- Efforts to address structural vulnerabilities to the economic and health effects of Covid-19

- Significant private sector stimulus complemented the public response

- Despite severe economic fallout, a number of countries recorded positive growth

- Implementation of AfCFTA to support greater regional trade in the future

Home to a relatively high number of low-income countries with limited health care infrastructure, Africa experienced a challenging 2020 due to Covid-19. However, a combination of strong anti-virus measures, increased digitalisation and shifting global trade patterns could see the region benefit from the post-pandemic landscape.

Using OBG Advisory’s “4R” matrix for analysing the impact of Covid-19 on emerging economies – encompassing Resilience, Response, Recovery and Reinvention – we highlight success stories and lessons from the region over 2020, and look forward to the year ahead.

RESILIENCE

As in other regions, the resilience of African countries to the pandemic was often linked to their respective levels of development.

In particular, many developing countries on the continent have comparatively weak health care infrastructure, leaving them exposed to pandemics.

While South Africa ranked 34th and Kenya 55th out of 195 countries in the 2019 Global Health Security Index, which evaluates health care resilience, many others placed further down the list. For example, Morocco ranked 68th, followed by Egypt (87th), Nigeria (96th), Côte d'Ivoire (105th), Ghana (106th), Tunisia (122nd) and Algeria (173rd).

Meanwhile, Africa’s high proportion of low-income economies and low levels of household income gave rise to fears that many people would be left without adequate financial support.

The risk was exacerbated in oil-exporting countries following the collapse in oil prices, which fell from year-opening levels of $66 per barrel to less than $20 in late April.

While prices recovered to around $50 per barrel by the end of the year, the fall nevertheless had a dramatic impact on Nigeria, Africa’s largest oil producer, as well as Angola and Algeria, where oil accounted for 90% of export revenue prior to the pandemic.

Similarly, countries with significant tourism sectors, such as Egypt, Morocco and Tunisia, were also in a vulnerable position, with border closures and social distancing measures bringing global leisure travel to a halt.

Bolstering resilience

While various factors limited the resilience of African countries, a large number also had specific characteristics that helped them deal with the crisis.

For example, countries such as Nigeria, Côte d'Ivoire and Algeria had relatively low levels of government debt leading up to the pandemic – at 27.6%, 31.9% and 38.2% of GDP, respectively – giving their governments breathing room to fund Covid-19 recovery plans.

Elsewhere, countries with more developed digital ecosystems, such as South Africa and Kenya, were able to shift more effectively towards digital payments, e-health and online education.

Another positive for countries in Africa was related to demographics. With around 60% of the continent’s population under the age of 25, most countries had a smaller proportion of citizens in high-risk health groups.

Africa’s previous experience with viruses such as Ebola helped prepare many nations in the region to quickly and effectively react to Covid-19.

For example, in many sub-Saharan countries officials already had equipment, strategies and plans that could be activated at borders, including body temperature scanners and outbreak surveillance systems.

A number of countries implemented lockdowns, typically consisting of curfews and travel restrictions for citizens and the closure of non-essential businesses.

While African countries also responded to the economic fallout of the crisis, their financial stimulus packages were considerably smaller than those of more developed countries.

According to analysis from the Bill and Melinda Gates Foundation, average stimulus funding from G20 countries was 22% of GDP; however, for those in sub-Saharan Africa, the figure was 3%. Furthermore, given the relatively smaller GDP of many countries in Africa, this led to a marked difference in the support offered to citizens.

Private sector response

Alongside government support, the business community played a key role in responding to the virus.

Shortly after the outbreak reached Nigeria, a number of local businesses came together to develop the Private Sector Coalition Against Covid-19 (CaCovid).

With all major banks and large companies contributing funds, CaCovid raised N25bn ($6.3m) in the early stages of the pandemic and was able to provide public authorities with medical expertise and urgent supplies.

For example, in Kaduna State, the local government received donations in the form of testing kits, personal protective equipment, hospital beds, essential medicines and food items from private companies.

The combined efforts of public and private bodies formed a crucial component of the continent’s immediate response to the pandemic.

While there has been a substantial number of cases in some countries, such as South Africa, with 1.1m, and Morocco, with 444,000 as of early January 2021, the continent has fared better than many had initially predicted.

For example, Ghana, which has a population of 30m, had recorded 55,000 cases and 335 deaths by the start of 2021. Meanwhile, in Côte d'Ivoire, with a population of 25m, there have been 23,000 recorded cases and 138 deaths.

Elsewhere, even though there has been a significant number of cases in Algeria (101,000), Kenya (97,000) and Nigeria (91,000), these countries have recorded comparatively lower Covid-19-related fatalities than many European nations.

However, testing is less extensive in Africa than in other regions, and some countries are experiencing a second wave of the virus which could see cases and deaths continue to rise into 2021.

Digitalisation

Another key response to the pandemic was the adoption and expansion of digital solutions.

To take an example, during the early stages of the pandemic the Central Bank of Kenya announced that banks would waive fees for financial transfers conducted via mobile banking.

This was followed by an announcement from Safaricom – the owner of Kenya’s most popular mobile money platform, M-Pesa – that all user-to-user transactions under KSh1000 ($9.15) would be free for 90 days, and that the daily transaction limit for SMEs would be increased from KSh70,000 ($640) to KSh150,000 ($1370).

The need to adhere to social distancing guidelines also led to a spike in demand for online payment and delivery services. While these companies experienced increased traffic, they were also forced to adapt to the new demands associated with the pandemic.

“[We] had to adapt from a platform where at any time consumers can buy whatever they want to a platform that primarily makes sure consumers can access basic essentials, such as food, sanitary items and personal hygiene products,” Juliet Anammah, chairwoman of e-commerce company Jumia Nigeria, told OBG in June.

Another sector that benefitted from digital solutions was health care. Many countries employed telemedicine initiatives that allowed doctors to diagnose patients remotely rather than in person, while drones proved to be useful in transporting medicines and other essentials to people living in remote areas.

“I expect that many of the health tech initiatives deployed during the crisis will remain after the crisis,” Daniel Marfo, general manager of medical drone company Zipline Ghana, told OBG in April. “As such, we could see the increased use of drone technology in health-related logistics, a boom in telemedicine and online pharmacies, and remote disease tracking and patient monitoring.”

RECOVERY

Despite some of the major challenges facing African countries in 2020, the continent as a whole seems to have fared better than some other regions.

According to the IMF’s 2020 outlook, released in October, GDP was predicted to fall by -1.3% in North Africa and by -3.3% in sub-Saharan Africa, less than the global average of -4.4%.

Although GDP in South Africa (-8.6%), Morocco (-7%), Tunisia (-7%) and Algeria (-5.5%) was expected to contract significantly last year, Africa saw a number of economies grow. The IMF projected that GDP would expand in Egypt (3.5%), Tanzania (1.9%), Côte d’Ivoire (1.8%), Kenya (1%) and Ghana (0.9%), among others.

Looking ahead, the fund expects North Africa and sub-Saharan Africa to recover with growth of 4.9% and 3%, respectively, in 2021, compared to the global average of 5.2%.

Oil and tourism key for recovery

While the resumption of trade will be key to an overall rebound, economic recovery in some countries is likely to be closely linked to the price of oil.

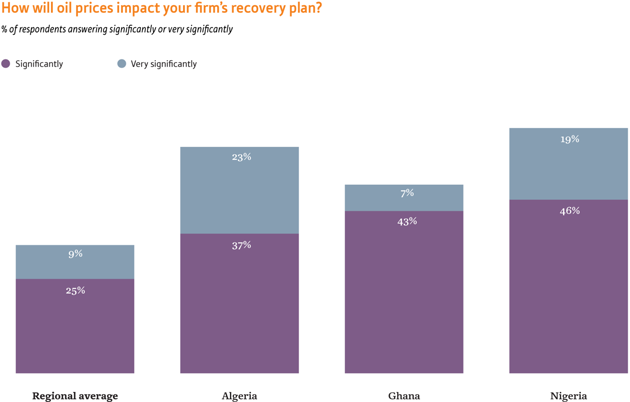

According to OBG’s Africa Covid-19 CEO Survey, released in May, 34% of all respondents said that oil prices would either significantly or very significantly affect their respective business recovery plans, with the figure rising to 65% in Nigeria, 60% in Algeria and 50% in Ghana.

Another important factor will be the resumption of travel and tourism.

Although Egypt and Tunisia – where tourism accounted for around 9% and 8% of pre-virus GDP, respectively – both implemented a series of safety and hygiene measures to encourage travellers to visit throughout the year, their local tourism industries were nevertheless significantly affected by Covid-19.

Year-end tourism revenue was down 67% in Egypt, according to local industry officials, while the drop measured around 60% in Tunisia.

Although global consultancy McKinsey estimates that global tourism will not return to 2019 levels until 2023 or 2024, some industry officials hope the rollout of Covid-19 vaccines will help speed up the recovery of the sector.

REINVENTION

With global supply chains disrupted as a result of the pandemic, many companies have engaged in a strategy known as China +1, diversifying their supply chains and production away from the Asian giant.

Some African countries stand to benefit from this phenomenon. In particular, North African states with developed industrial capacity, such as Morocco, Algeria, Tunisia and Egypt, could see European companies, or those with major European operations, shift production capacity in the future.

Somewhat related to China +1, the pandemic saw many countries and companies turn towards greater regionalisation – whereby regional countries collaborate to ensure the availability of goods and services.

This occurred in Africa, where the African Union’s Centres for Disease Control and Prevention helped set up a digital platform that pooled medical supply orders. Coordinating with Chinese counterparts, this ensured the efficient supply of medicines and other equipment to the region despite supply chain disruption.

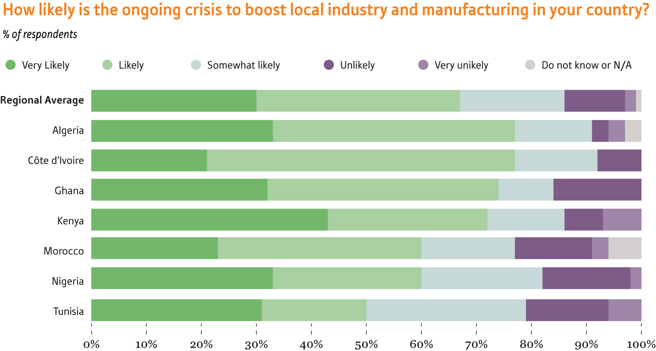

Looking further ahead, aggregating the region’s demand could create sufficient scale for Africa to create its own generic medicine industry. Indeed, the results of OBG’s latest Africa CEO Survey suggest that the region is likely to see increased local production beyond just medical supplies: some 66% of respondents reported that the crisis is either likely or very likely to boost industry and manufacturing in their respective countries.

“We expect the current disruption in international trade to encourage African countries to start looking inwards,” Yofi Grant, CEO of the Ghana Investment Promotion Centre, told OBG in May.

AfCFTA

This approach towards regional trade is likely to be bolstered by the African Continental Free Trade Agreement (AfCFTA), which became operational on January 1, 2021.

Initially agreed in March 2018 and subsequently signed by 54 of the 55 member countries of the African Union – Eritrea being the only country that did not participate – the deal aims to create a single market across Africa.

AfCFTA requires members to remove 90% of tariffs on goods, facilitate the movement of capital and people, and take steps towards creating an Africa-wide Customs union, which proponents say would not only significantly boost regional trade, but also help countries recover from the economic fallout of the pandemic.

According to US think tank the Brookings Institution, in 2017 intra-African trade accounted for just 17% of business activity on the continent, below comparative levels in Europe (69%), Asia (59%) and North America (31%).

When fully operational by 2030, AfCFTA is expected to cover a market of 1.2bn people, with a combined GDP of $2.5trn.

This information was originally published by Oxford Business Group (OBG), the global publishing, research and consultancy firm. Copyright Oxford Business Group 2017. Published under permission by OBG. For economic news about Africa and countries covered by OBG, click here.

KEYFACT Energy

KEYFACT Energy