Total SE’s Board of Directors met on February 8, 2021, under the chairmanship of CEO Patrick Pouyanné to approve the Group’s 2020 financial statements. On this occasion, Patrick Pouyanné said:

“The Group’s fourth quarter results rebounded from the previous quarter in a context where oil prices stabilized above $40 per barrel, thanks to strong OPEC+ discipline, and where gas prices rose sharply in Europe and Asia, but where refining margins remained depressed, still affected by low demand and high inventories. In this context, the Group demonstrates its ability to benefit from an overall more favorable environment with adjusted net income up by more than 50% to $1.3 billion and cash flow (DACF) of $4.9 billion.

Total faced two major crises in 2020: the Covid-19 pandemic that severely affected global energy demand, and the oil crisis that drove the Brent price below $20 per barrel in the second quarter. In this particularly difficult context, the Group implemented an immediate action plan and proved its resilience thanks to the quality of its portfolio (production cost of $5.1 per boe, the lowest among its peers) and its integrated model with cash flow (DACF) generation of nearly $18 billion. It posted adjusted net income of $4.1 billion and, thanks to strong discipline on investments ($13 billion, down 26%) and costs ($1.1 billion in savings), the organic cash breakeven was $26 per barrel. Consistent with its climate ambition, the Group recorded exceptional asset impairments of $10 billion, notably on Canadian oil sands assets, most of which were recorded in its accounts at the end of June, leading to an IFRS loss for the year of $7.2 billion.

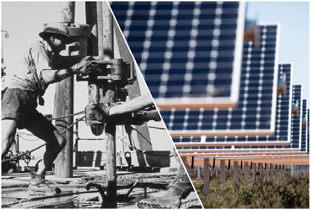

2020 represents a pivoting year for the Group’s strategy with the announcement of its ambition to get to Net Zero, together with society. The Group affirms its plan to transform itself into a broad energy company to meet the dual challenge of the energy transition: more energy, less emissions. Thus, the Group’s profile will be transformed over the 2020-30 decade: the growth of energy production will be based on two pillars, LNG and Renewables & Electricity, while oil products are expecting to fall from 55% to 30% of sales. To anchor this transformation, the Group will propose to its shareholders at the Annual General Meeting on May 28, 2021, changing its name to TotalEnergies. They will hence have the opportunity to endorse this strategy and the underlying ambition to transition to carbon neutrality.

In 2020, Total secured its investments in Renewables & Electricity ($2 billion) and accelerated the implementation of its strategy to grow renewables, adding 10 GW to its portfolio. With the acquisition at the start of 2021 of a 20% stake in Adani Green Energy Limited (AGEL), the largest solar developer in the world, and of portfolios of projects in the United States, the Group now has a portfolio of gross installed capacity, under construction and in development of 35 GW by 2025 with more than 20 GW already benefiting from long-term power purchase agreements.

Total preserves its financial strength with a gearing of 21.7% at the end of 2020. Confident in the Group’s fundamentals, the Board of Directors confirms its policy of supporting the dividend through economic cycles. Therefore, it will propose at the Annual General Meeting of Shareholders on May 28, 2021, the distribution of a final dividend of 0.66 € per share, equal to the previous three quarters, and set the dividend for 2020 at 2.64 € per share.”

Highlights

Upstream

- Fourth hydrocarbon discovery on Block 58 in Suriname

- Second gas and condensate discovery on Block 11B/12B in South Africa

- Entered new offshore exploration permit as operator in Egypt

- Sold Group’s 10% interest in onshore OML 17 block in Nigeria

Hydrocarbon production was 2,871 kboe/d for the year 2020, a decrease of 5% compared to the previous year, comprised of:

- -5% due to compliance with OPEC+ quotas, notably in Nigeria, the United Arab Emirates and Kazakhstan, as well as voluntary reductions in Canada and disruptions in Libya.

- +5% due to the ramp-up of recently started projects, notably Culzean in the United Kingdom, Johan Sverdrup in Norway, Iara in Brazil, Tempa Rossa in Italy and North Russkoye in Russia.

- -3% due to the natural decline of fields.

- -2% due to maintenance, and unplanned outages, notably in Norway.

Sustainability

- Strengthened the Group’s commitment to reduce methane emissions with initiative OGMP 2.0

- Withdrew from the American Petroleum Institute

- Total once again selected in 2020 in the Dow Jones Sustainability Indices

Renewables

- Acquired in India a 20% minority interest in Adani Green Energy Limited (AGEL), the largest solar developer in the world

- Acquired Fonroche Biogaz in France, making Total the leader in renewable gas production in France

- Agreed with 174 Power Global, a subsidiary of Hanwha, to develop a portfolio of 1.6 GW of solar and energy storage projects in the United States

- Acquired a 2.2 GW portfolio of solar and energy storage projects in Texas

- Developing the largest site in France for the production of green hydrogen based 100% on renewable electricity with Engie

- Issued € 3 billion of hybrid bonds dedicated to financing the strategy to grow renewables

Electricity

- Acquired portfolio of 2 million residential customers and 2 CCGT with cumulative capacity of 850 MW from Energías de Portugal in Spain

- Won the City of Paris concession tender to operate 2,300 charge points of the Bélib’ network

- Acquired Charging Solutions to become operator of 2,000 charge point network in Germany

CCUS

- Approval from Norwegian government of final investment decision for Northern Lights CO2 sequestration project in Northern North Sea

- Signed with ADNOC strategic framework agreement on CO2 emission reduction and CCUS in Abu Dhabi

- Announced world first sustainable packaging from captured and recycled carbon emissions by Lanzatech, Total and L’Oréal in France

LNG

- Finalized 16.6% participation in Energia Costa Azul LNG project on the Pacific coast of Mexico

- Delivered first carbon neutral LNG cargo to CNOOC (China)

- Completed first LNG bunkering for CMA CGM in Port of Rotterdam

- Chartered four new LNG-powered Aframax vessels to reduce maritime transport emissions

Summary and outlook

Supported by OPEC+ quota compliance, oil prices have remained above 50 $/b since the beginning of 2021. However, the oil environment remains uncertain and dependent on the recovery of global demand, still affected by the Covid-19 pandemic.

In a context of disciplined OPEC+ quota implementation, the Group anticipates 2021 production will be stable compared to 2020, benefiting from the resumption of production in Libya.

The Group continues its profitable growth in LNG with sales expected to increase by 10% in 2021 compared to 2020, notably due to the ramp-up of Cameron LNG.

European refining margins remain fragile, with low demand for jet fuel weighing on the recovery of distillates. However, thanks to the resilience of Marketing & Services, the Group expects Downstream to contribute more than $5 billion of cash flow in 2021, assuming refining margins of 25 $/t.

Faced with uncertainties in the environment, net investments are projected at $12 billion in 2021, while preserving the flexibility to mobilize additional investments should the oil and gas environment strengthen. After reducing operating costs by $1.1 billion in 2020 compared to 2019, the Group maintains strong discipline on spending and targets additional savings of $0.5 billion in 2021.

The Group’s teams are fully committed to the four priorities of HSE, operational excellence, cost reduction and cash flow generation.

The Group maintains its priorities for cash flow allocation: investing in profitable projects to implement the Group’s transformation strategy, support the dividend and maintain a strong balance sheet.

Already in 2021, in renewables, the Group has announced more than 10 GW of additional projects through the acquisition of a 20% stake in Adani Green Energy Limited (AGEL), the world’s leading solar developer, a partnership with Hanwha in the United States with a 1.6 GW portfolio, and the acquisition of a 2.2 GW portfolio of projects in Texas. Total will allocate in 2021 more than 20% of its net investments to Renewables and Electricity.

Change of name

Total plans to rebrand as TotalEnergies, as the company a moves towards cleaner energy over the coming decade and its long-term goal of reaching net-zero emissions by 2050.

The name change will be proposed to shareholders at an annual general meeting on 28 May, giving them opportunity to “endorse this strategy and the underlying ambition to transition to carbon neutrality”.

KeyFacts Energy: Total France country profile

KEYFACT Energy

KEYFACT Energy