Why, now more than ever, is there a need for experienced personnel?

In excess of 440,000 jobs have been lost in oil and gas globally since 2014. The need to retain experience in the industry is now more important than ever.

Our industry has become more complex in many ways over the last couple of decades. Not only has the search for hydrocarbons become more challenging, the environment within which this exploration has to be carried out is challenged by many uncertainties. This article does not argue against the increasing role of young people in our industry, but instead that in the transition phase of getting more of the youth exposed to the rigours of this industry, the experience of those who have been through the many complexities in the business will be crucial in the handover period. Management and company boards need to have a planned strategy to ensure they keep, or attract back, some of those who are about to or who have left the industry.

An Unknown Future for Oil and Gas

The oil and gas business globally is facing tremendous challenges on many fronts, the likes of which have not been seen before. There are uncertainties in many facets of our business, including in supply and demand with regard to the role of shale oil vs OPEC production, the challenges from renewables, the growth of electric vehicles, geopolitics, environmental, climate change and government policy issues. Projections of the future trajectory of our industry are thus vexed and complicated and there are many different predictions, but there is general consensus that, at least within the near term of the next two decades, oil and especially gas will continue to play a significant role in the energy mix. However, the hundreds of billions of dollars in delayed investment due to the low oil prices since 2014 and the attendant lowest discovery rates globally in decades, have left a hole to be filled as supplies dry up. This has set the stage for an impending anticipated increase in exploration and development where the requirement for experienced personnel will be critical.

In the midst of all the turmoil, there are increasing signs of improving technological breakthroughs that promise to make the exploration for and extraction of hydrocarbons more effective and efficient, including Artificial Intelligence, Machine Learning and Big Data Analytics. BP, for example, is a leader in this area. The combination of AI and Machine Learning can lead to quicker and more optimised answers within domains that are amenable to using these technologies. Our industry is capable of capturing huge volumes of data, from seismic to downhole realtime monitoring data, which if handled with the right kind of fast and efficient processing hardware and software can lead to beneficial real time solutions.

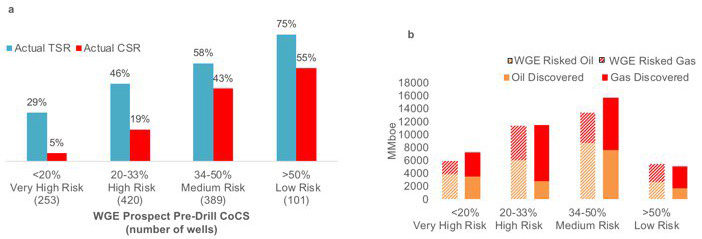

Pre-drill risking: CoCS and volumes. (a) Global 2012–2017 prospect risking (1,163 wells). TSR: technical success rate, CSR: commercial success rate; (b) Global comparison of pre-drill risked volumes and post-drill outcomes 2012 – 2017. Average CoCS = 37%, but there is strong evidence of overestimation of CoCS in high risk category prospects (<20% CoCS). Only 1 in 6 discoveries in the <20% CoCS category are big enough to be likely commercial. There is also a tendency to overestimate oil versus gas pre-drill. © Westwood Global Energy Group.

Despite the best technologies, the best data and the best brains, there are still limits to what we can achieve in this business. Globally, the chance of commercial success (CoCS) averages 30–40%. The figure above highlights our current ‘limits to success’. The details are interesting and point to various areas in which experience/ techniques/ technologies can be used to potentially improve our chances of success. There are issues related to both CoCS predictions as well as volumes, as the WGEG charts show. Some improvements could come from the areas of technology mentioned before, and there is a whole area here for discussion and elaboration beyond the scope of this article. Suffice to say that experience plays a key role in determining how good a person or team is at risking and volumetric predictions.

Technology vs Cognitive O&G Experience

There is a move towards utilising more high-end technologies in O&G and various facets of the industry are already showing benefits from this. Eventually, ongoing technological advances will lead to greater penetration of new technology in our business. It is, however, very important at the current mid phase of transformation to recognise what is technologically possible and what isn’t. It is easy to be over-excited about the dazzling array of possibilities, but it still comes back to the ‘limits of success’ to our exploration results noted above.

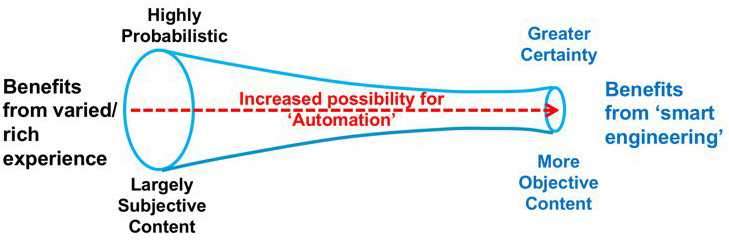

The figure below is my attempt to capture conceptually what is amenable to technological penetration and what is still going to be dependent on hard-earned human experience. Experience becomes very important when the situation is not well defined, is very ambiguous, and in the early parts of evaluation where a great deal of data is still not available. It is in situations like these where the incomplete nature of information requires ‘filling in the gaps’ and where experienced hands are indispensable. The data and information available will vary from poor to good and this will drive the degree to which automation is possible. The more nebulous the dataset, the more probabilistic the nature of assessment – the more the call on extensive prior experience.

I can draw on examples in exploration processes to illustrate the point here. Currently, in seismic interpretation you can propagate interpretations that can automatically produce surface maps. You do not necessarily have to understand geology to do this. In areas with good data, accurate time structure maps, fault maps and isochrons can be quickly and efficiently created: a time-saving and sound outcome. However, to understand the nature of the forces acting on the structure that determine the growth history and control on sedimentation requires interpretational skills beyond what machines can currently do. It is these latter skills that have an impact in the COS (Chance of Success) and volumetric predictions.

In each area of the industry, from exploration to production, it is important to analyse which tasks can benefit from automation and which still require a great deal of real life experience. Usually, it is the highly subjective, highly probabilistic areas of our business that are hard to replicate with technology – at least for now.

Negative Impact of New Technologies in Oil & Gas

One unintended consequence of the penetration of technology is the tendency to drive professionals towards specialisation. Unless management is vigilant and provides experienced oversight, professionals tend to specialise in particular fields and associated software in which they become experts. The positive in this is the development of great expertise in a particular field and/ or software. The negatives I have seen are that, unlike professionals of the pre-technology era, there is loss of awareness of the total subsurface challenge that is being addressed.

I have seen reservoir modellers turn on and off fault transmissibilities to match production without referring back to the seismic interpreters to check why some faults helped and others did not. Another example is where petrophysicists have interpreted the existence of a considerable column of oil because it is supported by shows. They did not look sideways and pay more attention to the MDT pressure points that show a very limited moveable oil column. This total approach to solving a subsurface problem appears to come with having varied experience. In my early Exxon days, my very experienced mentors would ask the question, ‘does it all hang together?’

Increasing Exploration Success

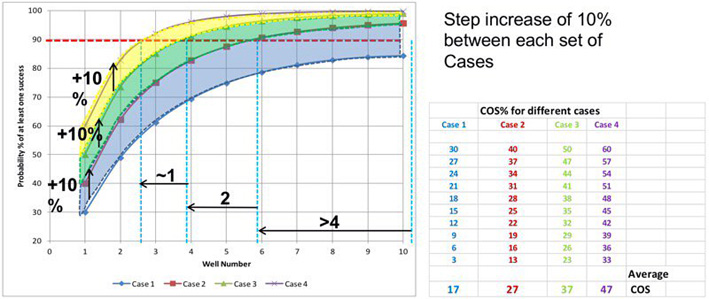

The figure below shows that there are reducing benefits to trying to attempt higher levels of certainty. It shows four different portfolios with ten wells each that have COS increasing by 10% each going from Case 1 to Case 4. The Y axis shows the probability of attaining at least one success at the point of each well being drilled in each of the four campaigns. The shaded areas between the curves shows the ‘certainty gained’ going from one portfolio to the next. Alternatively, you could use the measure of the increased number of prospects needed to be drilled before attaining 90% certainty of at least one success.

Making a call ‘on limits to perfection’: benefits obtained from greater effort to increase portfolio certainty of success reduce at higher end CoCS portfolios. B. Kunjan.

For small companies with limited resources and for those who want to be fleet-footed in the business, it is important to know when to make the call that sufficient work has been done to achieve one’s exploration goals. This is an area that calls upon a great deal of experience. There are many elements to this decision and those who have drilled more and varied prospects have a better chance of making this call.

The Loss of Valuable Experience in O & G

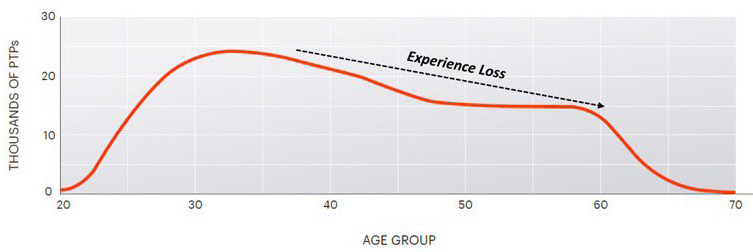

In the midst of all these concerns, we have lost a great deal of experience and talent from the industry. The final figure shows the age demographics in our business. The peak age group is around 33 years old. The older age groups drop off at a constant pace till you reach 60 years old, after which the number of mature people reduces drastically.

Current age demographic distribution of petrotechnical professionals (PTP) globally. © Accenture (2017).

It is critical that companies are aware of this and try to maintain experienced personnel as long as they can. Management have to work out ways to entice lost experienced talent back into the business. These experienced personnel should be mentors to younger people and pass on their skills while the younger generation is still learning.

From my own experience, having worked in many mostly small to moderate sized companies, I have come across errors made because the data has not been interpreted with eyes that have seen a great deal more than the less experienced personnel. Many mistakes have been made in past downturns in terms of losing experience and hence ending up with expensive errors being made.

We can, at least partially, avoid it as long as we can entice the ‘elders’ to remain or to rejoin our teams.

Balakrishnan Kunjan (This article appeared in GEO ExPro Vol. 15, No. 3 - 2018)

KEYFACT Energy

KEYFACT Energy