Africa Energy, an oil and gas company with exploration assets offshore South Africa and Namibia, announces financial and operating results for the year ended December 31, 2020. View PDF version

Garrett Soden, the Company's President and CEO, commented:

"We have two world-class discoveries with significant follow-on potential in Block 11B/12B offshore South Africa. The Luiperd drilling results were better than expected, and we are very pleased with the positive test results that proved high condensate yield and excellent reservoir connectivity and productivity. South Africa is a large market looking to transition from coal to natural gas, and it now has an attractive domestic solution with the potential development at Block 11B/12B. We also believe there is substantial exploration upside across the block. In the meantime, we look forward to closing the farmouts on Block 2B where we plan to drill an exciting oil exploration well later this year."

OUTLOOK

In 2020, Africa Energy announced the successful drilling and testing results of its second consecutive discovery on Block 11B/12B. The discovery on the Luiperd Prospect reconfirms the Paddavissie Fairway as a world-class exploration play with substantial follow-on potential. Due to the success at Luiperd, the joint venture decided to proceed with development studies and engage with authorities on gas commercialization. The company believe the fundamentals are strong for a gas condensate development on Block 11B/12B as South Africa is a large market looking to transition from coal to natural gas and is currently limited to expensive imports.

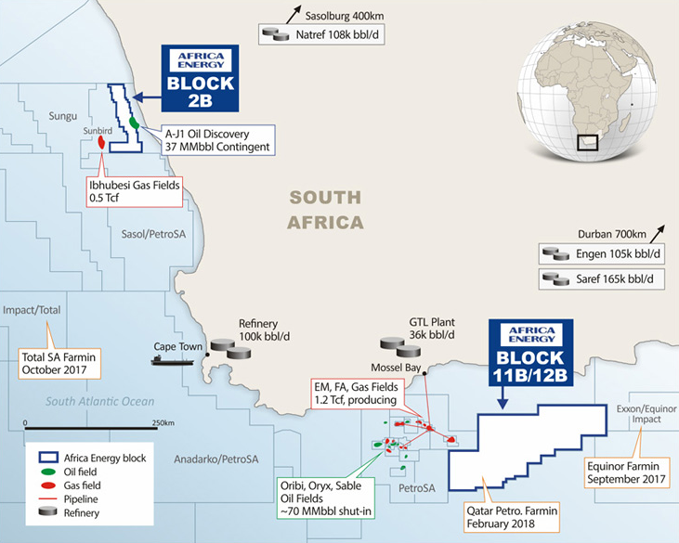

Map source: Africa Energy

Management is focused on closing the Block 2B farmouts and procuring a rig for the next exploration well, Gazania-1, which is expected to spud in the third quarter of 2021. Block 2B has significant contingent and prospective resources in shallow water close to shore and includes the A-J1 discovery from 1988 that flowed light sweet crude oil to surface. The Gazania-1 well will target two prospects in a relatively low-risk rift basin oil play up-dip from the discovery. The Company expects to close the Block 2B farmouts in the second quarter of 2021 whereby the Company will retain a 27.5% interest and be carried through the Gazania-1 well. Closing of the two farmout agreements is subject to standard conditions for this type of transaction, including approval of the South African government.

HIGHLIGHTS

- At December 31, 2020, the Company had $19.6 million in cash and no debt.

- In 2020, the Company executed two definitive agreements that will allow it to increase its effective interest in Block 11B/12B offshore South Africa from 4.9% to 10%, subject to certain consents and approvals.

- The Luiperd-1X exploration well was drilled in approximately 1,800 meters of water by the Odfjell Deepsea Stavanger semi-submersible rig to a total depth of about 3,400 meters. The well encountered 73 meters of net gas condensate pay over a mid-Cretaceous high-quality reservoir interval and did not encounter the water contact.

- The Luiperd-1X well was opened to flow and reached a maximum constrained flowrate through a 58/64" choke of 33 million cubic feet per day of natural gas and 4,320 barrels of condensate per day, an aggregate of approximately 9,820 barrels of oil equivalent per day.

- The Block 11B/12B joint venture received the fully-processed 2D seismic dataset (7,033 linear kilometers) from Shearwater in September 2020 and are currently in the process of finalizing a full prospect analysis for the eastern part of the block. The fast-track dataset received earlier in 2020 confirmed the Kloofpadda Play Trend, which consists of several large and encouraging leads.

- The Block 11B/12B joint venture also recently received the final fully-processed 3D data that integrates the PGS and Polarcus surveys over the Paddavissie Fairway (2,305 square kilometers from PGS and 570 square kilometers from Polarcus). The fully-processed 3D data has significantly improved resolution and will be integrated with the drilling and testing results to facilitate the development studies and to mature previously identified leads into prospects within the Paddavissie Fairway.

Board Update

Adam Lundin will be stepping down from the Board of Directors at the Annual General Meeting ("AGM") in June 2021 in order to comply with industry corporate governance guidelines regarding the maximum number of non-executive director appointments per individual. William Lundin will replace Adam as Chairman. William is currently Chief Operating Officer of International Petroleum Corp., a Canadian oil and gas company with global operations, and serves as a director for ShaMaran Petroleum Corp.

John Bentley will step down from the Board at the AGM and will be replaced by Siraj Ahmed, the CEO of Impact Oil & Gas Limited. Impact is an exploration company with a focus on large scale, deep and ultra-deep water plays, in Southern and Western Africa. Siraj has worked with Impact since 2014 and has considerable experience advising on PSAs, upstream M&A, partnering and joint venture arrangements and dealing with Governments.

Garrett Soden commented,

"On behalf of the Board, I would like to thank Adam for his invaluable leadership over the last few years. We appreciate the Lundin family's continued support for Africa Energy, and we look forward to working with Adam's brother, Will, following the AGM. I would also like to thank John for his contributions to the Board over the last six years. He led Energy Africa to great success and was key to forming Africa Energy with the same team in 2015. We welcome Siraj to the board from our major shareholder, Impact Oil & Gas, and we look forward to working with him to create value for all shareholders."

KeyFacts Energy: Africa Energy South Africa country profile

KEYFACT Energy

KEYFACT Energy