to sell 50% non-operated interests in the Empire Wind and Beacon Wind assets on the US east coast for a total consideration before adjustments of USD 1.1 billion. Through this transaction, the two companies are also establishing a strategic partnership for further growth within offshore wind in the US.

The transaction is in line with Equinor’s renewable strategy to access attractive acreage early and at scale, mature projects, and capture value by de-risking high equity ownership positions.

Through this partnership Equinor and bp will consider future joint opportunities in the US for both bottom-fixed and floating offshore wind and will leverage relevant expertise to jointly grow scale. As the partnership develops, both companies hope to expand this cooperation further in a market that is forecast to grow to between 600 and 800 gigawatts (GW) globally by 2050.

Empire Wind 2 and Beacon Wind 1

In January 2021, Equinor was selected to provide New York State with offshore wind power in one of the largest renewable energy procurements in the U.S. to date.

Under the award, Equinor and incoming strategic partner bp will provide 1,260 megawatts (MW) of renewable offshore wind power from Empire Wind 2, and another 1,230 MW of power from Beacon Wind 1 – adding to the existing commitment to provide New York with 816 MW of renewable power from Empire Wind 1 – totaling 3.3 gigawatts (GW) of power to the State.

VENEZUELA

The Petrocedeño project is a mixed company formed by state-owned Petróleos de Venezuela (PDVSA), Total and Equinor. Petrocedeño aims to improve the recovery of extra-heavy crude oil from the Orinoco Belt area and transform it into a higher quality syncrude than the Brent Blend reference crude. This product is known as Zuata Sweet.

The Petrocedeño agreement has a duration of 25 years starting in 2008, where PDVSA holds 60%, Total 30.33% and Equinor 9.67%.

As of 30 June 2017, the company's 9.67% ownership share in the Petrocedeño project was reclassified from an equity accounted investment to a non-current financial investment. Equinor have of this date stopped including production and reserves from Petrocedeño in financial reporting.

In the offshore area, Equinor hold 51% of the exploration license for Cocuina, in Plataforma Deltana block 4. The drilling phase was completed in October 2007 after which the authorities from Venezuela and Trinidad & Tobago entered in a process of unitisation for the Cocuina-Manakin reservoir. In February 2015, a Unitisation Agreement was executed by the two governments and currently, Equinor are in dialogue with the operator of the field on the Trinidad & Tobago side to agree on a Unit Operating Agreement and a Sole Operator.

Operational data

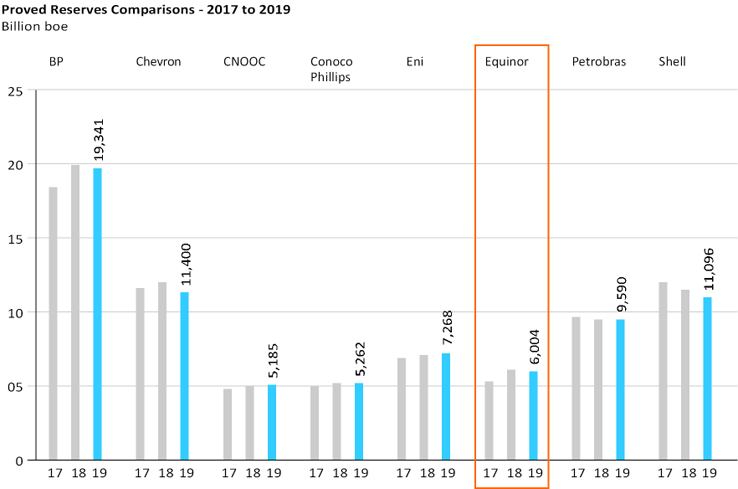

Reserves

Proved oil and gas reserves were estimated to be 6,004 million boe at year-end 2019, compared to 6,175 million boe at the end of 2018.

Approximately 88% of Equinor’s proved reserves are located in OECD countries. Norway is by far the most important contributor in this category, followed by the US and Canada. Of Equinor's total proved reserves, 5% are related to PSAs in non-OECD countries such as Azerbaijan, Angola, Algeria, Nigeria, Libya and Russia. Other non-OECD reserves are related to concessions in Brazil and Russia, representing all together 7% of Equinor's total proved reserves.

In 2019, approximately 426 million boe were matured from proved undeveloped to proved developed reserves. The startup of production from Johan Sverdrup, Trestakk and Utgard in Norway and in the UK, increased proved developed reserves by 305 million boe during 2019. The remaining 121 million boe of the matured volume is related to activities on developed assets. Over the last five years, Equinor has matured 2,012 million boe of proved undeveloped reserves to proved developed reserves.

Proved reserves in Norway

A total of 4,270 million boe is recognized as proved reserves in 61 fields and field development projects on the NCS, representing 71% of Equinor's total proved reserves. Of these, 56 fields and field areas are currently in production, 449 of which are operated by Equinor.

Proved reserves in Eurasia, excluding Norway

In this area, Equinor has proved reserves of 296 million boe related to seven fields in Russia, Azerbaijan, United Kingdom and Ireland. Eurasia excluding Norway represents 5% of Equinor's total proved reserves, Russia being the main contributor after sanctioning of the first stage of the full field development of the North Komsomolskoye field. This is also the largest addition to the proved reserves in this area in 2019. Other additions are related to sanctioning of the development of the Azeri Central East (ACE) platform in the Azeri Chirag Gunashli field in Azerbaijan, and the Barnacle field in the United Kingdom. All fields in this area are now producing. Of the proved reserves in Eurasia, 81 million boe or 27% are proved developed reserves.

Proved reserves in Africa

Equinor recognizes proved reserves of 198 million boe related to 28 fields and field developments in several West and North African countries, including Algeria, Angola, Libya and Nigeria. Africa represents 3% of Equinor's total proved reserves. Angola is the primary contributor to the proved reserves in this area, with 24 of the 28 fields. The reduction in oil and gas prices in 2019 had a net positive effect on the proved reserves from production sharing contracts in this area of approximately 5%.

Proved reserves in the US

In the US, Equinor has proved reserves equal to 870 million boe in a total of 12 fields and field development projects, ten of which are offshore field developments in the Gulf of Mexico and two are onshore tight reservoir assets.

Nine of the ten fields in the Gulf of Mexico are producing. Vito, which was sanctioned in 2018, is the only field in this area that is not yet producing. The onshore tight reservoir assets in the Appalachian basin and Bakken are all in production.

The largest changes to the proved reserves in the US in 2019 are related to new wells extending the proved areas in the US onshore assets. The acquisition of a 22.45% interest in the Caesar Tonga field in the Gulf of Mexico adds new proved reserves, whereas the divestment of Equinor’s 63% interest in the Eagle Ford shale play reduced the proved reserves in this area. The reduced oil and gas prices have a net negative effect of approximately 5% on the total proved reserves in this area, of which approximately two-thirds are related to the US onshore assets.

Proved reserves in the Americas excluding US

In the Americas excluding US, Equinor has proved reserves equal to 370 million boe in a total of six fields and field development projects. Four fields are located in Canada and two in Brazil.

In Canada, proved reserves are related to offshore field developments only and all four fields are producing. In Brazil, the two fields with proved reserves are both producing. The reduced oil and gas prices have not affected the proved reserves in this area in 2019.

Of the total proved reserves in the Americas excluding US, 255 million boe or 69%, are proved developed reserves. Less than 1% of the proved reserves in this area are gas reserves.

EXECUTIVE LEADERSHIP

Anders Opedal President and Chief Executive Officer

Jannicke Nilsson Chief Operating Officer

Svein Skeie Legal

Jannik Lindbæk Corporate Communication

Jon Arnt Jacobsen Corporate Audit

Ana Fonseca Nordang People & organisation

Irene Rummelhoff Marketing, Midstream & Processing

Kjetil Hove Development & Production Norway

Al Cook Development & Production International

Arne Sigve Nylund Technology, Projects & Drilling

Tore Løseth Exploration

Pål Eitrheim New Energy Solutions

Carri Lockhart Technology, Digital & Innovation

Website l Careers l Linkedin 'People'

From our selection of over 600 oil and gas companies, KeyFacts Energy now provide access to ‘first pass’ preliminary review data comprising; company description, overview of global assets, key operational activity, updated Energy Transition developments, contact details and leadership.

This new service allows subscribers to review our database of profiles by individual country or global company operational activity.

Contacts KeyFacts Energy for more details

KEYFACT Energy

KEYFACT Energy