Highlights:

- Operational Update: o P2607 Joint Venture (JV) continues to work on the development of the Anning & Somerville Gas Fields assuming various possible fiscal scenarios

- 2024 JV budget remains in place

- Hartshead remains in a strong and resilient position with its project partner, technical team and growth potential:

- P2607 remains a high value gas development project

- Hartshead maintains a strong balance sheet position for a junior company with over $22 million in cash

- Strong farm-in partner with Rockrose Energy, a highly motivated and engaged joint venture partner which have confirmed commitment to moving the project forward

- Strong gas market in the UK and Europe with long term gas demand

- Clear development plan to monetise the Phase 1 development project

- Strong support from UK oil and gas regulator continuing to work with the Company

- Hartshead continues to retain a highly skilled technical team

- Strong inherent project value with 300 Bcf of gas reserves for Phase 1 development with up to 800 Bcf of gas for development and delivery to the UK has market.

- Hartshead is currently exploring innovative funding arrangements as alternatives to fund critical infrastructure required to produce and transport gas to the UK market: o Potential for a third party to pay for some of the infrastructure, with the investment to generate a return through a tariff paid by Hartshead

- Such an arrangement would reduce the upfront Capex and move some of this capital cost into operating costs as a tariff

- The approach optimises the way the project cashflows work to unlock greater value for shareholders

- Hartshead continues productive discussions with political stakeholders aimed at fostering a conducive regulatory environment for gas development:

- Including politicians, unions, supply chain partners and industry trade bodies

- Aim to discuss, understand and help shape future fiscal policy and outline the effects that would result on the oil and gas industry in the UK if punitive or inequitable policies were to be adopted

Hartshead Resources today provides an overview of the Company’s quarterly activities for the period ending 31 March 2024 (Quarter, Reporting Period).

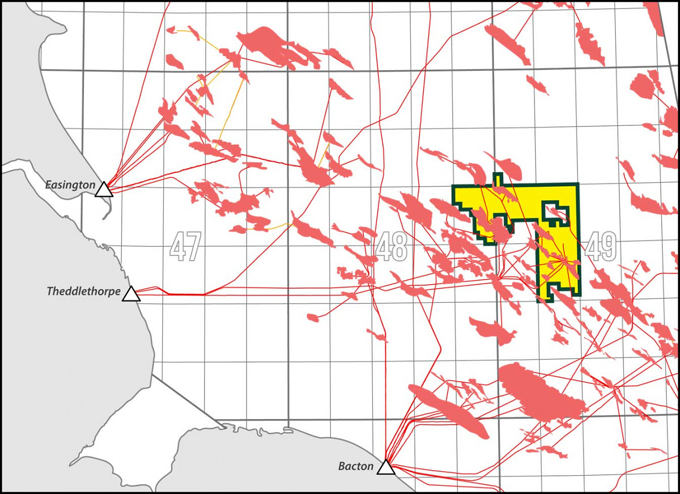

PHASE I FIELD DEVELOPMENT – ANNING AND SOMERVILLE GAS FIELDS

UK Southern Gas Basin – Further Operational Update

Subsequent to the Reporting Period, Hartshead announced that the P2607 Joint Venture (JV) is continuing work on the Phase 1 Gas Field Development. The JV is committed to progressing the project subject to receiving certainty, regarding future fiscal policy and confirms that the current 2024 JV budget remains in place.

Hartshead is continuing discussions on project finance and is in discussions on infrastructure funding that has the potential to significantly reduce the upfront CAPEX required by the JV, associated with the Phase 1 development project. This would be positive in respect to whole project economics, moving CAPEX into OPEX via a tariff payable in respect of third party infrastructure investment, and in respect of Hartshead funding, reducing the funding requirement that Hartshead would need to meet outside the RockRose carry.

The Company has had extensive dialogue with various political stakeholders to seek clarity on the future fiscal regime, however at this time, the situation still remains unclear. It is anticipated that beyond the next parliamentary election in the UK, likely in Q4 2024, there will be changes to the oil and gas fiscal regime and Hartshead has been involved in discussions on the proposed changes and their impact on industry. All stakeholders have expressed their desire to create a fiscal regime in the UK that will still attract and enable investment and activity in the sector.

Importantly, Hartshead is focused on maintaining its strong cash position during this period of delay and uncertainty. The Company has undertaken a cost reduction initiative in respect of the areas of the project team that were recruited to deliver the current and next phase of the development project and the related contract awards. This has led to a material cut in head count and a reduction of the monthly costs to the JV and to Hartshead directly.

UK NBP gas prices have strengthened to ~70p/therm which is a positive sign given the unusually mild winter in European and large supply of gas storage inventories at the exit of the winter season.

KeyFacts Energy: Hartshead UK country profile

KEYFACT Energy

KEYFACT Energy