TransGlobe Energy today announced its financial and operating results for the three and nine months ended September 30, 2020.

HIGHLIGHTS :

- TransGlobe is focused on conserving cash in the current low commodity price environment. The Company ended the third quarter with positive working capital of $12.7 million, including cash and cash equivalents of $27.1 million;

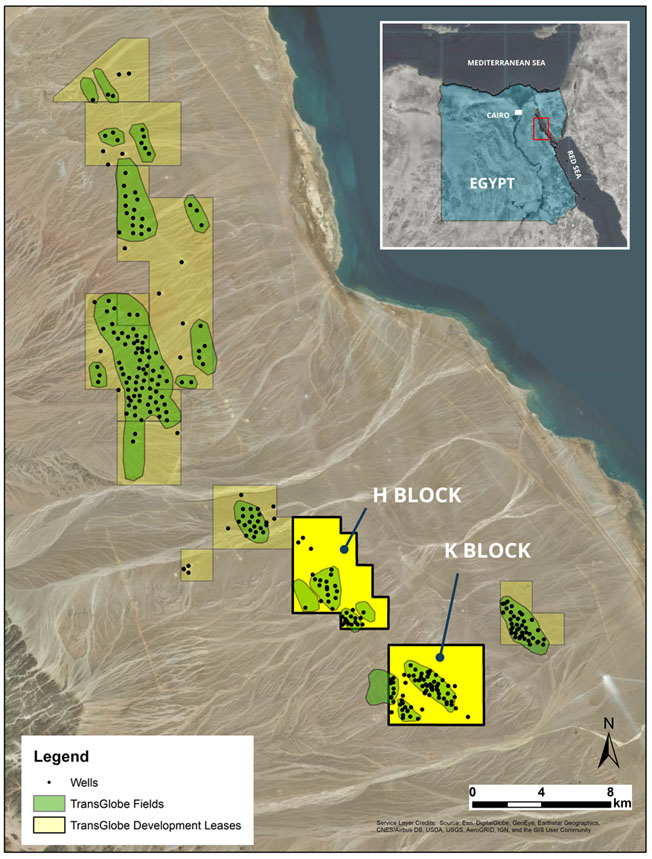

- Third quarter production averaged 12,044 boe/d (Egypt 9,812 bbls/d, Canada 2,232 boe/d), a decrease of 2,256 boe/d (16%) from the previous quarter primarily due to deferred well interventions in Egypt during low oil prices and natural declines;

- Production in October averaged ~12,162 boe/d (Egypt ~10,303 bbls/d, Canada ~1,859 boe/d), an increase of 1% from Q3-2020, and below revised budget expectations primarily due to deferred well interventions in Egypt and repairs on a third-party pipeline in Canada that required the Company to shut-in certain wells for two weeks in October;

- Sales averaged 10,680 boe/d including 259.2 Mbbls sold to EGPC for net proceeds of $10.2 million in Q3-2020. Average realized price for Q3-2020 sales of $33.63/boe; Q3-2020 average realized price on Egyptian sales of $37.15/bbl and Canadian sales of $20.80/boe;

- Funds flow from operations of $0.3 million ($0.00 per share) in the quarter;

- Third quarter net loss of $6.0 million ($0.08 per share), inclusive of a $0.3 million unrealized loss on derivative commodity contracts;

- Contracted a workover rig and began well interventions in Egypt in September 2020 at West Bakr;

- Consistent with the revised 2020 budget previously disclosed, there has been no drilling activity in Canada or Egypt during Q3-2020;

- Business continuity plans remain effective across our locations in response to COVID-19 with no health and safety impacts or disruption to production;

- Despite restrictions on travel, management concluded its negotiations with EGPC to amend, extend and consolidate the Company’s Eastern Desert concession agreements during the quarter. At this time, it is the Company’s belief that EGPC approval will occur in the near term; and

- TransGlobe continues to actively evaluate M&A opportunities, with a view to not only better position the Company to weather the current downturn but also rebound strongly once commodity prices begin to strengthen.

CORPORATE SUMMARY

TransGlobe Energy produced an average of 12,044 barrels of oil equivalent per day ("boe/d") during the third quarter of 2020. Egypt production was 9,812 barrels of oil per day ("bbls/d") and Canada production was 2,232 boe/d. Production for the quarter was below revised full year 2020 guidance of 13,300 to 13,800 boe/d due to deferred well interventions in Egypt during low oil prices and natural declines. It is expected that, with well interventions performed in September and Q4-2020, TransGlobe will be within full year 2020 guidance on an annual basis.

TransGlobe's Egyptian crude oil is sold at a quality discount to Dated Brent. The Company received an average price of $37.15 per barrel in Egypt during the quarter. Gharib Blend has benefited from a relative increase in demand for heavy oil in the past nine months and the resultant decrease in the differential to Brent. For the year to date the Gharib Blend differential to Brent has been ~$4.50/bbl. In Canada, the Company received an average of $36.99 per barrel of oil, $15.65 per barrel of NGL and $1.80 per thousand cubic feet ("Mcf") of natural gas during the quarter.

During Q3-2020, the Company had funds flow from operations of $0.3 million and ended the quarter with positive working capital of $12.7 million, including cash and cash equivalents of $27.1 million. The Company had a net loss in the quarter of $6.0 million, inclusive of a $0.3 million unrealized derivative loss on commodity contracts which represents a fair value adjustment on the Company's hedging contracts as at September 30, 2020.

In Egypt, the Company sold 259.2 thousand barrels (“Mbbls”) of entitlement crude oil to EGPC during the quarter, and had 534.2 Mbbls of entitlement crude oil inventory at September 30, 2020. The increase in inventoried crude oil is attributed to a decrease in sales volumes, offset by a decrease in production in Q3-2020. Subsequent to the quarter, TransGlobe completed a ~452 Mbbls cargo lifting of Egypt entitlement crude oil, with proceeds expected in December. In Canada, the Company sold the Q2-2020 ending inventory balance of 6.3 Mbbls of Canadian light crude oil in July 2020; all Canadian production was sold during the quarter.

In Egypt, the Company contracted a workover rig to perform well interventions at West Bakr beginning in September 2020, and continuing into the fourth quarter. Consistent with the Company’s revised 2020 budget, there has been no drilling activity in Canada or Egypt during the third quarter.

Despite restrictions on travel, management concluded its negotiations with EGPC to amend, extend and consolidate the Company’s Eastern Desert concession agreements during the quarter. At this time, it is the Company’s belief that EGPC approval will occur in the near term. Following such approval, the merged concession will require parliamentary ratification. The Company will provide timely updates as developments unfold.

The Company remains forward looking and prepared to use its operational control to take advantage of any sustained upward movement in oil price. TransGlobe continues to be vigilant in its search for attractive M&A opportunities while steadfastly retaining its focus on shareholder value creation.

LIQUIDITY AND CAPITAL RESOURCES

Funding for the Company’s capital expenditures is provided by cash flow from operations and cash on hand. The Company is funding its 2020 development program through the use of working capital and cash flow from operations. The Company also expects to pay down debt and explore business development opportunities with its working capital. Fluctuations in commodity prices, product demand, foreign exchange rates, interest rates and various other risks may impact capital resources and capital expenditures.

Working capital is the amount by which current assets exceed current liabilities. As at September 30, 2020, the Company had a working capital surplus of $12.7 million (December 31, 2019 - $32.2 million). The decrease in working capital is primarily due to the $20 million outstanding balance of the Mercuria prepayment agreement being reclassified as current at quarter end, a decrease in cash resulting from payments on accounts payable in the period, a decrease in crude oil inventory due to increased sales to EGPC in 2020, partially offset by a corresponding increase in accounts receivable and decrease in accounts payable.

As at September 30, 2020, the Company's cash equivalents balance consisted of short-term deposits with an original term to maturity at purchase of one month or less. All of the Company's cash and cash equivalents are on deposit with high credit-quality financial institutions.

Over the past 10 years, the Company has experienced delays in the collection of accounts receivable from EGPC. The length of delay peaked in 2013, returned to historical delays of up to nine months in 2017, and has since fluctuated within an acceptable range. As at September 30, 2020, amounts owing from EGPC were $8.0 million. The Company considers there to be minimal credit risk associated with amounts receivable from EGPC.

In Egypt, the Company sold 259.2 Mbbls of crude oil to EGPC in Q3-2020 for net proceeds of $10.2 million. During the third quarter of 2020, the Company collected $16.4 million of accounts receivable from EGPC, an additional $1.0 million has been collected subsequent to the quarter. The Company incurs a 30-day collection cycle on sales to third-party international buyers. Depending on the Company's assessment of the credit of crude oil purchasers, they may be required to post irrevocable letters of credit to support the sales prior to the cargo lifting. As at September 30, 2020, crude oil held as inventory was 534.2 Mbbls.

As at September 30, 2020, the Company had $86.0 million of revolving credit facilities with $26.2 million drawn and $59.8 million available. The Company has a prepayment agreement with Mercuria that allows for a revolving balance of up to $75.0 million, of which $20.0 million was drawn and outstanding as at September 30, 2020. During the nine months ended September 30, 2020, the Company repaid $10.0 million on this prepayment facility. The Company also has a revolving Canadian reserves-based lending facility with ATB that was renewed and reduced as at June 30, 2020 from C$25.0 million ($18.4 million) to C$15.0 million ($11.0 million), of which C$8.2 million ($6.2 million) was drawn and outstanding. The reduction in the ATB facility is a result of lower forecasted commodity prices and the associated impact on asset value. During the nine months ended September 30, 2020, the Company had drawings of C$0.4 million ($0.3 million) and repayments of C$2.0 million ($1.5 million) on this facility.

KeyFacts Energy: TransGlobe Energy Egypt country profile

KEYFACT Energy

KEYFACT Energy