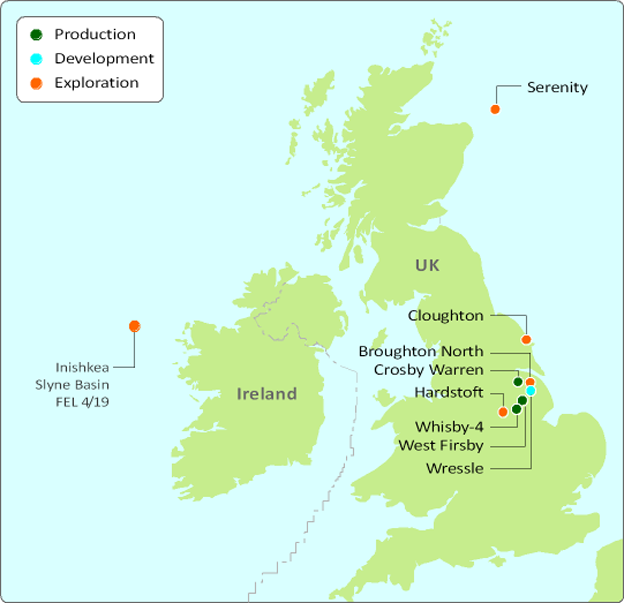

Europa Oil & Gas (Holdings) plc is an AIM-listed exploration and production company focused on building a balanced portfolio of producing, appraisal and exploration assets in the UK, Atlantic Ireland and West Africa with minimal emissions, whilst also looking to repurpose legacy UK wells for geothermal energy generation.

Europa’s objective is to participate actively in the national energy transition to sustainable renewables. The UK Government recognises that delivering a low-carbon future will be achieved by protecting infrastructure already present in the UK Continental Shelf through continued activity. Hydrocarbons are considered a key pillar of the UK Government’s Energy Security Strategy, with domestic production of oil and gas projects continuing to garner strong support.

Europa is well-placed to continue its exploration, production and appraisal of existing onshore and offshore UK assets, alongside the Company’s project in Ireland, whilst approximately 93 barrels of oil per day are currently produced from three of Europa’s UK oilfields as well as net 225 bopd with the development at Wressle.

Global operational review

UK

Europa Oil & Gas has a diverse portfolio of onshore and offshore oil and gas assets at various stages of the development cycle including exploration and production.

Production

West Firsby (W.I. 100%)

The Company produces from three oilfields in the East Midlands – a 100% working interest in both the West Firsby and Crosby Warren fields and a 65% non-operated interest in the Whisby W4 well. Overall daily production is stable at approximately 110 barrels of oil, all of which is transported by tanker to the refinery at Immingham in NE Lincolnshire.

The West Firsby Field, which commenced production in 1991 and is 15km north of Lincoln, is the main operating base with two wells producing ~40bopd.

West Firsby provides an excellent opportunity to evaluate, test and prove the assorted technical aspects of CausewayGT’s geothermal systems. Located in the East Midlands, West Firsby is late in its productive life with nine wellbores with seven wellheads. The wellbores extend over an area of some 2.5 km² and extend to a depth of 1,680 m. The existing well bores, together with the availability of production and data which has been collected over the last 34 years and the geothermal gradient make West Firsby a good candidate for testing geothermal solutions.

Wressle – The East Midlands (W.I. 30%)

Wressle continues to exceed the Company’s expectations, generating high levels of production and revenues, with the Wressle-1 well currently amongst the most productive in the onshore UK, producing over 170,000 barrels of oil up to May 2022. In 2022, the North Sea Transition Authority (NSTA) approved the Field Development Plan for the oilfield, ensuring the Wressle project remains on track to transition from an extended well test to production.

Europa is focused on advancing the development plan and consenting process to enable production from the Penistone Flags reservoir, where gross Mid-case Contingent Resources of 1.53 million barrels of oil and 2 billion cubic feet of gas have been independently reported, in addition to progressing gas monetisation and continuing to optimise oil and gas production from the Ashover Grit reservoir.

The Wressle oil discovery straddles PEDL180 and PEDL182. It lies 5km southeast of, and along the same structural trend as, the Europa-operated Crosby Warren field which has been producing oil for almost 30 years. The field was discovered by the Wressle-1 conventional exploration well which was drilled to a total depth of 2,240m (1,814m TVDSS) on 23 August 2014.

Crosby Warren (W.I. 100%)

The Company produces from three oilfields in the East Midlands – a 100% working interest in both the West Firsby and Crosby Warren fields and a 65% non-operated interest in the Whisby W4 well. Overall daily production is stable at approximately 110 barrels of oil, all of which is transported by tanker to the refinery at Immingham in NE Lincolnshire.

The Company produces from three oilfields in the East Midlands – a 100% working interest in both the West Firsby and Crosby Warren fields and a 65% non-operated interest in the Whisby W4 well. Overall daily production is stable at approximately 100 barrels of oil, all of which is transported by tanker to the refinery at Immingham in NE Lincolnshire.

The Whisby well, which is just to the west of Lincoln, was drilled by Europa in early 2003 and produces ~40bopd gross via a beam pump (~26bopd net to Europa).

Appraisal

Cloughton – The East Midlands (40%)

PEDL 343 contains two adjacent blocks, TA09 and SE99a and covers 110 square kilometres. Block TA09 is located north of Scarborough running up the east coast and Block SE99a is located to its west.

The Cloughton-1 discovery well was drilled by Bow Valley in 1986 and encountered gas throughout the Carboniferous section. Four zones were tested, three of which were in the Carboniferous, the other within the Permian dolomitic limestone. The Cloughton-1 well test achieved rates of between 2-40,000 scf/day on natural flow, however with the right completion and production optimisation techniques it is believed a well could flow at 6 mmscft/day. The gas is sweet good quality gas with >98% methane and ethane.

Europa regards Cloughton as a gas appraisal opportunity with the critical challenge being to obtain commercial flowrates from future production testing operations. A location for an appraisal well pad has been identified and following successful testing operations the field would be monetised by connecting to the nearby gas grid.

Serenity (W.I. 25%)

The Serenity farm-in is a continuation of Europa delivering on its stated strategy of developing significant value accretive opportunities and late-stage appraisal and development projects whilst ensuring the Company continues to minimise risk.

Discovered in 2019 by Operator i3 Energy, Serenity is located at the northern edge of Block 13/23c. Europa farmed-in to Serenity in 2022, raising £7 million in Q1 2022 to fund an appraisal well. EOG will earn 25% WI by funding £6 million of the £13 million appraisal well.

Serenity provides a transformational opportunity for EOG, with the appraisal well representing gross value of over $1,000 million at current AIM market comparisons (assuming 35% recovery factor), and potentially de-risking 197 mmbbls STOIIP (P50).

Exploration

Broughton North – The East Midlands (W.I. 30%)

Adjacent and north of PEDL180, PEDL182 holds the Broughton North prospect.

Broughton North is in a fault block immediately to the northwest of Wressle, and as a result, ERCE Equipoise in its capacity as a Competent Person has assigned a high geological chance of success of between 40% to 49% to the prospect as well as gross mean unrisked prospective resources of 0.6 millionboe.

Hardstoft – The East Midlands (25% W.I. (conventional prospectivity only))

This is a one block (SK46c) licence located west of Mansfield, Derbyshire.

PEDL299 contains the Hardstoft oilfield. This was discovered in 1919 by the UK’s first ever exploration well and produced 26,000 barrels of oil from Carboniferous limestone reservoir. A CPR on Hardstoft, issued by joint venture partner Upland Resources, identified gross 2C contingent resources of 3.1 mmboe and gross 3C contingent resources of 18.5 mmboe in PEDL299. Production testing methodologies for carbonate reservoirs have evolved since 1919, which has the potential to allow commercial oil flowrates to be obtained.

IRELAND

Irish Atlantic Margin

Europa consider the Inishkea prospect in FEL 4/19 in the Slyne basin and near the Corrib gasfield their flagship project in Ireland. The Triassic gas hydrocarbon play is well understood and proven to work both technically and commercially in the Slyne basin by the Corrib gasfield. Therefore, play risk is lower than in other Atlantic Ireland basins where play risk remains to be conclusively proven by a commercially successful exploration discovery. Europa therefore views the licence as low risk exploration in a proven gas play.

FEL 4/19 Licence (W.I. 100%)

Inishkea West is a large four way anticlinal feature. The crest of the structure is faulted but these faults see Corrib Sandstone against Corrib Sandstone and are not believed to seal. This sets up a larger four way closure to the structure which is larger than previous mapping iterations.

Engineering studies demonstrate strong positive economics, and porosity values are expected to be high with the present day depth of burial shallower than both the Corrib field and the Corrib North discovery. Inishkea West is significantly shallower than the Inishkea prospect and reservoir quality is expected to be good. Flow rates from discovery wells in Corrib were excellent despite being lower quality reservoir than what is expected in Inishkea West.

Inishkea West is within easy tie-back range of the Corrib gas field situated some 18km to the south east. The proximity to the Corrib infrastructure, the mapped four way closure, the large prospective resource and the reduced seal risk means the Inishkea West prospect is the primary target on the FEL 4/19 licence.

Gas infrastructure is already present nearby at Corrib and, therefore, a fast track path to commercialisation is potentially available, subject to negotiation and cooperation with the infrastructure owners.

EQUATORIAL GUINEA

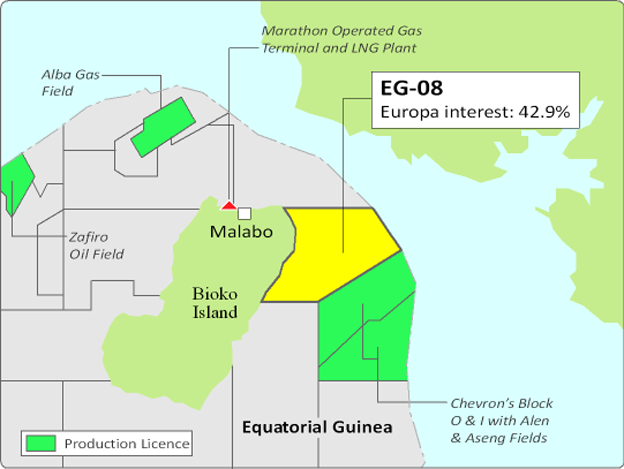

EG-08 (W.I. 42.9%)

Block EG-08 offshore in the Douala Basin of Equatorial Guinea is held by Antler Global Ltd, a company that was set up specifically to acquire the EG-08 block which is effective from October 2023, with 100% equity. Europa acquired a 42.9% interest in Antler in December 2023.

EG-08 has three high-graded prospects which Europa assess to have similar AVO characteristics to the Alen and Aseng fields and other discoveries in Chevron’s Blocks O and I immediately to the south.

The AVO story is very compelling and, accordingly, Europa estimate the chance of success is estimated at 60-70% for the three prospects. Volumes across the three identified prospects are estimated at mean prospective resources of 1.3 TCFE (this figure includes the gas and liquids). Together, these three prospects when combined provide over a 90% chance of finding a commercial discovery and, as such, this is a high quality, low risk and high reward asset in shallow water with modest well costs.

A successful discovery in EG-08 could be developed quickly with possible offtake to Chevron’s nearby Alen platform (9km), where hydrocarbons will be processed, transhipped, and exported through the Chevron infrastructure to an FPSO to export liquids with gas going via the Chevron pipeline to the Alba gas plant facility on Bioko Island.

The initial phase of the licence is a two-year drill or drop. During this period, Antler intends to refine the existing 3D seismic data and begin a farm out process. There then follows a two-year second period, two one-year extension periods and a development phase. The PSC is typical for Equatorial Guinea whereby the state has a carried 20% interest and a royalty and profits share depending on production.

Leadership

Brian O'Cathain Non-executive Chairman

Will Holland Chief Executive Officer

Alastair Stuart COO, Executive Director

Dr Eleanor Rowley Non Executive Director

Contact

Europa Oil & Gas (Holdings) plc

30 Newman Street, London W1T 1PT, United Kingdom

Tel: +44 (0)20 3968 6411 l mail@europaoil.com

KeyFacts Energy: Europa Oil & Gas UK country profile l KeyFacts Energy: Company Profile

KEYFACT Energy

KEYFACT Energy