KeyFacts Energy's 'Energy Country Review' database provides instant access to over 2,600 continually updated 'country-specific' oil and renewable company profiles from a selection of 144 countries.

Information typically includes; description, overview of assets, historic, current and planned operational activity, capex, local and corporate locations, key personnel and news archive.

As part of the evolving Energy Transition, our oil and gas company profiles now include the latest renewable energy initiatives that are increasingly a part of their ongoing operational activity.

The following is an example 'country-specific' company profile, highlighting Equinor's oil and gas and renewable activities in Norway:

Equinor is an international energy company present in more than 30 countries worldwide, including several of the world’s most important oil and gas provinces. Founded in 1972 under the name Den Norske Stats Oljeselskap AS - Statoil (the Norwegian State Oil company), The name changed to Equinor in May 2018.

Equinor is engaged in exploration, development and production of oil and gas in addition to renewables. They are the leading operator on the Norwegian continental shelf and have substantial international activities. Equinor sell crude oil and is a major supplier of natural gas. Processing, refining, offshore wind and carbon capture and storage is also part of their operations.

Shareholders

The Norwegian State holds 67% of the company's shares through the Ministry of Petroleum and Energy, while US investors hold 11%, private Norwegian owners hold 8%, other European investors 8%, UK investors hold 3%, and others 2%.

Production and reserves

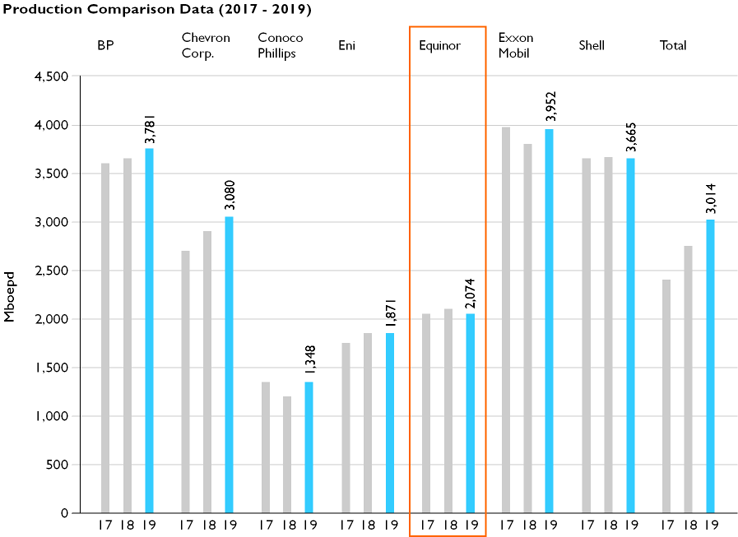

Equinor delivered record high total equity production of 2,198 mboe per day in the fourth quarter of 2019, up 1% from the same period in 2018. The flexibility in the gas fields was used to defer production into periods with higher expected gas prices. Successful start-up and ramp-up of new fields as well as new well capacity, contributed to growth in production.

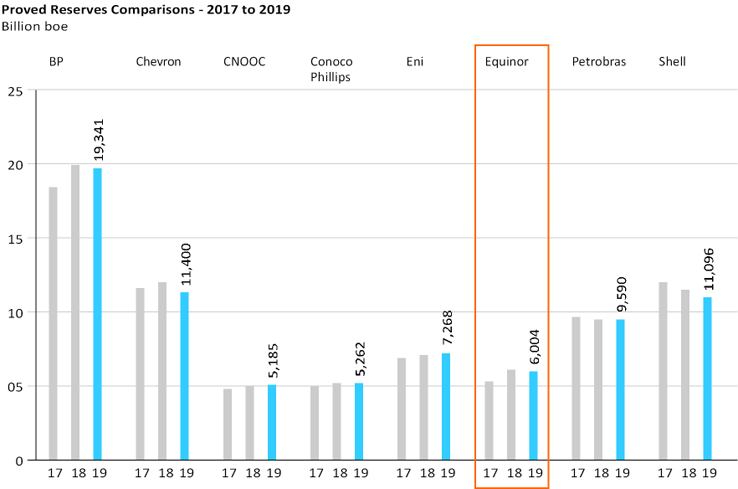

The organic proved reserve replacement ratio (RRR) was 83%, with a three-year average of 140%. With 6 billion barrels in proved reserves, Equinor’s reserves to production ratio (R/P) was 8.6 years.

History

Equinor has grown up along with the emergence of the Norwegian oil and gas industry, dating back to the late 1960s. Today, the company is one of the world's largest suppliers of oil and gas.

In 1972, the Norwegian State Oil Company, Statoil, was formed, and two years later the Statfjord field was discovered in the North Sea. In 1979, the Statfjord field commenced production, and in 1981 Statoil was the first Norwegian company to be given operator responsibility for a field, at Gullfaks in the North Sea.

Statoil merged with Norsk Hydro’s oil and gas division on 1 October 2007. The new company was given the temporary name of StatoilHydro, and the company reached a size and strength for considerable international expansion. The company changed its name back to Statoil on 1 November 2009.

Norsk Hydro’s oil history stretches back to the late 1960’s, when the company was a license holder in the giant Ekofisk discovery in the North Sea in 1969.

In May 2018, the company name changed to Equinor, supporting the company’s strategy and development as a broad energy company.

Equinor has been one of the most important players in the Norwegian oil industry, and has contributed strongly to make Norway into a modern industrial nation. Today, Norway is one of the world's most productive petroleum provinces and a test lab for technology development.

Renewable projects

Equinor has a sizeable renewables portfolio with an offshore wind portfolio with the capacity of providing over 1 million homes with renewable energy. The company operates the Sheringham Shoal wind farm in the UK, which has been in production since 2012. The Dudgeon offshore wind farm in the UK, also operated by Equinor – and the world’s first floating offshore wind farm, Hywind Scotland – started producing in 2017. In 2016 Equinor also acquired 50% of the Arkona offshore wind farm in Germany, which will deliver power in 2019.

Website l Careers l Linkedin 'People'

Norway E&P operations

Equinor currently operate 42 fields on the Norwegian continental shelf and produce around 2.5 million barrels a day, including the volumes from their partners. For more than 40 years, Equinor has accumulated broad expertise, which will be used to further develop the Norwegian continental shelf.

Equinor's fields consist of everything from small fast-track projects to giants like Troll, Statfjord and Gullfaks. The Norwegian continental shelf delivers consistently good results, and Statoil believe there is great potential for finding more oil and gas - in new areas, in already opened areas and, not least, near infrastructure that has already been built.

Since production started on the Norwegian continental shelf in the early 1970s, the petroleum industry has contributed more than NOK 11,000 billion to Norway's gross national product, measured in current kroner. (Source: Ministry of Petroleum and Energy).

At the same time, only 45 per cent of what is estimated to be the total extractable resources on the Norwegian continental shelf have been extracted.

Johan Sverdrup

Nearly 130 years after the Norwegian Prime Minister Johan Sverdrup became known as the father of Norwegian parliamentarism, his name was linked to the largest Norwegian oil discovery in recent times. Johan Sverdrup was found in some of the first licences awarded on the Norwegian continental shelf. With its 1.7–3.0 billion barrels of oil, the field is one of the largest and most important oil finds globally in the past decade. At plateau, the field will be responsible for around 40 per cent of oil production on the Norwegian continental shelf, and it is considered a giant field.

In August 2019, The Norwegian Petroleum Directorate granted its consent for start-up of the Johan Sverdrup field. The field is expected to produce oil for the next 40 years.

Equinor plans start-up sometime this autumn for the first phase of the field development. Construction phase two is slated to start in the fourth quarter of 2022.

According to Equinor, investment costs for development of the first stage of construction are expected to be NOK 83 billion.

Estimates indicate that the total recoverable reserves are about 430 million standard cubic meters of oil equivalents (2.7 billion barrels o.e.)

About 95 per cent of this is oil, 3 per cent is dry gas and the rest is NGL (Natural Gas Liquids). The field has a production capacity of 105 000 cubic metres of oil per day (660 000 bbls per day).

Troll

Troll is the largest gas find in the North Sea, and is a cornerstone of Norwegian gas production, with as much as 60 per cent of the reserves in Norway. It is also one of the largest oil fields on the Norwegian continental shelf, producing more than 400,000 barrels a day. The field is developed with three platforms: Troll A, B and C, which are all operated by Statoil. Troll A produces gas sufficient for 10 million households in Europe, while Troll B and C produce oil.

At 472 metres, Troll A is the tallest man-made construction to have ever been moved. The field started production in 1996, and the installations have an estimated operational life of at least 70 years. Because the oil-bearing layers in the Troll field were so thin, nobody thought it would be possible to extract the oil. However, thanks to the development of advanced technology for horizontal wells, Troll B and C produce high volumes of oil from the thin oil-bearing layers in Troll West.

In the third quarter of 2017, the Fram licence partners decided to invest more than NOK 1 billion in a new gas module on Troll C, and now they have decided to drill three new wells on the field for NOK 1.9 billion.

The three wells will give 70 million new barrels of oil and gas, thanks to higher gas processing capacity on Troll C.

The installation preparations for the gas module started early in May, and the installation work on the platform will commence in June. Start-up of the new gas module is expected in the autumn of 2019.

The new gas module will enable accelerated recovery of resources in the Fram area, which has previously been limited by the Troll C gas processing capacity.

Fram Key Facts

- Fram is an oil and gas field in the northern part of the North Sea, located around 20 kilometres north of Troll. Water depth in the area is about 350 metres.

- Fram is expected to produce almost 70% more reserves than originally estimated in the Fram plans for development and operation.

- Since much of the oil has already been recovered, the remaining reserves will have a high share of gas.

- Covering several deposits, the field has been developed in two stages: Fram West and Fram East. Both development stages covered two templates that are connected to Troll C.

- The Fram H-North and Byrding field developments comprise a third template which is connected to Fram West. The Fram field came on stream in 2003.

- The Fram well stream is piped to Troll C for processing. The oil is transported via Troll Oil Pipeline II to Mongstad, and the gas is exported via Troll A to Kollsnes.

- Licence owners: Equinor (45%), ExxonMobil Exploration and Production Norway (25%), Neptune Energy AS (15%), Idemitsu Petroleum Norge AS (15%).

Ten more years for Troll B

In April 2020, the authorities granted consent to operator Equinor and the other licensees for a 10-year lifetime extension for the Troll B facility in the North Sea.

The extended lifetime for Troll B also includes the oil and gas pipelines that were included in the approved Plan for Development and Operation (PDO). The current consent expires in September this year. The Troll B start-up date was in September 1995.

Extension of Troll B’s lifetime to 2030 is one of the potential solutions for further developing gas production from the Troll Vest gas cap, Troll phase three.

Snorre field

In July 2018, the Ministry of Petroleum and Energy approved the plan for development and operation (PDO) for the Snorre Expansion Project. Investments of just above NOK 19 billion (2017) will increase recovery from the Snorre field by almost 200 million barrels and extend the field life beyond 2040.

Snorre Expansion Project is the largest project for improved recovery on the Norwegian continental shelf and provides valuable production and activity benefitting Equinor, partners and society. The project involves a comprehensive subsea development, upgrading of the Snorre A installation, increased gas injection and gas import for injection.

The Snorre field was originally estimated to produce until 2011–2014. Now the field life has been extended beyond 2040, and the recovery rate increases from 46 to 51 per cent.

The PDO for Snorre Expansion Project was handed over as a Christmas gift to Terje Søviknes (right) in December 2017, minister of Petroleum and Energy. From the left: Mette Halvorsen Ottøy, Margareth Øvrum and Bjarne Bakken. (Photo: Arne Reidar Mortensen)

Scheduled to start production in 2021, the Snorre Expansion Project will be operated and maintained by the existing Snorre organisation in Stavanger. Supplies will still be handled by Fjordbase in Florø.

Equinor estimates that around 80% of the investments, which are just above NOK 19 billion, will include Norwegian companies. Based on analyses made by Agenda Kaupang approximately 23,000 man-years will be carried out in Norway in the project phase.

In October 2018, Equinor received consent to continue use of the Snorre A and Snorre B facilities through 2040.

Johan Castberg PDO approved

The plan for development and operation of the Johan Castberg field in the Barents Sea was approved by the Norwegian Parliament on Monday 11 June 2018. The plan will now be submitted to the Ministry of Petroleum and Energy for formal approval.

With first oil scheduled for 2022, the field has a production horizon of 30 years. Capital expenditures for the project are NOK 49 billion, and recoverable resources are estimated at 450-650 million barrels of oil equivalent. The field development consists of a production vessel and a comprehensive subsea system, including a total of 30 wells distributed on 10 templates and 2 satellite structures. This is currently the largest subsea field under development globally.

The Johan Castberg partnership consists of Equinor (operator 50%), Eni Norge (30%) and Petoro (20%).

In October 2018, Equinor and partners ENI and Petoro completed the Skruis exploration well in the Johan Castberg licence. The well confirms a volume of 12-25 million recoverable barrels of oil.

Skruis is the first operated exploration well drilled by Equinor this year in the Barents Sea.

The partners will now further consider tie-in of the discovery to Johan Castberg. The Johan Castberg field is planned for start-up in 2022 and currently has full capacity up to 2026-2027.

Visund Nord IOR

Visund Nord IOR is a subsea development with two new wells in a new subsea template, which is tied back to an existing template on Visund. The oil is piped via the existing template to the Visund platform.

The project provides 13.3 million new barrels of oil to the Visund field, 6% more than originally estimated. When the investment decision was made the costs were estimated at NOK 1.5 billion. During the execution phase they were reduced to NOK 1.3 billion.

The Visund licence partners are: Equinor Energy A/S (operator) 53.2%, Petoro A/S 30%, ConocoPhillips Skandinavia AS 9.1% and Repsol Norge A/S 7.7%.

Marulk field

In September 2019, Equinor and its partners AkerBP and Wellesley Petroleum found gas in the Ørn exploration well south-west of the Marulk field in the Norwegian Sea. Recoverable resources are estimated at 8–14 million standard cubic metres of oil equivalent, corresponding to 50–88 million barrels of oil equivalent (boe).

Krafla, Fulla and North of Alvheim

In June 2020, Equinor and Aker BP entered into an agreement on commercial terms for a coordinated development of the licenses Krafla, Fulla and North of Alvheim (NOA) on the Norwegian Continental Shelf.

Equinor is the operator of the Krafla license and Aker BP is the operator of the NOA and the Fulla licenses.

The area consists of many licenses and complex reservoirs that contains several oil and gas discoveries with total recoverable resources estimated at more than 500 million barrels of oil equivalents, with further exploration and appraisal potential identified.

Barents Sea

While mature areas will make up a higher proportion of Statoil’s Norwegian exploration efforts, the company will drill five or six wells in the Arctic Barents Sea in 2018. The 2017 campaign yielded disappointing results, especially at the much-anticipated Korpfjell prospect. While Statoil will drill a deeper well at the same license next year, it now has lower expectations.

In December 2017, Transocean announced that the harsh environment semisubmersible Transocean Spitsbergen was awarded a 22-well contract with an estimated duration of 33 months; plus two one-well options in the Norwegian North Sea with Statoil. The contract is expected to commence in the third quarter of 2019.

Goliat West appraisal

In January 2019, Vår Energi, together with license partner Equinor, completed an appraisal in PL 229 in the Barents Sea through the successful drilling of the 7122/7-7 S Goliat West appraisal well.

The appraisal well 7122/7-7 S is located about 2 km south of the Goliat FPSO and 80 km northwest of Hammerfest, in the southern Hammerfest Basin. The well was spud on 28th November in a water depth of 379 m with the West Hercules semi-submersible drilling rig. The Goliat West well was drilled in an untested fault compartment westward of the field to prove additional resources.

The target of the well was the Lower Jurassic/Upper Triassic reservoir sandstones of the Tubåen and Fruholmen formation in the Realgrunnen sub-group. The well was drilled to a vertical depth of 1240 m below sea level, and reached TD in the Upper Triassic Snadd Formation. Two levels of hydrocarbon bearing sandstones were encountered in the Realgrunnen sub-group at original pressure and hydraulically separated from each other. The accumulation is separated from the main Goliat Field.

The Tubåen Reservoir is about 10 m thick and has been encountered gas and oil bearing with excellent reservoir properties; the hydrocarbon column in the Tubaen Formation is estimated to range between 18m to 60m. The Lower Reservoir has been found oil-bearing and is composed of several sandstone layers with good reservoir properties and a minimum hydrocarbon column of 35 m. Extensive data collection and fluid sampling was carried out in all the targets. The well has been permanently plugged and abandoned.

Recoverable resources are estimated to be 0.7 – 2.2 million standard cubic meters oil equivalents (4.4 – 13.8million barrels of oil equivalents – Mbbl). Total volumes in place are estimated to be between 2 and 7 Mscm (13 – 44 Mbbl).

Resource estimates for Goliat before the drilling of the well had already increased to 31.5 Mscm of oil equivalents (198 Mbbl), from 28.0 million Mscm (176 Mbbl) at the time of the PDO. Goliat West will further increase the resource estimates on Goliat.

Vår Energi operates PL 229 and the oil producing Goliat field with an interest of 65 per cent, together with Equinor Energy AS as partner.

APA 2019

In January 2020, Equinor announced the award of 23 new production licences by the Ministry of Petroleum and Energy during the awards in predefined areas (APA) 2019 – 14 of the licences are Equinor-operated and 9 are partner-operated.

Extending the life of eight installations

In March 2019, Equinor received the authorities’ approval for extending the life of eight installations on the Norwegian continental shelf (NCS) during the last three years.

Several of these installations were originally scheduled for shutdown already, or in only a few years. Instead, the extensions will give many more years of operation on the NCS.

| Installation | Original lifetime | New lifetime | Years of extension |

| Gullfaks A | 2016 | 2036 | 20 |

| Gullfaks B | 2017 | 2036 | 19 |

| Gullfaks C | 2019 | 2036 | 17 |

| Oseberg East | 2018 | 2031 | 13 |

| Snorre A | 2022 | 2040 | 18 |

| Snorre B | 2021 | 2040 | 19 |

| Norne | 2020 | 2036 | 16 |

| Åsgard A | 2018 | 2030 | 12 |

Breidablikk field development

In September 2020, Equinor and partners Petoro, Vår Energi and ConocoPhillips Skandinavia decided to develop the Breidablikk field in the North Sea.

The development concept chosen for the Breidablikk field is subsea development with 23 oil producing wells from four subsea templates that are controlled from Grane. Breidablikk will be tied in to the Grane platform for oil processing prior to being brought ashore at the Sture terminal. The production from Grane will be monitored with advanced digital tools from Equinor's integrated operations centre (IOC) at Sandsli to ensure optimal production and value creation from the wells.

Tor Field and Tor Unit

In September 2020, the Norwegian Petroleum Directorate granted consent for start-up of the Tor II facilities from 1 November 2020.

Tor II comprises two new subsea templates to be installed on the Tor field and tied in to Ekofisk, about 13 kilometres away. Eight new production wells will be drilled. The recoverable reserves were estimated at 10 million standard cubic metres of oil equivalent (Sm3) in the PDO.

Gråsel field

In December 2020, Equinor and its licence partners decided to go ahead with the development of the Gråsel field in the Norwegian Sea, targeting first production in the fourth quarter of 2021.

The Gråsel field is located within the same licence unit as PGNiG Upstream Norway's (PUN's) producing fields Skarv and Ærfugl. It holds mostly oil, with its reserves estimated at 13 million barrels of oil equivalent. First oil from Gråsel is expected in the fourth quarter of 2021, when start-up of gas production from phase two of the Ærfugl development project is also planned.

Discoveries

Barents Sea: In August 2019, Equinor and partners OMV and Petoro reported an oil discovery in the Sputnik exploration well in the Barents Sea. Recoverable resources are preliminarily estimated at 20-65 million barrels of oil.

The Sputnik well was drilled in licence PL855, approximately 30 kilometres North East of the Wisting discovery. The well encountered a 15 metre oil column in a Triassic sandstone reservoir. Fluid samples contain light oil and water.

Fram: In November 2019, Equinor and partners ExxonMobil, Idemitsu and Neptune discovered oil and gas in exploration well Echino South, 35/11-23, by the Fram field in the North Sea. Recoverable resources are estimated at 6-16 million standard cubic metres of oil equivalent, corresponding to 38-100 million barrels of oil equivalent.

Swisher prospect: In September 2020, Equinor and its licence partners Petoro AS and Wellesley Petroleum reported an oil and gas discovery in the Swisher prospect. Recoverable resources are estimated to be in the range of 2-6 million standard cubic metres of oil equivalent, corresponding to 13-38 million barrels of oil equivalent.

Wells 35/11-24 S, 35/11-24 A and 35/11-24 B were drilled around 7 kilometres west of the Fram field and 130 kilometres northwest of Bergen.

PL 923: In February 2021, Equinor and partners DNO Norge, Petoro and Wellesley Petroleum struck gas and oil in production licence 923. Recoverable resources are estimated at between 7 and 11 million standard cubic metres of oil equivalent, corresponding to 44 – 69 million barrels of oil equivalent.

APA 2020

Equinor secured the award of 17 new production licences in the 2020 Award in Predefined Areas (APA) – 10 licences as operator and 7 licences as partner. These comprise 8 production licences in the North Sea and 9 licences in the Norwegian Sea.

Energy Transition

In November 2020, Equinor announced its ambition to become a net-zero energy company by 2050. The ambition includes emissions from production and final consumption of energy. It sets a clear strategic direction and demonstrates Equinor’s continued commitment to long-term value creation in support of the Paris Agreement.

Equinor expects to deliver an average annual oil and gas production growth of around 3 percent from 2019 to 2026. Equinor is well positioned with world-class global assets in attractive areas with substantial value creation potential. By optimizing its portfolio through financial discipline and prioritization, Equinor will continue to develop competitive and resilient projects whilst maintaining industry-leading recovery rates, unit costs and carbon efficiency. The net-zero ambition will strengthen future competitiveness and value creation at the Norwegian continental shelf (NCS). Equinor’s plans for production, development and exploration at the NCS remain firm.

To develop Equinor as a broad energy company, renewables will be a significant growth area. Equinor has previously set ambitions for profitable growth within renewables and expects a production capacity of 4-6 Gigawatts (GW) by 2026 and 12-16 GW by 2035. Equinor now plans to expand its acquisition of wind acreage, with the aim of accelerating profitable growth and will continue to leverage its leading position in offshore wind. Equinor will establish renewables as a separate reporting segment from first quarter 2021.

To achieve net-zero emissions requires a well-functioning market for carbon capture and storage (CCS) and natural sinks, as well as the development of competitive technologies for hydrogen. Building on its capabilities from oil and gas, Equinor is well positioned to provide low-carbon technologies and establish zero-emission value chains. Equinor is driving the development of these technologies through projects such as Northern Lights, which aims to store CO2 from industrial sites across Europe. Equinor also assumes that an increasing share of oil and gas will be used for petrochemicals towards 2050.

EQUINOR’S CLIMATE AMBITIONS

- Become net zero by 2050. The ambition includes scope 1, 2 and 3 GHG emissions, where scope 3 emissions represent a calculation of indirect emissions from customers’ use of Equinor’s equity production volumes.

- Reduce emissions from oil and gas. Maintain industry leading carbon efficiency by (i) aiming to reach upstream <8 kg CO2 per boe by 2025, (ii) achieving carbon neutral global operations by 2030, (iii) reducing absolute greenhouse gas emissions from operated offshore fields and onshore plants in Norway towards near zero by 2050 without offsets, and (iv) ensuring no routine flaring and near zero methane emissions intensity by 2030.

- Grow in renewable energy. Expecting a production capacity of 4-6 GW by 2026 and 12-16 GW by 2035, Equinor equity.

- Reduce net carbon intensity to zero by 2050.

The ambition to reduce net carbon intensity by at least 50% by 2050 takes into account scope 1, 2 and 3 emissions, from initial production to final consumption. By 2050 each unit of energy produced will, on average, have less than half of the emissions compared to today. The ambition is expected to be met primarily through significant growth in renewables and changes in the scale and composition of the oil and gas portfolio. Operational efficiency, CCUS and hydrogen will also be important, and recognised offset mechanisms and natural sinks may be used as a supplement.

In 2026, Equinor expects a production capacity from renewable projects of 4 to 6 GW, Equinor share, mainly based on the current project portfolio. This is around 10 times higher than today’s capacity, implying an annual average growth rate of more than 30%. Towards 2035, Equinor expects to increase installed renewables capacity further to 12 to 16 GW, dependent on availability of attractive project opportunities.

The scale and composition of Equinor’s oil and gas portfolio, and the efficiency of its operations, will play a key role in achieving Equinor’s net carbon intensity ambition. Carbon efficient production of oil and gas will increasingly be a competitive advantage, and Equinor will seek to ensure a high value and robust oil and gas portfolio.

In January 2020, Equinor announced an unprecedented set of ambitions to reduce absolute greenhouse gas emissions from its operated offshore fields and onshore plants in Norway by 40% by 2030, 70% by 2040 and towards near zero by 2050. The ambition can be realised through electrification projects, energy efficiency measures and new value chains such as carbon capture and storage and hydrogen.

Equinor is aiming to reduce the CO2 intensity of its globally operated oil and gas production to below 8 kg per barrel of oil equivalent by 2025, five years earlier than the previous ambition. The current global industry average is 18 kg CO2 per barrel*.

Equinor sets a new ambition to reach carbon neutral global operations by 2030. The main priority will be to reduce greenhouse gas emissions from own operations. Remaining emissions will be compensated either through quota trading systems, such as EU ETS, or high-quality offset mechanisms. By setting this ambition, Equinor demonstrates its long-standing support to carbon pricing and the establishment of global carbon market mechanisms as outlined in the Paris Agreement.

Equinor’s low methane emissions are industry leading at around 10% of the global industry average. The climate roadmap includes ambitions to keep methane emissions at near zero and to eliminate routine flaring before 2030.

Arkona offshore wind farm

In April 2019, Chancellor of Germany Angela Merkel and Norwegian petroleum and energy minister Kjell-Børge Freiberg opened the Arkona offshore wind farm in the Baltic Sea in Mukran on the German island of Rügen today.

Arkona is operated by the Germany company E.ON in collaboration with Equinor.

Arkona started its power supply to the German national grid in September 2018, and its 60 wind turbines, each producing six megawatts (MW), reached peak production in 2019. The wind farm has a total capacity of 385 MW.

In addition to their share in the Arkona offshore wind farm, Equinor holds a position in the Baltyk I, II and III wind farm projects in the Polish sector of the Baltic Sea. In the UK Equinor operates the Sheringham Shoal, Dudgeon and Hywind Scotland offshore wind farms.

Equinor’s present offshore wind portfolio has the capacity to supply renewable energy to more than one million European homes.

Hywind Tampen project

In August 2019, Enova approved an application for funding of up to NOK 2.3 billion to support the Hywind Tampen project for developing the world’s first floating offshore wind farm supplying renewable power to offshore oil and gas installations.

Equinor and its partners are considering the possibility of supplying electricity from a floating offshore wind farm to the Gullfaks and Snorre fields. The licences received confirmation that the Hywind Tampen project has been granted funding of up to NOK 2.3 billion from Enova’s programme for full-scale innovative energy and climate measures.

Hywind Tampen may be the first project in the world for supplying electricity generated by floating offshore wind turbines to oil and gas platforms. The project will ensure profitable oil and gas production from the Snorre and Gullfaks fields with low CO2 emissions. The project may reduce CO2 emissions by more than 200,000 tonnes per year, equivalent to emissions from 100,000 private cars.

The Hywind Tampen offshore wind farm will consist of 11 wind turbines with a total capacity of 88 MW. The wind farm will be able to meet around 35% of the annual demand for electricity of the five platforms: Snorre A and B and Gullfaks A, B and C. In periods of strong wind, the percentage will be much higher.

Contract awards

On behalf of the Gullfaks and Snorre partners, in October 2019, Equinor signed contracts totalling around NOK 3.3 billion for the Hywind Tampen wind farm development.

The contracts have been awarded to Kværner AS, Siemens Gamesa Renewable Energy AS, JDR Cable System Ltd and Subsea 7 AS.

The substructures will be designed and constructed by Kværner, allowing the company to utilize its expertise in concrete structures on the Norwegian continental shelf for this contract.

The oil and gas platforms will be the first ever powered by a floating offshore wind farm. Emissions from the Gullfaks and Snorre fields will be reduced by more than 200,000 tonnes per year, equivalent to annual emissions from 100,000 passenger cars.

The Hywind Tampen investment will be close to NOK 5 billion. All contracts are subject to final approval of the plan for development and operation (PDO) by Norwegian authorities. The wind farm is scheduled to start production at the end of 2022.

Partners

- Gullfaks licence: Equinor Energy AS: 51%, Petoro AS: 30%, OMV (Norge) AS: 19%

- Snorre licence: Equinor Energy AS: 33.3%, Petoro AS: 30%, ExxonMobil Exploration and Production Norway AS: 17.5%, Idemitsu Petroleum Norge AS: 9.6%, DEA Norge AS: 8.6%, Vår Energi AS: 1.1%

In October 2020, construction started on the Hywind Tampen floating offshore wind farm.

The development of the Hywind Tampen project involves around 250 full-time equivalents for Kværner employees. Kværner's project will also generate around 800 full-time equivalents in ripple effects for suppliers and the public sector, among others.

Northern Lights carbon capture and storage

In October 2020, Equinor signed a Memorandum of Understanding (MoU) with Microsoft to explore ways to support the Northern Lights carbon capture and storage (CCS) project as a technology partner. Microsoft will explore using the project to enable the transportation and storage of captured CO2 . Equinor is developing the project together with Shell and Total as equal partners.

Equinor and Microsoft have agreed to:

- Explore a technology collaboration to integrate Microsoft’s digital expertise into the Northern Lights project.

- Microsoft will explore the use of Northern Lights' CO2 transport and storage facility as part of Microsoft’s portfolio of carbon capture, transportation, and storage projects.

- Explore ways for Microsoft to invest in the effective development of Northern Lights.

- Explore and establish advocacy of policies that help accelerate the contribution CCS can make to meeting Europe’s climate goals.

Equinor, Shell and Total made a conditional investment decision on the Northern Lights CO2 transport and storage project in May 2020. Pending approval by regulatory authorities, the project partners will form a joint venture. It will be responsible for creating an open-source, ship-based carbon transport and storage network including developing business models to store captured CO2 from across Europe. The final investment decision is subject to the Norwegian parliament’s approval, anticipated late 2020. The plan is to start operations in the first half of 2024.

MoUs have been signed with eight European entities representing different industries, including Air Liquide, Arcelor Mittal, Ervia, Fortum Oyj, HeidelbergCement AG, Preem, Stockholm Exergi and ETH Zürich. As part of the MoUs, the parties are looking at solutions for CO2 delivery, transport and storage of CO2, including logistics, CO2 specifications and roadmap towards potential start of operations.

NORTHERN LIGHTS:

- The Northern Lights project is part of the Norwegian full-scale carbon capture and storage (CCS) project “Langskip (Longship),” supported by the Norwegian government. The project will initially include capture of CO2 from Norwegian industrial capture sources. The Northern Lights project comprises transportation, receipt and permanent storage of CO2 in a reservoir in the northern North Sea.

- Initially, Northern Lights includes capacity to transport, inject and store up to 1.5 million tonnes of CO2 per year. Once the CO2 is captured onshore, it will be transported by ships, injected and permanently stored 2,600 meters below the seabed of the North Sea.

- The facilities are scheduled to be operational in 2024.

- The CO2 receiving terminal will be located at the premises of Naturgassparken industrial area in the municipality of Øygarden in Western Norway.

- The plant will be operated from Equinor’s facilities at the Sture terminal in Øygarden.

- Exploitation licence EL001 "Aurora" was awarded in January 2019.

- The geological storage complex is located 2,600 meters below the seabed.

- In March 2020 the Eos confirmation well was successfully drilled completed.

NortH2 green hydrogen project

In December 2020, Equinor joined the NortH2 green hydrogen project. The project aims to produce green hydrogen using renewable electricity from offshore wind off the coast of Netherlands of about 4 gigawatts by 2030, and 10+ gigawatts by 2040, kickstarting the hydrogen economy in Northwest Europe.

NortH2 was launched in February 2020, with Shell, Groningen Seaports Gasunie and the province of Groningen. Equinor joins RWE as new partners to the project. The project will complete a feasibility study by 2021, with the aim to start project development activities in the second half of 2021.

The project will have a capacity of 1 GW in 2027, 4 GW by 2030 and 10+ GW by 2040 for electrolysis. This equates to 0.4. million tonnes of green hydrogen production in 2030 and 1 million tonnes green hydrogen production by 2040. This can abate 8 to 10 million tonnes of CO2 emissions. This is equivalent to the yearly emissions from road traffic in Norway. The rapid growth in offshore wind is well suited to developing a green hydrogen value chain.

Offshore solar power

In January 2021, Equinor announced plans to explore the opportunities within offshore solar power. Together with Moss Maritime the company wants to start testing off the island of Frøya.

The plan is to build a floating pilot plant off Frøya near Trondheim in the late summer of 2021. It is set to become the world’s first pilot plant for floating solar power in rough waters.

The municipality of Frøya has been positive to and is involved in the planning of the pilot plant. Equinor has filed an application with the Norwegian Water Resources and Energy Directorate. Planned to measure 80 m x 80 m, the plant will tower less than 3 metres over the sea surface. According to plans the pilot will be tested for minimum one year. The project is a collaboration between Equinor and the technology company Moss Maritime.

The purpose of the pilot plant is not primarily to see how much energy it can produce, but how the weather conditions affect the plant. The Norwegian coast and continental shelf are world-class when it comes to oil, gas and wind, but when it comes to sun, other regions offer better conditions. As a test area, Frøya is still very suitable.

Operational data

Operational data

Reserves

Proved oil and gas reserves were estimated to be 6,004 million boe at year-end 2019, compared to 6,175 million boe at the end of 2018.

Approximately 88% of Equinor’s proved reserves are located in OECD countries. Norway is by far the most important contributor in this category, followed by the US and Canada. Of Equinor's total proved reserves, 5% are related to PSAs in non-OECD countries such as Azerbaijan, Angola, Algeria, Nigeria, Libya and Russia. Other non-OECD reserves are related to concessions in Brazil and Russia, representing all together 7% of Equinor's total proved reserves.

In 2019, approximately 426 million boe were matured from proved undeveloped to proved developed reserves. The startup of production from Johan Sverdrup, Trestakk and Utgard in Norway and in the UK, increased proved developed reserves by 305 million boe during 2019. The remaining 121 million boe of the matured volume is related to activities on developed assets. Over the last five years, Equinor has matured 2,012 million boe of proved undeveloped reserves to proved developed reserves.

Proved reserves in Norway

A total of 4,270 million boe is recognized as proved reserves in 61 fields and field development projects on the NCS, representing 71% of Equinor's total proved reserves. Of these, 56 fields and field areas are currently in production, 449 of which are operated by Equinor.

Proved reserves in Eurasia, excluding Norway

In this area, Equinor has proved reserves of 296 million boe related to seven fields in Russia, Azerbaijan, United Kingdom and Ireland. Eurasia excluding Norway represents 5% of Equinor's total proved reserves, Russia being the main contributor after sanctioning of the first stage of the full field development of the North Komsomolskoye field. This is also the largest addition to the proved reserves in this area in 2019. Other additions are related to sanctioning of the development of the Azeri Central East (ACE) platform in the Azeri Chirag Gunashli field in Azerbaijan, and the Barnacle field in the United Kingdom. All fields in this area are now producing. Of the proved reserves in Eurasia, 81 million boe or 27% are proved developed reserves.

Proved reserves in Africa

Equinor recognizes proved reserves of 198 million boe related to 28 fields and field developments in several West and North African countries, including Algeria, Angola, Libya and Nigeria. Africa represents 3% of Equinor's total proved reserves. Angola is the primary contributor to the proved reserves in this area, with 24 of the 28 fields. The reduction in oil and gas prices in 2019 had a net positive effect on the proved reserves from production sharing contracts in this area of approximately 5%.

Proved reserves in the US

In the US, Equinor has proved reserves equal to 870 million boe in a total of 12 fields and field development projects, ten of which are offshore field developments in the Gulf of Mexico and two are onshore tight reservoir assets.

Nine of the ten fields in the Gulf of Mexico are producing. Vito, which was sanctioned in 2018, is the only field in this area that is not yet producing. The onshore tight reservoir assets in the Appalachian basin and Bakken are all in production.

The largest changes to the proved reserves in the US in 2019 are related to new wells extending the proved areas in the US onshore assets. The acquisition of a 22.45% interest in the Caesar Tonga field in the Gulf of Mexico adds new proved reserves, whereas the divestment of Equinor’s 63% interest in the Eagle Ford shale play reduced the proved reserves in this area. The reduced oil and gas prices have a net negative effect of approximately 5% on the total proved reserves in this area, of which approximately two-thirds are related to the US onshore assets.

Proved reserves in the Americas excluding US

In the Americas excluding US, Equinor has proved reserves equal to 370 million boe in a total of six fields and field development projects. Four fields are located in Canada and two in Brazil.

In Canada, proved reserves are related to offshore field developments only and all four fields are producing. In Brazil, the two fields with proved reserves are both producing. The reduced oil and gas prices have not affected the proved reserves in this area in 2019.

Of the total proved reserves in the Americas excluding US, 255 million boe or 69%, are proved developed reserves. Less than 1% of the proved reserves in this area are gas reserves.

Contact

Equinor ASA

Drammensveien 264

Vaekero, 0283 Oslo

Norway

Tel: +47 22 97 20 00

Equinor ASA

Grenseveien 21, N-4035 Stavanger

Norway

Tel: +47 51 99 00 00

Equinor ASA

Research Centre, Bergen

Technology and New Energy, Sandsliveien 90

Postboks 7200, NO-5020 Bergen

Norway

Tel: +47 55 99 50 00

Equinor ASA

Rotvoll, N7005 Trondheim

Arkitekt Ebbellsvei 1

Norway

Tel: +47 73 58 40 11

News archive

Equinor secures drilling permit for well 7220/7-4 in production licence 532

Equinor Announces Norwegian North Sea Oil Discovery

Equinor Expects a third capacity increase at Johan Sverdrup

Key contracts in place for the Northern Lights project

Equinor highlights ten of the most exciting startups within the energy sector

APA 2020: Equinor awarded 17 new production licences

Equinor awarding framework contracts for integrated wireline services

Equinor to explore offshore solar power opportunities

Contact KeyFacts Energy to discover how you can secure access to over 2,600 'country-specific' company profiles from 144 countries.

KEYFACT Energy

KEYFACT Energy