Trinity Exploration & Production, the independent E&P company focused on Trinidad and Tobago, provides an update on its operations for the three-month period ended 31 December 2020.

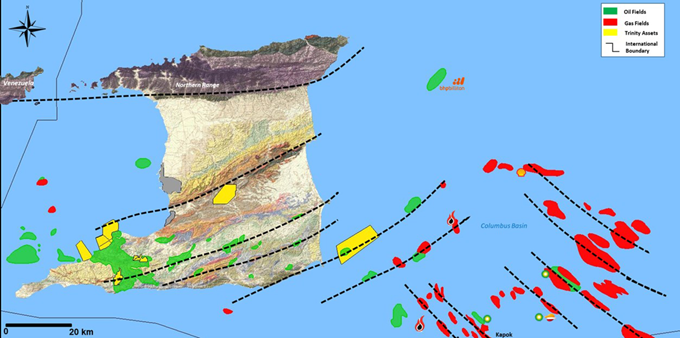

Map source: Trinity Exploration & Production

Q4 2020 Summary

Production levels remained strong during Q4 2020 with volumes averaging 3,206 bopd, yielding a full year 2020 average of 3,226 bopd (2019: 3,007 bopd) in line with market guidance. This represents a 7% increase over the prior year despite the challenges presented by COVID-19 and no new drilling activity taking place during the year. This is the third consecutive year of delivering production growth and meeting our stipulated production targets. Furthermore, the Group's unaudited FY 2020 operating break-even was US$20.5/bbl, meeting the challenging target set in response to the COVID-19 pandemic and being the fifth consecutive year of maintaining a sub-US$30/bbl operating break-even.

This robust operational performance ensured cash generation remained strong during the period, with the Group's unaudited cash balances at the year-end 2020 being US$20.2 million (US$13.8 million (audited) as at 31 December 2019).

Bruce Dingwall, CBE, Executive Chairman of Trinity, commented:

"2020 has been a year of significant progress for Trinity in not only continuing to grow production and generate cash during unprecedented times but also in maturing a strategic framework to meaningfully scale the business. Given the number of growth initiatives now underway, 2021 will be a year of investment as we seek to advance current developments, identify new opportunities via the strategic partnerships we have recently entered into and pursue further low cost appraisal and exploration targets.

"During Q4 the Company continued to build on the momentum that we have achieved, with growth in production despite not drilling any new wells during 2020. We have created a sustainable model that proved itself despite the wider COVID-19 related issues. We continue to work on ways of growing value from existing operations at the same time as maturing new projects to enhance our portfolio and create a differentiated company of scale for our shareholders. We are excited by the multitude of attractive growth opportunities available in Trinidad for companies of our scale, which have been further enhanced by the recent welcome changes to the SPT threshold.

"I must again thank all our staff for their unstinting dedication and to the supply chain and their employees for supporting our operations throughout this period. We are well positioned and see exciting opportunities in front of us."

Strategic Highlights: Routes to a step-change in Scale

Production

· Third consecutive year of production growth - targets met

· Proven operating model with a robust approach to base management

· Low operating break-even maintained, with targeted full year 2020 operating break-even of US$20.5/bbl (unaudited) being achieved

· Automation of offshore east coast assets continues to generate low volatility/stable production

· Wide scale roll-out of onshore automation continues

· Extensive use of analytics, transition technologies and automation provide a differentiated and scalable foundation for continued growth

Assets

· Solid reserves base and production profile are matched by an extensive development pipeline

· Acquisition of onshore 3D & 2D seismic data potentially transformative for onshore licences

· Onshore seismic is of good quality over much of the area and initial first pass screening shows interesting prospective features not previously mapped

· Development, appraisal and exploration pipeline to be augmented following 3D onshore seismic interpretation (now underway)

· Echo development (offshore Galeota) well advanced

· New, longer term onshore licences expected to be finalised during Q1 2021

· Supplemental Petroleum Tax ("SPT") reforms have commenced

Partnerships

· Partnership formed with Cairn Energy to bid on material offshore Gulf of Paria production and development asset (Jubilee) and a potentially high impact onshore exploration play (North West District)

· Partnership established with The National Gas Company of Trinidad and Tobago Ltd. ("NGC") to explore and develop new energy projects

· Asset acquisitions and partnerships offer the potential to increase scale, share risk and drive returns to shareholders

· Strong financial position means that Trinity is well placed to take advantage of further commercial opportunities as and when they arise

Q4 2020 Operational Highlights

· Robust COVID-19 measures continue with no significant impact to operations and production

· Quarter on quarter Group average production volumes were increased to 3,206 bopd for Q4 2020 (Q3 2020: 3,135 bopd)

· 7% year on year increase in Group average production volumes to 3,226 bopd for the full year 2020 (2019: 3,007 bopd)

· The increase in year-on-year production, despite no new drilling in 2020, is the result of the Company's rigorous approach to managing every aspect of our production operations

· During Q4, 4 recompletions ("RCPs") (Q3 2020: 8) and 31 workovers were completed (Q3 2020: 27) with swabbing operations continuing across onshore and West Coast assets

· A total of 18 RCPs and 115 workovers were completed during 2020

· The application of Supervisory, Control and Data Acquisition ("SCADA") technology and wider scale automation ramped up during Q4 and the Group is on track to have 31 Tier 1 onshore wells fully automated by H2 2021. With further roll out over a longer period the full production benefits and operating cost savings will become increasingly apparent

Q4 2020 Financial Highlights

· Average realisation of US$37.9/bbl for Q4 (Q3 2020: US$39.3/bbl) yielding a full year 2020 average of US$37.4/bbl (FY 2019: US$58.1/bbl). As a result, no SPT will be payable for 2020

· Operating break-even estimated at US$20.5/bbl for FY 2020 (2019: US$26.4/bbl)

· Net hedge income of US$1.4 million during 2020 (unaudited)

o 3 new instruments purchased during Q4 offering downside protection for between 30-50% of expected monthly production levels for 2021

· Cash balance of US$20.2 million (unaudited) as at 31 December 2020 versus US$13.8 million (audited) as at 31 December 2019 and US$22.2 million (unaudited) as at 30 September 2020.

o Cash balances at year end in-line with guidance given in Q3 2020 update and reflects investment in growth projects during Q4

· Net cash (cash minus US$2.7 million drawn working capital facility) of US$17.5 million as at 31 December 2020 (unaudited), versus US$13.8 million as at 31 December 2019 (audited)

· The 27% increase in net cash balances during the year was driven by strong operating cash flow generation and achieved despite a 36% reduction in average oil price realisations versus 2019

· During Q4 the working capital facility has been further increased to US$5.0 million (US$2.3 million undrawn) to enhance liquidity position further

Q4 2020 Key Developments

· Memorandum of understating ("MOU") signed with the NGC, to explore and develop new projects to enable energy transition in Trinidad and, potentially, in the wider Caribbean and Latin America, including;

o A Micro Liquefied Natural Gas ("micro LNG") business

o Renewable energy opportunities, inclusive of a wind power generation project

o Pursuit of stranded gas assets and associated opportunities in existing Trinity assets; and

o Pursuit of other mutually beneficial business opportunities

· The Trinidad & Tobago Government implemented the proposed reforms of SPT for small onshore producers

o These reforms are now effective with the threshold for the imposition of SPT lifted from US$50/bbl to US$75/bbl for the financial years 2021 and 2022

o Confirmation of these reforms represents a considerable boost to potential cash generation from Trinity's onshore licences should realisations average above US$50.01/bbl for any calendar quarter during 2021 and 2022

· 3D and 2D seismic and well log data acquired from Heritage Petroleum Company Limited

o Provides the basis for developing a new structural and stratigraphic framework in order to better understand how to maximise the value potential of Trinity's onshore licences

o Improves Trinity's ability to identify subsurface targets, particularly for high angle and horizontal wells

o Facilitates the identification and maturation of new appraisal and exploration targets onshore

KeyFacts Energy: Trinity Trinidad and Tobago country profile

KEYFACT Energy

KEYFACT Energy