WTI (May) $85.36 -5c, Brent (June) 90.02 -8c, Diff -$4.66 -3c

USNG (May) 1.73 +4c, UKNG (May) 83.46p +4.56p, TTF (May) €33.0 +€1.07

Oil price

Oil remains very quiet, the API inventories were slightly worse than expected but so far no retaliation from Israel against the Iranian attack at the weekend.

Union Jack Oil

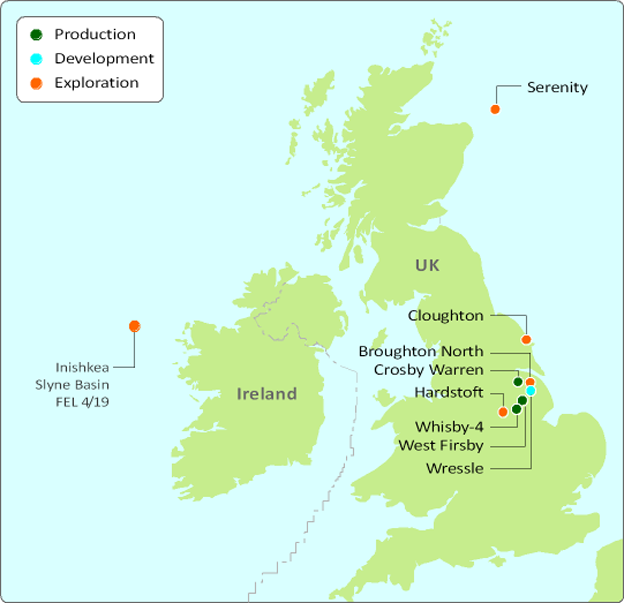

Union Jack Oil has announce an update in respect of the Wressle hydrocarbon development located within licences PEDL180 and PEDL182 in North Lincolnshire on the western margin of the Humber Basin.

Union Jack holds a 40% economic interest in this development.

- In excess of US$19,000,000 generated net to Union Jack since the recommencement of production at Wressle in August 2021 and remains materially cash generative

- Production for Q1 2024 averaged circa 530 barrels of oil per day (gross) with an average water cut of 24.3%, which is easily disposed of at a nearby facility at negligible cost

- Current production comfortably exceeds ERC Equipoise’s forecasts, as indicated in its December 2023 Competent Person’s Report

- Wressle continues to be the second most productive onshore UK oilfield

- Planning permission has been submitted to the North Lincolnshire Council in respect of the drilling of two additional back-to-back development wells and gas export facilities to the national grid to allow for the monetisation of the significant gas reserves associated with the Penistone Flags formation

- The new drilling and development campaign will commence at the earliest opportunity, subject to regulatory approval

- In addition to the development and drilling plans at Wressle, the Company is also optimistic about the potential positive implications of a new seismic interpretation and mapping exercise across the Wressle field that has highlighted a possible significant increase in resources from the Ashover Grit formation

Notice of Results and Dividend

The Company confirms that it will announce its audited results for the year ended 31 December 2023 on 20 May 2024. The Board also expects to announce the payment of a dividend to qualifying shareholders, details of which will be notified in May 2024.

David Bramhill, Executive Chairman of Union Jack, commented:

“Wressle continues to deliver robust revenues, bolstering our already strong Balance Sheet.

“The next stage of Wressle’s development will underline the management’s approach to unlocking value and further optimise production and economic returns for shareholders from our flagship asset.

“Cash flows from Wressle remain the fuel for growth going forward, providing the financial resources necessary to progress the development of assets both in the UK and USA.

“The Company is in excellent financial health and well poised to take advantage of the opportunities before it.

“Given our sound financial position and the additional cash flow from Union Jack’s expanding United States Mineral royalty portfolio, the Board will be announcing the payment of a dividend to qualifying shareholders, details of which will be notified in May 2024.”

Union Jack is firing on all cylinders although you wouldn’t know it by looking at the market which continues to stare aghast at strong revenue from Wressle which is hoping to develop in the Penistone Flags and the Ashover Grit formations.

Management is wisely investing some of the Wressle revenue in the USA where in the land of the free they have a significantly more pro-business environment and indeed UJO has already had a successful well at Andrews and hope for more.

The revenues have also enabled the board to announce a dividend given the strength of the balance sheet and confidence in the future, what more could one ask for as a shareholder, well there are always a few who can’t see what is a well managed company with a great, growing asset base and fantastic opportunities for the future…

Zephyr Energy

Zephyr has provided an operational update on the State 36-2 LNW-CC-R well at its flagship project in the Paradox Basin, Utah, U.S.

Further to the Company’s announcement on 22 March 2024, the Helmerich & Payne Rig 257 has begun rigging up operations to spud the initial, surface section of the new well in the coming days. All necessary ancillary service providers have also arrived on site to support the Company’s drilling operations.

The new well, for which the Company expects to recover substantially all the drilling costs incurred through the well control insurance policy that it had in place for the State 36-2 LNW-CC well, will target the same Cane Creek reservoir and the over pressured, gas bearing natural fracture system that was proven during the drilling of the original well. Drilling at the new well is planned to reach a total depth at 10,362 feet measured depth (9,600 feet true vertical depth) incorporating a 270-foot horizontal reservoir section (see Figure 1 below). The new well has also been designed to allow the drilling of a longer, 10,000-foot horizontal section later, should that be required.

The key objectives of the new well are:

- To successfully complete drilling operations to TD safely and without harm to people, the environment or equipment.

- To successfully twin the original well and intersect the same Cane Creek reservoir natural fracture system identified by it.

- To confirm the presence of hydrocarbons as found by the original well, and further appraise the Cane Creek reservoir at Zephyr’s federal White Sands Unit.

- Should the original well result be replicated, to assess the reservoir productivity by flow testing the new well.

Drilling operations are expected to take approximately 30 days from the date of spud. After reaching TD, a completion and well test crew will be mobilised to complete the short horizontal section and test any productive natural fracture system intersected by the new well.

Colin Harrington, Zephyr’s CEO commented:

“We are excited about the commencement of drilling operations with a goal to deliver a safe and timely drilling operation followed by a successful well test.”

“We look forward to keeping our stakeholders updated as drilling progresses and believe that these operations will be the catalyst to further unlock the significant potential of the Paradox project.”

The rig arrives on station at the Paradox Basin and will spud imminently, paid for by the insurance well State 36-2 LNW-CC-R it should take around 30 days to drill and then testing after that. These are exciting times for Zephyr shareholders and if I was anywhere near correct the last time then shareholders should get geed up for a fantastic few weeks.

Deltic Energy

Deltic has announced its audited results for the year ended 31 December 2023 and that it has released an updated corporate presentation. The corporate presentation is available on the homepage at the Company’s website: www.delticenergy.com.

Highlights

- Drilling of Pensacola prospect resulted in the largest discovery in the Southern North Sea in the last decade, at the upper end of our pre-drill estimates

- RPS Energy Ltd independently assessed Pensacola on the basis of a combined gas and oil case, estimating a gross 2C contingent resource of 72.6 mmboe (21.8 mmboe net to Deltic) and in the gas only case gross 2C contingent resource of 50 mmboe (15 mmboe net to Deltic)

- RPS also estimated a Post tax NPV10 in the combined case of $683m (gross) or $205m net to Deltic and $663m (gross) in the gas only case or $199m net to Deltic

- Planning has progressed for a well to be drilled with Shell over the Selene gas prospect followed by an appraisal well for Pensacola in the second half of 2024

- Rig contract signed and structured such that both Selene and Pensacola will be drilled back to back using the Valaris 123, a heavy duty jack-up rig, expected to commence July 2024

- Success in 33rd UK Licensing Round

- Cash position of £5.6 million at 31 December 2023 (2022: £20.4 million) with no debt

- Net cash outflow for the year of £14.8 million (2022: inflow £10.3 million) mainly for funding Pensacola exploration drilling and other exploration investments

- Completed a farmout of the Selene prospect to Dana Petroleum post-period end with Deltic fully carried for the estimated cost of the success case well

Graham Swindells, Chief Executive of Deltic Energy, commented:

“2023 was a transformational year for Deltic following the Pensacola discovery in the Southern North Sea in February. As one of the area’s biggest discoveries in the past ten years, this was a fantastic result for the Company and is testament to the hard work carried out in the years leading up to this point. We continue to prepare for an appraisal well on Pensacola in Q4 this year, which I believe will take us a step closer towards commerciality. During 2023 we also continued to progress our equally significant Selene exploration prospect, culminating in an excellent farmout in early 2024. We are now in the enviable position of drilling two consecutive wells in the second half of the year, with two world class partners in Shell and Dana.”

“I am delighted with the progress that Deltic made in 2023 and firmly believe we can continue on this trajectory throughout 2024. The UK needs to bolster its security of energy supply more than ever and I believe that Deltic will play a key role in this.”

Whilst these figures in themselves don’t add anything specific to our sum knowledge being of a historic nature it does give us a chance to assess the significant successes in the recent accounting period which include the following.

The Pensacola well was drilled and came in with result a great deal better than had been expected. Indeed, RPS Energy Ltd independently assessed Pensacola on the basis of a combined gas and oil case, estimating a gross 2C contingent resource of 72.6 mmboe (21.8 mmboe net to Deltic) and in the gas only case gross 2C contingent resource of 50 mmboe (15 mmboe net to Deltic) an historic success in the SNS.

Also worth noting is that RPS also estimated a Post tax NPV10 in the combined case of $683m (gross) or $205m net to Deltic and $663m (gross) in the gas only case or $199m net to Deltic, another huge figure when compared to Deltic’s market cap.

The company also achieved a highly successful farm-out at the Selene prospect to Dana and were fully carried for the upcoming action.

Looking forward life could probably not get more exciting for Deltic, with a rig booked I am expecting the drilling of the Selene well to start in July and to be followed by the Pensacola appraisal by the same rig, back-to-back. With success in the 33rd Round of UK Government licensing and potential still for a further farm-out at Pensacola life is about to get a great deal busier. It remains perhaps the stock in the sector with the most upside potential and investors should climb aboard…

Hunting

Hunting has issued the following Trading Update for Q1 2024, ahead of its Annual General Meeting that will take place today at 10:30a.m. BST in London.

Highlights

- Positive start to the year, with EBITDA of c.$28.9 million during Q1 2024 (Q1 2023 – c.$22.4 million), marginally ahead of management’s expectations.

- Sales order book remains healthy at c.$544.0 million (Q1 2023 – c.$492.9 million), with tender pipeline for new OCTG orders remaining buoyant.

- OCTG and Subsea product groups reporting a good first quarter, ahead of management’s expectations, as offshore and international activity continues to be strong.

- Advanced Manufacturing business also reporting a positive quarter, with a good mix of energy and non-oil and gas sales.

- Perforating Systems has reported a slower first quarter, as US onshore markets remain soft; however, the outlook for H2 remains more positive as international activity is projected to drive new drilling.

- Total cash and bank / (borrowings) of c.$(33.6) million at quarter-end reflecting new orders, which are driving higher inventory and receivables.

- Full-year guidance remains unchanged with both EBITDA of c.$125-135 million and EBITDA margin of 12-13% targeted. EBITDA to Free Cash Flow conversion of 50% still anticipated for the full year, driven by increased EBITDA and robust working capital management.

Commenting on Q1 2024 trading and the market outlook, Hunting’s Chief Executive, Jim Johnson said:

“The year has started positively for the Group, with Q1 2024 results marginally ahead of management’s expectations, and well ahead of the Q1 2023 result, which demonstrates the continued growth momentum of the Group. Our OCTG, Subsea and Advanced Manufacturing product groups are continuing to see strong momentum as offshore and international activity remains robust. While Perforating Systems has had a slow start to the year, H2 2024 is likely to see stronger activity as increased LNG exports in the US drive natural gas demand.

“It is particularly pleasing to see our Q1 2024 EBITDA result surpassing the Q4 2023 result, given the strong result delivered in the prior quarter, with Subsea being our standout performer this quarter.

“2024 is likely to be a further year of growth for the industry driven by geopolitical and macro-economic factors. Therefore, management remains confident of delivering its current EBITDA guidance, given the broad-based strength of the global oil and gas sector.”

Another whisper beating number from Hunting and whilst the company are cautiously optimistic about the guidance and some activities such as perforating systems, I am fully confident in the management’s abilities to deliver another exceptional year. Accordingly the 50% gain in the shares y/y should be the precursor to the same again.

Trading Statement

|

$ million |

Q1 2024 |

Q4 2023 |

Q1 2023 |

|

Sales order book |

544.0 |

565.2 |

492.9 |

|

Revenue |

244.9 |

228.1 |

211.5 |

|

EBITDA |

28.9 |

28.2 |

22.4 |

|

EBITDA margin |

12% |

12% |

11% |

|

Working Capital |

469.6 |

415.9 |

456.5 |

|

Total cash and bank / (borrowings) |

(33.6) |

(0.8) |

(59.8) |

EBITDA in Q1 2024 was c.$28.9 million, which compares to c.$22.4 million in Q1 2023 and $28.2 million in Q4 2023. EBITDA margin remains in line with management’s expectations with full-year guidance remaining between 12-13%, as product mix, some higher product pricing and stronger facility utilisation continue to improve performance.

Driven by the current sales order book, coupled with some forward purchasing of raw materials associated with imminent projects, working capital has increased in the quarter. Management remains confident of delivering a reduction in inventory throughout the balance of the year, which will release cash and, coupled with the improved EBITDA, remains focused on delivering an EBITDA to Free Cash Flow conversion of c.50%. The final dividend recommended for 2023 of 5.0 cents per share is due for payment on 10 May 2024, following shareholder approval on 17 April 2024, which will absorb c.$7.9 million.

The Group’s OCTG product lines have commenced the year strongly, with activity in North and South America and Asia Pacific supported by buoyant levels of offshore and international projects. Tender activity across the Middle East has remained very positive in the period, which supports the projected revenue growth in this product line in the short to medium term. OCTG accessories manufacturing has continued to deliver good results supported by strong activity in South America, specifically in Guyana and Brazil.

Results for the Group’s Subsea product lines have been strong during Q1 2024, as orders for titanium and steel stress joints, hydraulic valves and couplings and flow access modules have increased, given the strong offshore drilling environment.

The Group’s Advanced Manufacturing product lines continue to report good growth as energy-related and non-oil and gas sales momentum continue to increase.

Hunting’s Perforating Systems product lines continue to target increasing international sales as market activity in South America and the Middle East continue to improve. The onshore US market has been less resilient in the period due, in part, to the lower activity and soft pricing for natural gas. However, activity levels are projected to improve in the second half of the year as new LNG capacity comes on stream in the US, which will support higher exports.

In summary, the majority of the Group’s product lines have reported a positive start to the year, leading to management retaining its full-year EBITDA guidance of $125-135 million.

Directorate Change

As previously announced, Jay Glick, Company Chair, will be retiring as a Director at the conclusion of the AGM with Stuart Brightman succeeding Mr Glick as Hunting PLC’s Company Chair.

The Board thanks Jay for his services to the Company since 2015, chairing the Company from 2017 and overseeing the Group through the COVID-19 pandemic and subsequent recovery. Jay has overseen the rollout of the Hunting 2030 Strategy which was launched at the Company’s Capital Markets Day in 2023 and which continues to be executed by management.

Date of H1 2024 Trading Statement

Hunting PLC’s next Trading Statement will be announced on Monday 8 July 2024.

Europa Oil & Gas

Europa has announced its unaudited interim results for the six-month period ended 31 January 2024.

Financial Performance

- Revenue £1.4 million (H1 2023: £3.7 million)

- Gross loss £0.1 million (H1 2023: £1.5 million profit)

- Pre-tax loss of £1.0 million (H1 2023: pre-tax loss £1.3 million) after impairment charge of £0.2 million (H1 2023: exploration impairment charge £1.7 million)

- Net cash used in operating activities £0.3 million (H1 2023: £1.7 million generated by operating activities)

- Cash balance at 31 January 2024: £3.8 million (31 July 2023: £5.2 million), of which £1.1 million is restricted

Onshore UK

- Over the three months to January 2024, after the completion of the jet pump installation at Wressle, production has averaged over 530 boepd (net 160 boepd to Europa), which is above the forecast upside case from the recent independent technical report (the "CPR")

- Total production across our whole portfolio net to Europa averaged 116 bopd during the H1 period, a 57% decrease on H1 last year

- Wressle net production to Europa decreased 57%, from 207 bopd in H1 2023 to 88 bopd during H1 2024, due to a three-month shutdown period required to source and install a jet pump for artificial lift on the Wressle-1 well

- Wressle continues to be the second most productive onshore UK oilfield

- During March 2024 the well is produced with 24.3% water cut and remains materially cash generative

- A new seismic interpretation and mapping exercise across the Wressle field has highlighted a potentially significant increase in resources from the Ashover Grit and the results of the analysis are now being incorporated into the field development plan. The intention is that two back-to-back development wells will be drilled from the existing Wressle site and planning and permitting work for these wells is ongoing. The wells will be drilled at the earliest opportunity, subject to receipt of regulatory approval

- In addition to the two development wells, work is ongoing to monetise the associated gas being produced from Wressle by connecting to a local gas distribution network. This work is expected to be completed around the same time as the development wells and is subject to the same regulatory approvals

- At Cloughton Europa continue with their stakeholder engagement and believe they have identified a number of suitable pad locations for an appraisal well which, following commercial rates being established from the appraisal well, could subsequently be used to develop the discovery. Negotiations with landowners to secure a pad are ongoing

The revised CPR on Wressle was completed in H1 2024 by ECRE which incorporated the new field interpretation, historical production performance data and the field development plan. The key highlights of the CPR included:

- 263% increase in 2P Reserves compared to 2016 CPR

- Reclassification of 1,883 mboe in Penistone Flags Contingent Resources to 2P Reserves

- 59% upgrade to the Ashover Grit and Wingfield Flags Estimated Ultimate Recoverable

- 23% upgrade to Broughton North Prospective 2U Resources

Equatorial Guinea

- Europa announced a ground-breaking deal in December 2023 with the acquisition of a 42.9% stake in Antler Global Limited ("Antler"), which has an 80% working interest in licence EG-08 offshore Equatorial Guinea. This gives rise to a joint venture arrangement (note 8)

- Europa agreed a US$3 million cash subscription for new ordinary shares in Antler, with the payments being made in four instalments (see note 8 of the financial statements)

- EG-08 is a highly prospective licence which already has three drill-ready prospects, with internally estimated total prospective resources of 1.4 trillion cubic feet of gas equivalent ("TCFE")

- Antler expects to commence a farm-down process in Q2 this year with a view to bringing in a partner for drilling

Offshore Ireland - Low risk / high reward infrastructure-led exploration in the proven Slyne Basin gas play

- The FEL 4/19 licence extension was granted by the Irish Government, extending the licence term to 31 January 2026

- Licence FEL 4/19 contains the Inishkea West gas exploration prospect, estimated by Europa to hold 1.5 TCF of recoverable gas

- Following the license extension, a farm-out process has begun again with the aim of bringing in a partner to assist with the drilling of the prospect

Offshore UK

- Progress continues with the potential development of the Serenity oil discovery in the Central North Sea alongside partner i3 Energy plc, ahead of the licence's current expiry date in September 2024

- The partners believe that Serenity offers a commercially viable development opportunity with a number of potential development scenarios available given local infrastructure

- A future development could result in approximately 1,000 bopd net to Europa's 25% interest

- Whilst Europa continue to assess various development scenarios for Serenity, the Company are concerned about possible future UK fiscal changes in the event of a change of government which could negatively impact the economics of the project

Post Period

- On 14 February 2024, the North Sea Transition Authority ("NSTA") notified Europa that it has agreed to a two-year extension of the Initial Term to 20 July 2026 and a two-year extension of the Second Term to 20 July 2028 for PEDL 343 (Cloughton)

- On 8 April 2024 Dr Eleanor Rowley was appointed to the board as independent non-executive director. Eleanor is a proven hydrocarbon finder who has extensive experience in the upstream energy sector working as a geoscientist in both exploration and development projects. Her extensive knowledge of exploration and appraisal asset evaluation will complement the existing strengths of the board very well and her appointment as independent non-executive director enhances the independent governance at Europa, returning the board to a majority of independent directors

Will Holland, CEO of Europa, said:

"It has been an exciting first half to the financial year with Europa entering into a ground-breaking deal in Equatorial Guinea in West Africa. The acquisition of a 42.9% stake in Antler gives the Company material exposure to highly prospective exploration acreage in a genuinely exciting geography. I have always believed that Europa could extend its vast knowledge base into new territories and am very hopeful for the future that in our new licence provides.

We continue to progress our activities offshore West Ireland and I am very pleased that the Irish Government granted us an extension to licence FEL 4/19 containing the 1.5TCF Inishkea West gas prospect, located only 18km from existing infrastructure and the European gas network. I remain very optimistic about our chances of farming this out to a credible industry partner who can then carry us through the exploration phase of the licence.

Despite the lower revenues during the interim period, due to the temporary shutdown to install the jet pump at Wressle, our balance sheet remains robust and we expect to continue generating meaningful cashflow from our UK assets. This sets Europa up well for the future and will allow us to work up our well balanced portfolio and deliver value for shareholders."

Nothing to add to what we know already in today’s figures, Europa looks strongly placed with some exciting upside potential.

KeyFacts Energy Industry Directory: Malcy's Blog

KEYFACT Energy

KEYFACT Energy